Concept explainers

EXPANDED STATEMENT OF

Additional information:

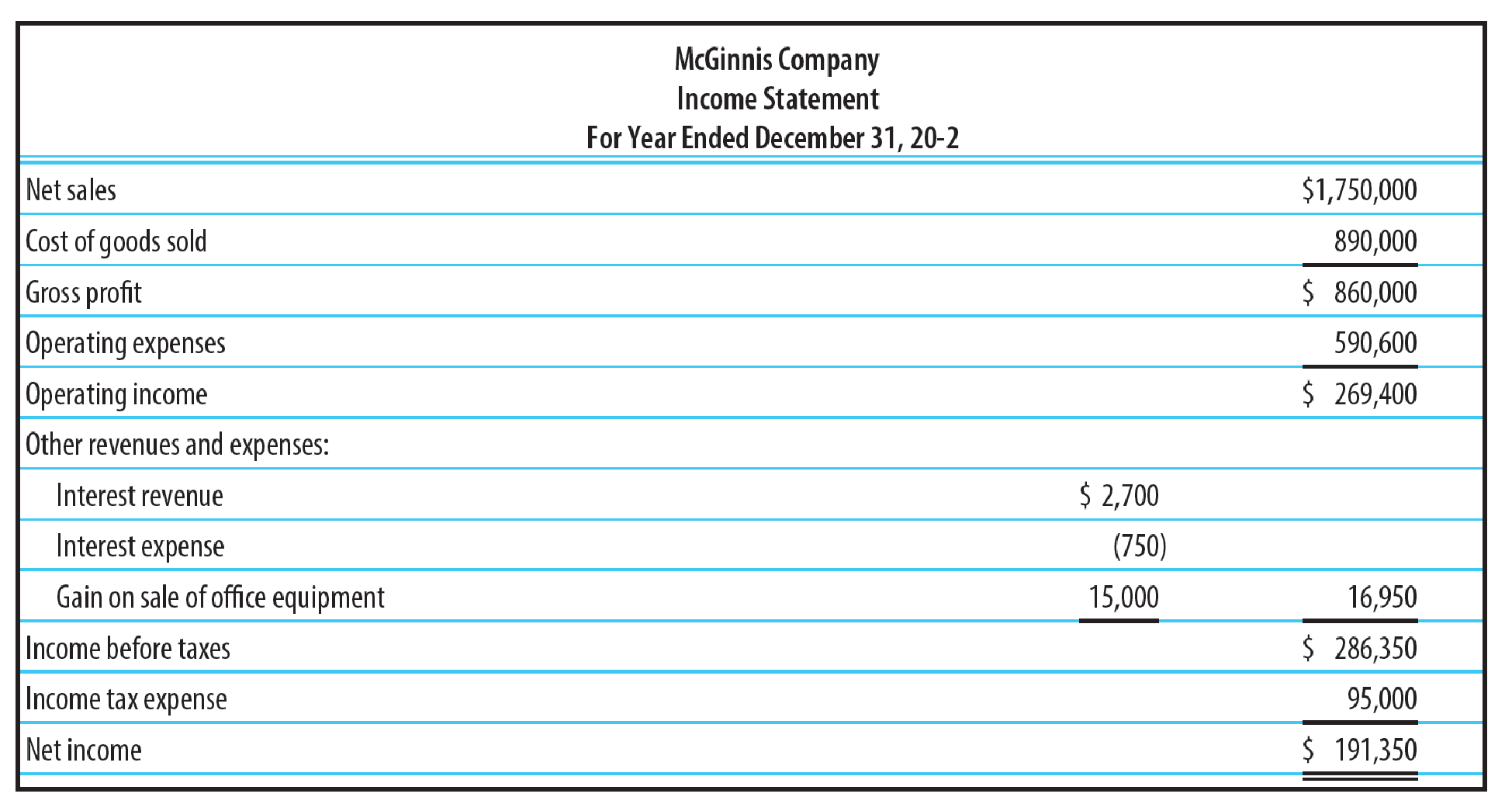

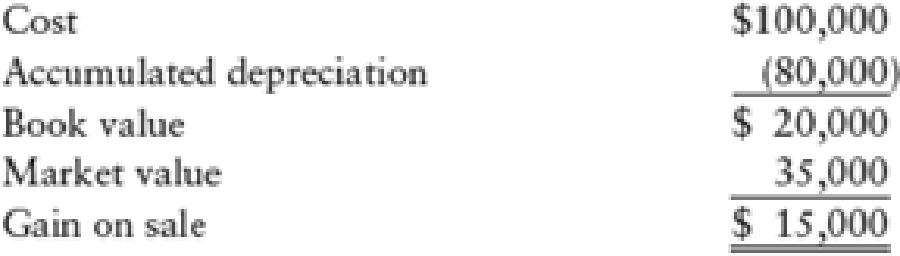

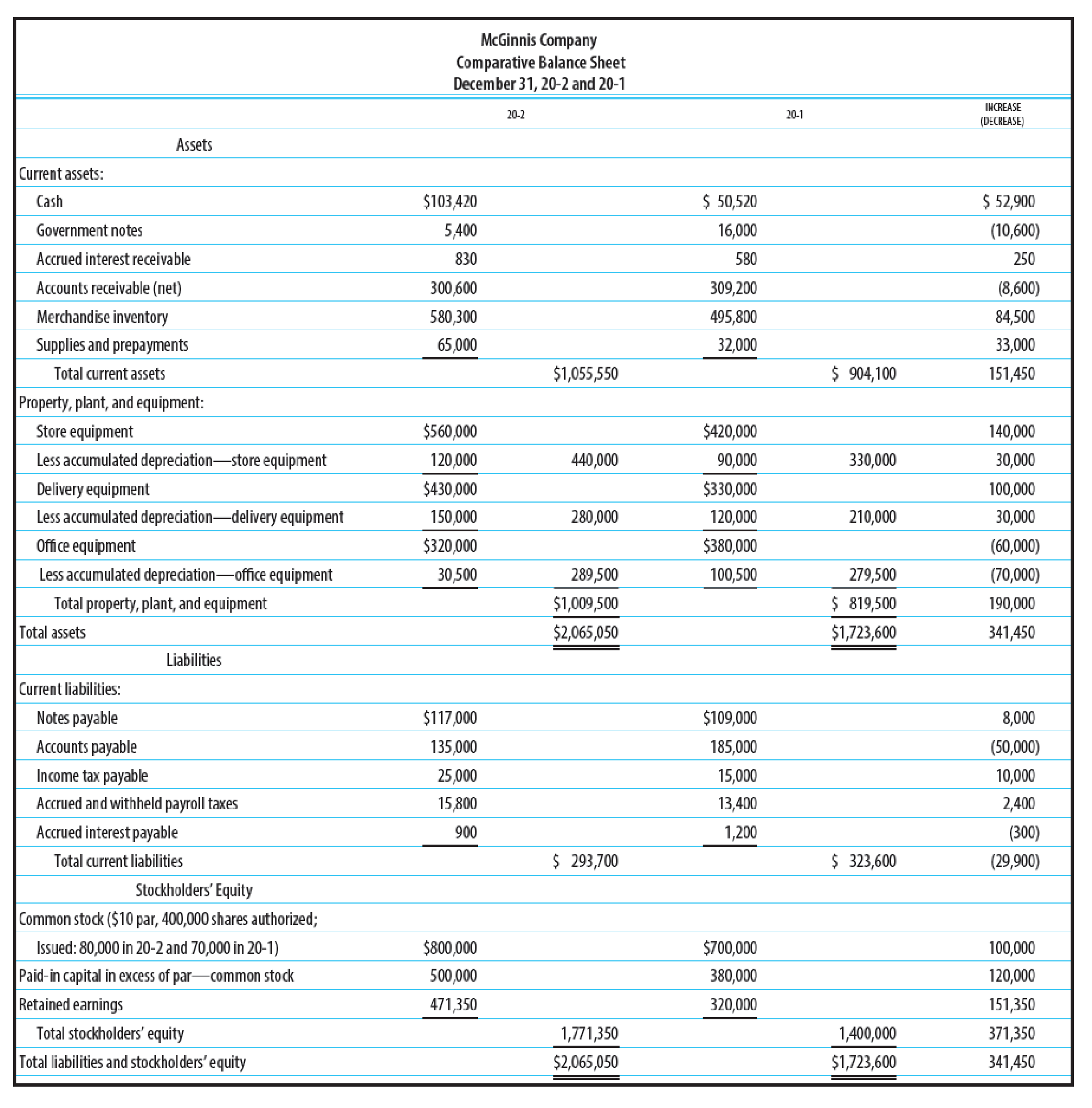

1. Office equipment was sold in 20-2 for $35,000. Additional information on the office equipment sold is provided below.

2.

3. The following purchases were made for cash:

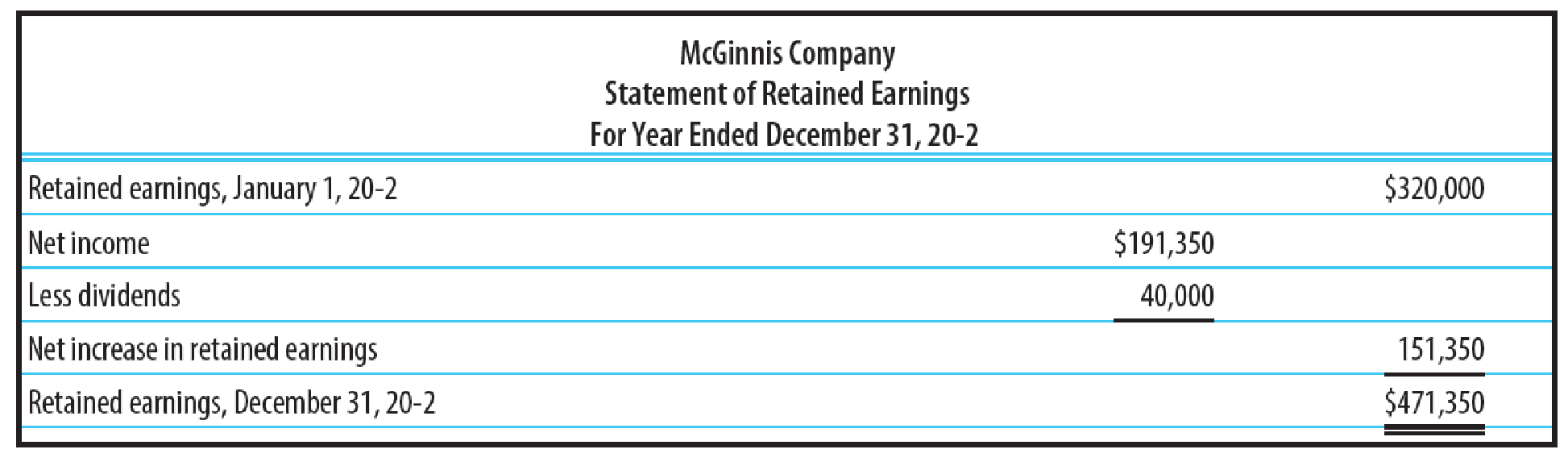

4. Declared and paid cash dividends of $40,000.

5. Issued 10,000 shares of $10 par common stock for $22 per share.

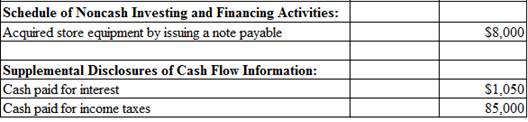

6. Acquired additional office equipment by issuing a note payable for $8,000.

REQUIRED

Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.

Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.

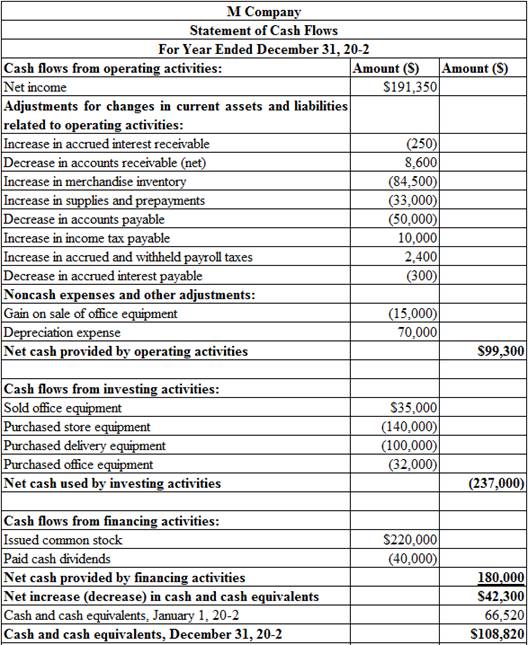

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Indirect method: Under indirect method, net income is reported first, and then non-cash expenses, losses from fixed assets, and changes in opening balances and ending balances of current assets and current liabilities are adjusted to reconcile the net income balance.

Cash flows from operating activities: Operating activities refer to the normal activities of a company to carry out the business.

The below table shows the way of calculation of cash flows from operating activities:

| Cash flows from operating activities (Indirect method) |

| Net income: |

| Add: Decrease in current assets |

| Increase in current liability |

| Depreciation expense and amortization expense |

| Loss on sale of plant assets |

| Deduct: Increase in current assets |

| Decrease in current liabilities |

| Gain on sale of plant assets |

| Net cash provided from or used by operating activities |

Table (1)

Cash flows from investing activities: Investing activities refer to the activities carried out by a company for acquisition of long term assets. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from collection of loan made to borrowers |

| Sale of marketable securities / investments |

| Sale of property, plant and equipment |

| Proceeds from discounting notes receivables |

| Deduct: Purchase of fixed assets/long-lived assets |

| Loan made by the company to others |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (2)

Cash flows from financing activities: Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings by signing of a mortgage |

| Proceeds from sale of treasury stock |

| Proceeds from issuance of debt |

| Deduct: Payment of dividend |

| Repayment of debt |

| Repayment of the principal on loan |

| Redemption of debt |

| Purchase of treasury stock |

| Net cash provided from or used by financing activities |

Table (3)

Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.

Table (1)

Working notes:

Calculate the amount of cash and cash equivalents at January 1, 20-2:

Compute the amount of cash paid for interest in 20-2:

Step 1: Calculate the change in accrued interest payable.

Step 2: Calculate the amount of cash paid for interest in 20-2.

Compute the amount of cash paid for income taxes in 20-2:

Step 1: Calculate the change in income taxes payable.

Step 2: Calculate the amount of cash paid for income taxes in 20-2.

Want to see more full solutions like this?

Chapter 23 Solutions

Study Guide for Working Papers for Heintz/Parry's College Accounting, Chapters 16-27, 23rd

- Can you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardCan you provide the accurate answer to this financial accounting question using correct methods?arrow_forward

- The cost of goods sold of norah company?arrow_forwardMCQarrow_forwardKimberly Manufacturing has $31,400 of ending finished goods inventory as of Dec. 31, 2024. If beginning finished goods inventory was $27,900 and COGS was $103,500, how much would Kimberly Manufacturing report for cost of goods manufactured? Need answerarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning