Concept explainers

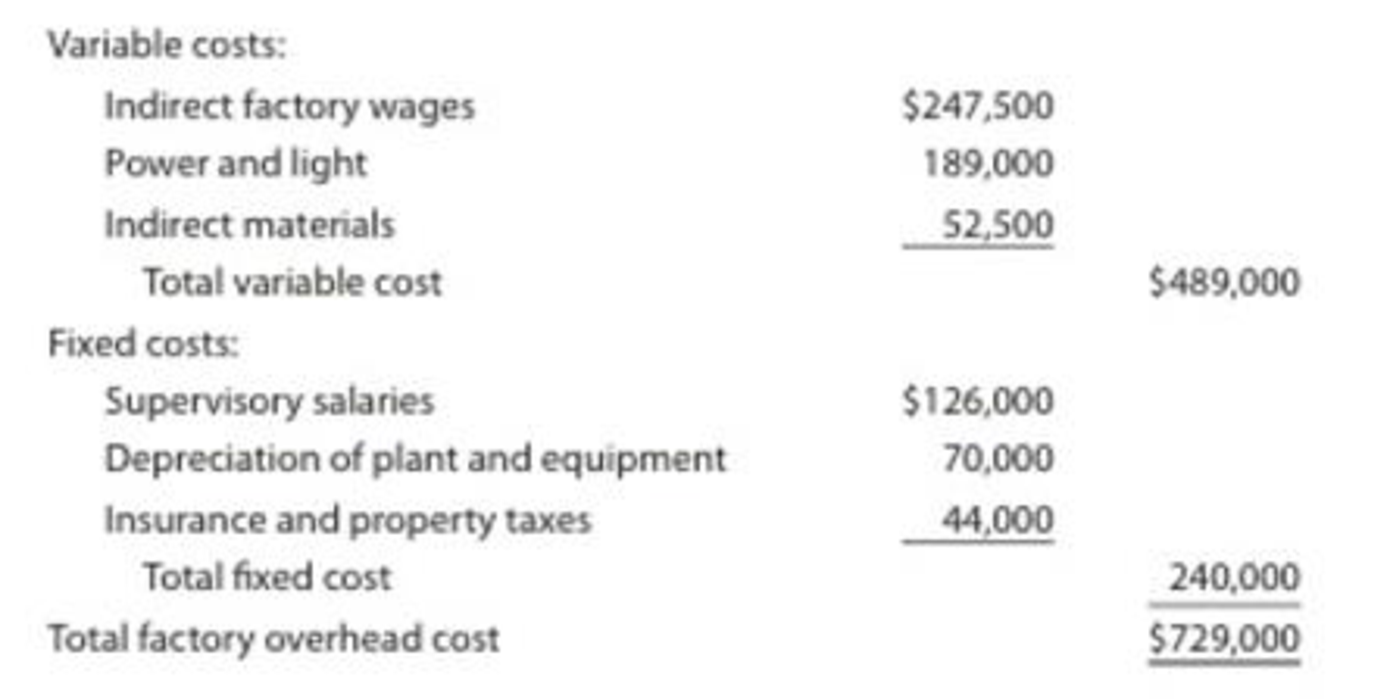

Feeling Better Medical Inc., a manufacturer of disposable medical supplies, prepared the following factory overhead cost budget for the Assembly Department for October of the current year. The company expected to operate the department at 100% of normal capacity of 30,000 hours.

During October, the department operated at 28,500 hours, and the factory overhead costs incurred were indirect factory wages, $234,000; power and light, $178,500; indirect materials, $50,600; supervisory salaries, $126,000;

Instructions

Prepare a factory overhead cost variance report for October. To be useful for cost control, the budgeted amounts should be based on 28,500 hours.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

Financial and Managerial Accounting - Workingpapers

- What is the interest tax shield ? pleas solve this general accounting questionarrow_forwardIronton Inc. had a net income of $92,300 and paid dividends of $30,000 to common stockholders and $16,700 to preferred stockholders in 2023. Ironton Inc.'s common stockholders' equity at the beginning and end of 2023 was $480,000 and $540,000, respectively. Ironton Inc.'s return on common stockholders' equity is _.arrow_forwardgeneral accountingarrow_forward

- Find the applied overhead for the period and determine whether the overhead is overapplied or underapplied.arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forwardVarma Corporation distributes property to its sole shareholder, Maya. The property has a fair market value of $675,000 and an adjusted basis of $425,000. With respect to the distribution, Varma has a gain of ____.arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardVarma has a gain of_.arrow_forwardToyota Manufacturing has 12 employees and each employee is paid on average $215 per day and works 6 days per week. The company's year-end is December 31. The employees were last paid on December 20 for the two weeks that ended on December 14. What is the wages and salary payable to record for December 31?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College