INTERMEDIATE FINANCIAL MGMT.-W/MINDTAP

14th Edition

ISBN: 9780357533598

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 22, Problem 8P

Monitoring of Receivables

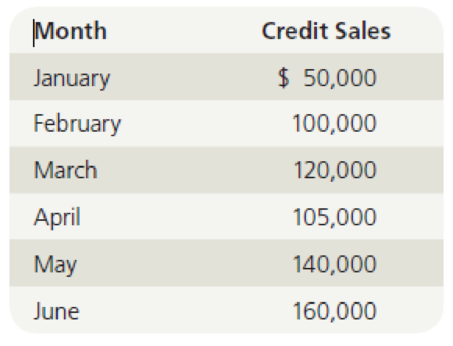

The Russ Fogler Company, a small manufacturer of cordless telephones, began operations on January 1. Its credit sales for the first 6 months of operations were as follows:

Throughout this entire period, the firm’s credit customers maintained a constant payments pattern: 209b paid in the month of sale, 309b paid in the first month following the sale, and 509b paid in the second month following the sale.

- a. What was Fogler’s receivables balance at the end of March and at the end of June?

- b. Assume 90 days per calendar quarter. What were the average daily sales (ADS) and days sales outstanding (DSO) for the first quarter and for the second quarter? What were the cumulative ADS and DSO for the first half-year?

- c. Construct an aging schedule as of June 30. Use account ages of 0-30, 31-60, and 61-90 days.

- d. Construct the uncollected balances schedule for the second quarter as of June 30.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How does the weighted average cost of capital (WACC) affect a company’s valuation? Need help

How does the weighted average cost of capital (WACC) affect a company’s valuation?

How do companies evaluate the feasibility of a project using NPV and IRR? I need help in this question.

Chapter 22 Solutions

INTERMEDIATE FINANCIAL MGMT.-W/MINDTAP

Ch. 22 - Prob. 1QCh. 22 - Prob. 2QCh. 22 - Is it true that if a firm calculates its days...Ch. 22 - Firm A had no credit losses last year, but 1% of...Ch. 22 - Indicate by a (+), (), or (0) whether each of the...Ch. 22 - Cost of Bank Loan On March 1, Minnerly Motors...Ch. 22 - Cost of Bank Loan Mary Jones recently obtained an...Ch. 22 - Del Hawley, owner of Hawleys Hardware, is...Ch. 22 - Gifts Galore Inc. borrowed 1.5 million from...Ch. 22 - Relaxing Collection Efforts The Boyd Corporation...

Ch. 22 - Tightening Credit Terms Kim Mitchell, the new...Ch. 22 - Effective Cost of Short-Term Credit Yonge...Ch. 22 - Monitoring of Receivables

The Russ Fogler Company,...Ch. 22 - Prob. 10PCh. 22 - Prob. 1MCCh. 22 - Prob. 2MCCh. 22 - Prob. 3MCCh. 22 - Prob. 4MCCh. 22 - Prob. 5MCCh. 22 - Prob. 6MCCh. 22 - Prob. 7MCCh. 22 - Assume that it is now July of Year 1 and that the...Ch. 22 - Now assume that it is several years later. The...Ch. 22 - Prob. 10MCCh. 22 - Prob. 11MCCh. 22 - Prob. 12MCCh. 22 - Prob. 13MCCh. 22 - Prob. 14MCCh. 22 - Suppose the firm makes the change but its...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License