Concept explainers

Determining missing items from computations

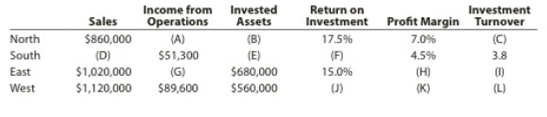

Data for the North, South, East, and West divisions of Free Bird Company are as follows:

- A. Determine the missing items, identifying each by the letters (A) through (L). (Round percentages and investment turnover to one decimal place.)

- B. Determine the residual income for each division, assuming that the minimum acceptable

return on investment established by management is 12%. - C. Which division is the most profitable in terms of (1) return on investment and (2) residual income?

(a)

Profit margin: This ratio gauges the operating profitability by quantifying the amount of income earned from business operations from the sales generated.

Formula of profit margin:

Investment turnover: This ratio gauges the operating efficiency by quantifying the amount of sales generated from the assets invested.

Formula of investment turnover:

Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Formula of ROI according to Dupont formula:

Residual income: The remaining income from operations after deducting the desired acceptable income is referred to as residual income.

Formula of residual income:

| Income from operations | XXX |

| Less minimum acceptable income from operations as a percent of invested assets | XXX |

| Residual income | XXX |

Table (1)

To compute: The missing items

Explanation of Solution

1)

Compute income from operations.

2)

Compute invested assets.

Note: Refer to missing amount (a) for value of income from operations.

3)

Compute investment turnover.

4)

Compute sales value.

5)

Compute sales value.

Note: Refer to missing amount (d) for value of sales.

6)

Compute ROI.

Note: Refer to missing amount (e) for value of invested assets.

7)

Compute income from operations.

8)

Compute profit margin.

Note: Refer to missing amount (g) for value of income from operations.

9)

Compute investment turnover.

10)

Compute ROI.

11)

Compute profit margin.

12)

Compute investment turnover.

(b)

Explanation of Solution

1)

Determine residual income of N Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for N Division.

Note: Refer to missing amount (b) of part (a) for value of invested assets.

Step 2: Determine residual income of N Division.

| Particulars | Amount ($) |

| Income from operations | $60,200 |

| Less minimum acceptable income from operations as a percent of invested assets | 41,280 |

| Residual income | $18,920 |

Table (2)

Note: Refer to missing amount (a) of part (a) for value of income from operations, and Step 1 for value and computation of minimum acceptable income.

2)

Determine residual income of S Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for S Division.

Note: Refer to missing amount (e) of part (a) for value of invested assets.

Step 2: Determine residual income of S Division.

| Particulars | Amount ($) |

| Income from operations | $51,300 |

| Less minimum acceptable income from operations as a percent of invested assets | 36,000 |

| Residual income | $15,300 |

Table (3)

Note: Refer to Step 1 for value and computation of minimum acceptable income.

3)

Determine residual income of E Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for E Division.

Step 2: Determine residual income of E Division.

| Particulars | Amount ($) |

| Income from operations | $102,000 |

| Less minimum acceptable income from operations as a percent of invested assets | 81,600 |

| Residual income | $20,400 |

Table (4)

Note: Refer to missing amount (g) of part (a) for value of income from operations, and Step 1 for value and computation of minimum acceptable income.

4)

Determine residual income of W Division.

Step 1: Compute minimum acceptable income from operations as a percent of invested assets for W Division.

Step 2: Determine residual income of W Division.

| Particulars | Amount ($) |

| Income from operations | $89,600 |

| Less minimum acceptable income from operations as a percent of invested assets | 67,200 |

| Residual income | $22,400 |

Table (5)

Note: Refer to missing amount (g) of part (a) for value of income from operations, and Step 1 for value and computation of minimum acceptable income.

(c) 1

Explanation of Solution

The division with highest return on investment is considered as the most profitable division. Hence, N Division is the most profitable division with highest ROI of 17.5%.

Want to see more full solutions like this?

Chapter 23 Solutions

Financial & Managerial Accounting

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- what are the Five List of Michael Porter's 5 Force Framework that describes the competitive dynamics of a firm and the industry they are in?arrow_forwardHello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwarddefine each item below: A competitive advantage. 2) Data incorporation. 3) Financial Statement Analysis. 4) Product Differentiation. 5) Strategic positioning for a business firmarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College