Concept explainers

Communication

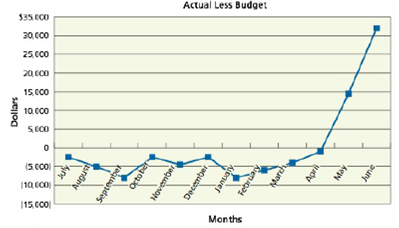

The city of Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each department. The annual budget is divided by 12 months to provide a constant monthly static budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be “returned” to the General Fund. Thus, if department heads fail to use their budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for the recent fiscal year. The chart was as follows:

Write a memo to Stacy Collins, the city manager, interpreting the chart and suggesting improvements to the budgeting system.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

ACCOUNTING (LOOSELEAF)-W/STD.GDE+ACCESS

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College