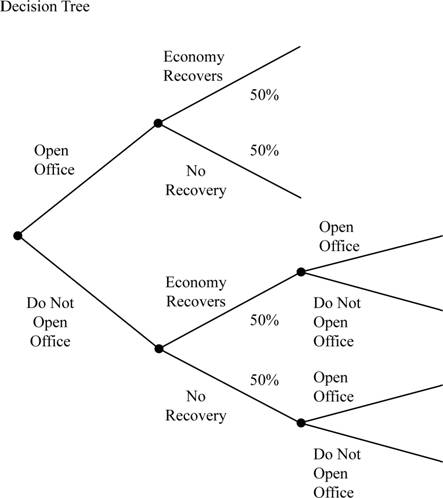

Your company is planning on opening an office in Japan. Profits depend on how fast the economy in Japan recovers from its current recession. There is a 50% chance of recovery this year. You are trying to decide whether to open the office now or in a year. Construct the decision tree that shows the choices you have to open the office either today or one year from now.

To draw: The decision tree.

Introduction:

Decision tree is a tree-like graph which helps to identify strategies which are most likely to achieve goals. A decision tree comprises decision support tools.

Explanation of Solution

Given information:

A company is planning on opening an office in Japan. Company profit depends on Japanʼs economyʼs recovery from its current recession. The chance of recovery from recession is 50.00%.

Possible decision:

Possible decision in the decision tree:

- 1. To open office

- 2. To not open office

If to open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office and economy recover, then two possible decisions:

- 1. To open office

- 2. To not open office

If to not open office and the economy does not recover, then two possible decisions:

- 1. To open office

- 2. To not open office

Diagram from decision tree:

Want to see more full solutions like this?

Chapter 22 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Principles Of Taxation For Business And Investment Planning 2020 Edition

Financial Accounting: Tools for Business Decision Making, 8th Edition

Operations Management

Accounting For Governmental & Nonprofit Entities

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Beta Company Ltd issued 10% perpetual debt of Rs. 1,00,000. The company's tax rate is 50%. Determine the cost of capital (before tax as well as after tax) assuming the debt is issued at 10 percent premium. helparrow_forwardFinance subject qn solve.arrow_forwardPlease help with questionsarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College