Concept explainers

a.

Compute the expected increase in the responsibility margin of Division 1 for product A and product B.

a.

Explanation of Solution

Contribution margin:

Contribution margin is a measurement of performance where only revenue and variable costs are taken into consideration. Hence, this measurement is useful in the evaluation of the probable outcomes of decisions including pricing decisions and other marketing strategies that affect primarily revenue and variable costs.

Responsibility margin:

Responsibility margin is a measurement of performance where not only revenue and variable costs, but also the fixed costs traceable to the responsibility center are taken into consideration. Hence, this measurement is useful in the evaluation of the decisions involving significant changes in traceable fixed costs including expanding or contracting plant capacity.

Compute the expected increase in the responsibility margin of Division 1 for Product A and Product B as follows:

Compute the expected increase in the responsibility margin of Product A:

Compute the expected increase in the responsibility margin of Product B:

Working note:

Compute the expected increase in the contribution margin of Product A:

(1)

Compute the expected increase in the contribution margin of Product B:

(2)

b.

State the product line that is recommended for expanding.

b.

Explanation of Solution

Responsibility margin:

Responsibility margin is a measurement of performance where not only revenue and variable costs, but also the fixed costs traceable to the responsibility center are taken into consideration. Hence, this measurement is useful in the evaluation of the decisions involving significant changes in traceable fixed costs including expanding or contracting plant capacity.

State the product line that is recommended for expanding as follows:

In order to increase the sales, the company requires new manufacturing facilities, and the revenue should be sufficient to cover the increase in both fixed costs and variable costs of production. Thus, the responsibility margin ratio has the ability to cover the fixed costs. Hence, Product B appears to be reasonable best for expansion. Because, the responsibility margin ratio of Product B is higher (28%) than the responsibility margin ratio of Product A (26%).

c.

Explain the manner in which the given fixed costs would appear in the income statement of Incorporation B.

c.

Explanation of Solution

The amount $21,000 in common fixed costs of Division 1 has been classified as “common” because this cost could not be traced to the subunits within the division but are traceable to the division itself. Thus, this cost gets combined with other fixed costs in Division 1, when once the segments of the Division are defined as entire division. Then, the cost ($21,000) could be identified as “traceable” to the division. As a result, this would increase the total amount of fixed cost traceable of Division to $63, 000

d.

Compute the expected effect of the change in Division 2 on the operating income of the company.

d.

Explanation of Solution

If the amount of sales increased from $150,000 to $200,000, then it would increase the amount of contribution margin by $35,000

Compute the expected effect of the change in Division 2 on the operating income of the company as follows:

| Particulars | Division II | |

| Dollars | Percent | |

| Sales | $ 200,000 | 100% |

| Less: Variable costs | 60,000 (3) | 30% |

| Contribution margin | $140,000 (4) | 70% |

| Less: Fixed costs traceable to product line | $72,000 | 36% |

| Income from operations | $68,000 | 34% |

Table (1)

Working notes:

Variable cost:

(3)

Contribution cost:

e.

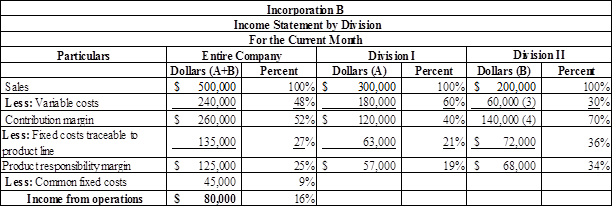

Prepare an income statement of Incorporation B with the information stated in requirement d.

e.

Explanation of Solution

Prepare an income statement of Incorporation B with the information stated in requirement d as follows:

Figure (1)

Note:

The percentage should be calculated by dividing the respective amount of any costs with sales. Example: The variable cost percentage for the entire company should be calculated as

Want to see more full solutions like this?

Chapter 22 Solutions

Gen Combo Loose Leaf Financial Accounting; Connect Access Card

- On March 1, 20X1, your company,which uses Units-of-Production (UOP) Depreciation, purchases a machine for $300,000.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardI am searching for the right answer to this financial accounting question using proper techniques.arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardi will give unhelpful.blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education