Financial and Managerial Accounting - CengageNow

15th Edition

ISBN: 9781337911979

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 22, Problem 4CMA

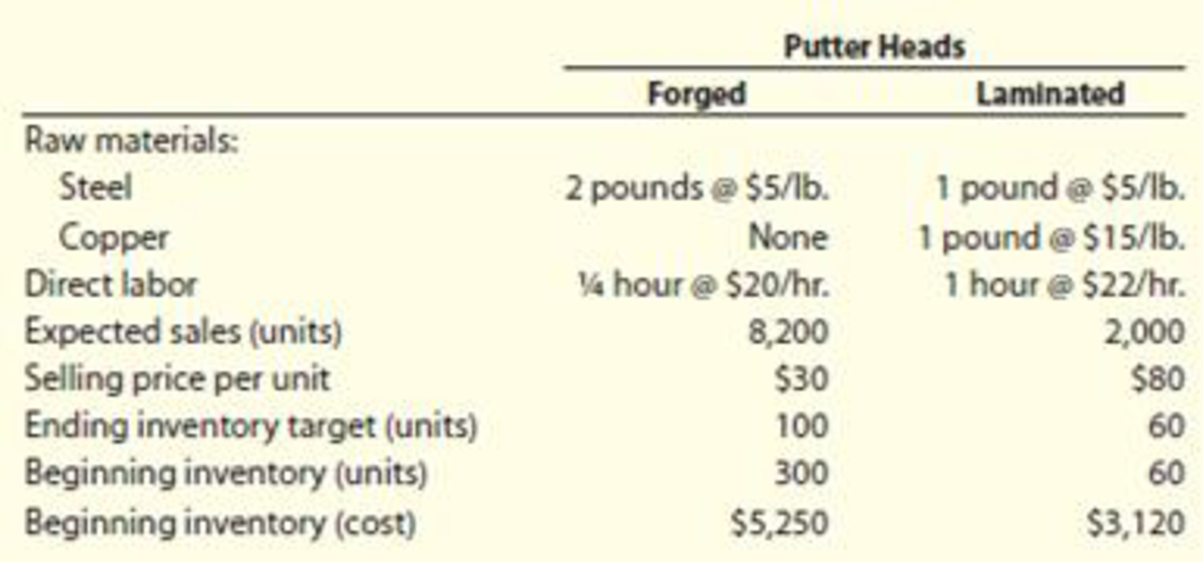

Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing its operating budget for the coming year. Selected data regarding the company’s two products are as follows:

Manufacturing

- a. $42.

- b. $46.

- c. $52.

- d. $62.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you help me solve this financial accounting problem using the correct accounting process?

Which of these is considered a permanent account?A. Salaries ExpenseB. RevenueC. Retained EarningsD. Dividends

Need help

Which of these is considered a permanent account?A. Salaries ExpenseB. RevenueC. Retained EarningsD. Dividends

Chapter 22 Solutions

Financial and Managerial Accounting - CengageNow

Ch. 22 - Prob. 1DQCh. 22 - Briefly describe the type of human behavior...Ch. 22 - What behavioral problems are associated with...Ch. 22 - What behavioral problems are associated with...Ch. 22 - Under what circumstances would a static budget be...Ch. 22 - Prob. 6DQCh. 22 - Why should the production requirements set forth...Ch. 22 - Why should the timing of direct materials...Ch. 22 - A. Discuss the purpose of the cash budget. B. If...Ch. 22 - Give an example of how the capital expenditures...

Ch. 22 - At the beginning of the period, the Fabricating...Ch. 22 - Pasadena Candle Inc. projected sales of 800,000...Ch. 22 - Pasadena Candle Inc. budgeted production of...Ch. 22 - Pasadena Candle Inc. budgeted production of...Ch. 22 - Prepare a cost of goods sold budget for Pasadena...Ch. 22 - Prob. 6BECh. 22 - At the beginning of the school year, Craig Kovar...Ch. 22 - Digital Solutions Inc. uses flexible budgets that...Ch. 22 - Static budget versus flexible budget The...Ch. 22 - Flexible budget for Assembly Department Steelcase...Ch. 22 - Production budget Healthy Measures Inc. produces a...Ch. 22 - Sales and production budgets Sonic Inc....Ch. 22 - Professional foes earned budget for a service...Ch. 22 - Professional labor cost budget for a service...Ch. 22 - Direct materials purchases budget Tobins Frozen...Ch. 22 - Direct materials purchases budget Coca-Cola...Ch. 22 - Direct materials purchases budget Anticipated...Ch. 22 - Direct labor cost budget Ace Racket Company...Ch. 22 - Production and direct labor cost budgets Levi...Ch. 22 - Factory overhead cost budget Sweet Tooth Candy...Ch. 22 - Cost of goods sold budget Delaware Chemical...Ch. 22 - Cost of goods sold budget The controller of...Ch. 22 - Schedule of cash collections of accounts...Ch. 22 - Schedule of cash collections of accounts...Ch. 22 - Schedule of cash payments for service company...Ch. 22 - Schedule of cash payments for a service company...Ch. 22 - Capital expenditures budget On January 1, 20Y6,...Ch. 22 - Forecast sales volume and sales budget For 20Y8,...Ch. 22 - Sales, production, direct materials purchases, and...Ch. 22 - Budgeted income statement and supporting budgets...Ch. 22 - Budgeted income statement and supporting budgets...Ch. 22 - Cash budget The controller of Bridgeport...Ch. 22 - Budgeted income statement and balance sheet As a...Ch. 22 - Forecast sales volume and sales budget Sentinel...Ch. 22 - Sales, production, direct materials purchases, and...Ch. 22 - Budgeted income statement and supporting budgets...Ch. 22 - Prob. 4PBCh. 22 - Cash budget The controller of Mercury Shoes Inc....Ch. 22 - Budgeted income statement and balance sheet As a...Ch. 22 - Analyze Johnson Stores staffing budget for...Ch. 22 - Nursing staff budget Mercy Hospital staffs its...Ch. 22 - Parking lot staff budget Adventure Park is a large...Ch. 22 - Housekeeping staff budget Ambassador Suites Inc....Ch. 22 - Ethics in Action The director of marketing for...Ch. 22 - Communication The city of Milton has an annual...Ch. 22 - Prob. 4TIFCh. 22 - Static budget for a service company A hank manager...Ch. 22 - Objectives of the master budget Dominos Pizza LLC...Ch. 22 - When compared to static budgets, flexible budgets:...Ch. 22 - Hannon Retailing Company prices its products by...Ch. 22 - Ming Company has budgeted sales at 6,300 units for...Ch. 22 - Krouse Company produces two products, forged...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lakshmi Investment Group has total sales of $1,250,000, costs of $520,000, depreciation expense of $85,000, and an interest expense of $65,000. The company has a tax rate of 25%. What is Lakshmi Investment Group's net income?arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardI need correct answer without ai I will unhelpful. If blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- Solve this financial accounting problemarrow_forwardThe adjusting entry for depreciation includes:A. Debit Asset, Credit Depreciation ExpenseB. Debit Depreciation Expense, Credit Accumulated DepreciationC. Debit Accumulated Depreciation, Credit AssetD. Debit Cash, Credit Assetarrow_forwardTutor, can you please help me solve this general accounting problemarrow_forward

- Which document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memo Correct solutionarrow_forwardWhich document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memoneedarrow_forwardWhich document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY