Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 22, Problem 22.5CP

Integrity and evaluating budgeting systems

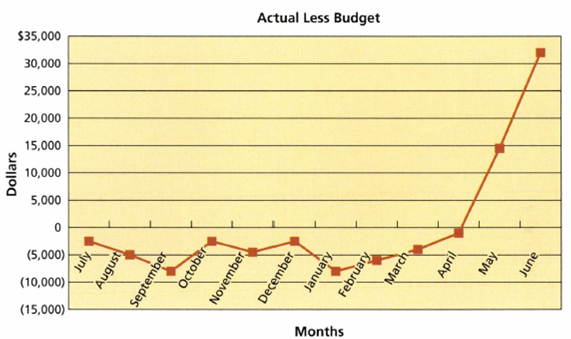

The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided by 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be "returned" to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for the recent fiscal year. The chart was as follows:

- a. Interpret the chart.

- b. Suggest an improvement in the budget system.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate the times-interest-earned ratios for PEPSI CO, Given the following information

Calculate the times-interest-earned ratios for Coca Cola in 2020.

Explain if the times-interest-earned ratios is adequate?

Is the times-interest-earned ratio greater than or less than 2.5? What does that mean for the companies' income?

Can the company afford the interest expense on a new loan?

Which of the following is a temporary account?A. EquipmentB. Accounts PayableC. Utilities ExpenseD. Common Stock

Chapter 22 Solutions

Accounting (Text Only)

Ch. 22 - Prob. 22.1DQCh. 22 - Briefly describe the type of human behavior...Ch. 22 - What behavioral problems are associated with...Ch. 22 - What behavioral problems are associated with...Ch. 22 - Under what circumstances is a static budget...Ch. 22 - How do computerized budgeting systems aid firms in...Ch. 22 - Why should the production requirements set forth...Ch. 22 - Why should the timing of direct materials...Ch. 22 - a. Discuss the purpose of the cash budget. b. If...Ch. 22 - Prob. 22.10DQ

Ch. 22 - Prob. 22.1APECh. 22 - Flexible budgeting At the beginning of the period,...Ch. 22 - Prob. 22.2APECh. 22 - Production budget Magnolia Candle Inc. projected...Ch. 22 - Direct materials purchases budget MyLife...Ch. 22 - Direct materials purchases budget Magnolia Candle...Ch. 22 - Prob. 22.4APECh. 22 - Direct labor cost budget Magnolia Candle Inc....Ch. 22 - Prob. 22.5APECh. 22 - Cost of goods sold budget Prepare a cost of goods...Ch. 22 - Prob. 22.6APECh. 22 - Cash budget Magnolia Candle Inc. pays 10% of its...Ch. 22 - Personal budget At the beginning of the school...Ch. 22 - Flexible budget for selling and administrative...Ch. 22 - Static budget versus flexible budget The...Ch. 22 - Flexible budget for Assembly Department Steelcase...Ch. 22 - Production budget True Tab Inc. produces a small...Ch. 22 - Sales and production budgets SoundLab Inc....Ch. 22 - Professional fees earned budget for a service...Ch. 22 - Prob. 22.8EXCh. 22 - Direct materials purchases budget Romano's Frozen...Ch. 22 - Prob. 22.10EXCh. 22 - Prob. 22.11EXCh. 22 - Prob. 22.12EXCh. 22 - Direct labor budget for a service business...Ch. 22 - Production and direct labor cost budgets Levi...Ch. 22 - Factory overhead cost budget Sweet Tooth Candy...Ch. 22 - Cost of goods sold budget Delaware Chemical...Ch. 22 - Cost of goods sold budget The controller of...Ch. 22 - Schedule of cash collections of accounts...Ch. 22 - Schedule of cash collections of accounts...Ch. 22 - Schedule of cash payments for a service company...Ch. 22 - Schedule of cash payments for a service company...Ch. 22 - Capital expenditures budget On January 1, 2016,...Ch. 22 - Forecast sales volume and sales budget For 2016,...Ch. 22 - Sales, production, direct materials purchases, and...Ch. 22 - Budgeted income statement and supporting budgets...Ch. 22 - Cash budget The controller of Sonoma Housewares...Ch. 22 - Budgeted income statement and balance sheet As a...Ch. 22 - Forecast sales volume and sales budget Sentinel...Ch. 22 - Sales, production, direct materials purchases, and...Ch. 22 - Budgeted income statement and supporting budgets...Ch. 22 - Cash budget The controller of Mercury Shoes Inc....Ch. 22 - Budgeted income statement and balance sheet As a...Ch. 22 - Prob. 22.1CPCh. 22 - Prob. 22.2CPCh. 22 - Static budget for a service company A bank manager...Ch. 22 - Objectives of the master budget Dominos Pizza...Ch. 22 - Integrity and evaluating budgeting systems The...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY