Transfer pricing, perfect and imperfect markets. Letang Company has three divisions (R, S, and T), organized as decentralized profit centers. Division R produces the basic chemical Ranbax, in multiples of 1,000 pounds, and transfers it to divisions S and T. Division S processes Ranbax into the final product Syntex, and division T processes Ranbax into the final product Termix. No material is lost during processing.

Division R has no fixed costs. The variable cost per pound of Ranbax is $0.18. Division R has a capacity limit of 10,000 pounds. Divisions S and T have capacity limits of 4,000 and 6,000 pounds, respectively. Divisions S and T sell their final product in separate markets. The company keeps no inventories of any kind.

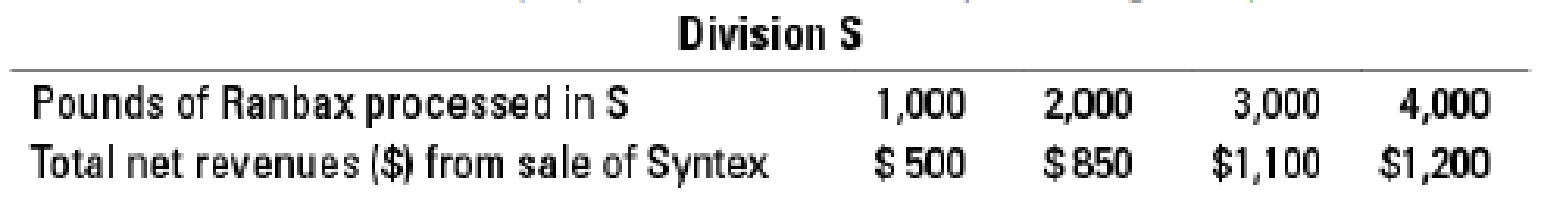

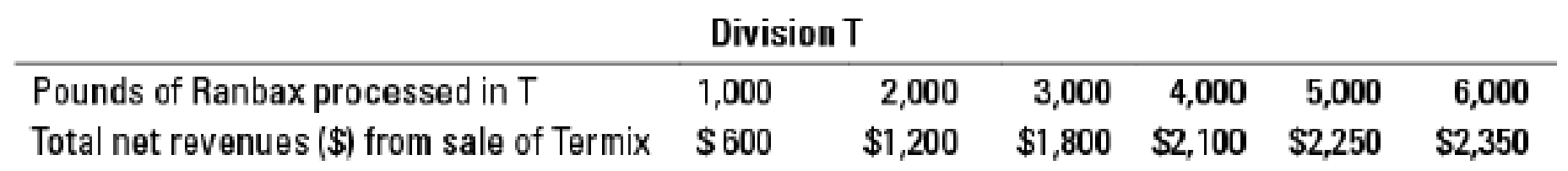

The cumulative net revenues (i.e., total revenues – total

- A. Suppose there is no external market for Ranbax. What quantity of Ranbax should the Letang Company produce to maximize overall income? How should this quantity be allocated between the two processing divisions?

- B. What range of transfer prices will motivate divisions S and T to demand the quantities that maximize overall income (as determined in requirement 1), as well as motivate division R to produce the sum of those quantities?

- C. Suppose that division R can sell any quantity of Ranbax in a

perfectly competitive market for $0.33 a pound. To maximize Letang’s income, how many pounds of Ranbax should division R transfer to divisions S and T, and how much should it sell in the external market? - D. What range of transfer prices will result in divisions R, S, and T taking the actions determined as optimal in requirement 3? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- XYZ CORPORATION, WHICH APPLIES MANUFACTURING OVERHEAD ON THE BASIS OF MACHINE HOURS, HAS PROVIDED THE FOLLOWING DATA FOR ITS MOST RECENT YEAR OF OPERATIONS: ESTIMATED MANUFACTURING OVERHEAD = $420,000 •. • ESTIMATED MACHINE HOURS = 10,000 ACTUAL MANUFACTURING OVERHEAD = $425,000 ACTUAL MACHINE HOURS = 10,200 THE ESTIMATES WERE MADE AT THE BEGINNING OF THE YEAR TO COMPUTE THE PREDETERMINED OVERHEAD RATE. COMPUTE THE PREDETERMINED OVERHEAD RATE.arrow_forwardCan you please solve this financial accounting question?arrow_forward3. The management of an amusement park is considering purchasing a new ride for $95,000 that would have a useful life of 10 years. The company has estimated that the net present value of all cash flows except salvage value from the initial investment and annual cash inflows is ($4,853). The company's discount rate is 9%. What would the salvage value of the ride in 10 years need to be to make this investment attractive?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,