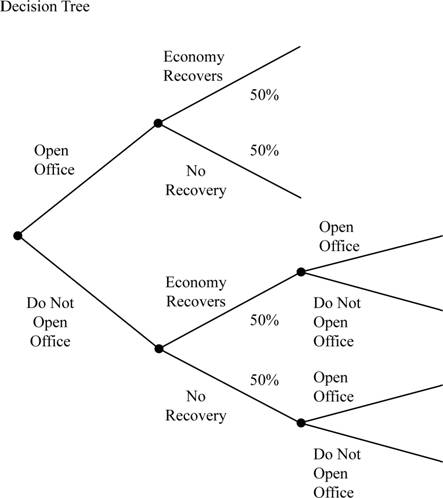

Your company is planning on opening an office in Japan. Profits depend on how fast the economy in Japan recovers from its current recession. There is a 50% chance of recovery this year. You are trying to decide whether to open the office now or in a year. Construct the decision tree that shows the choices you have to open the office either today or one year from now.

To draw: The decision tree.

Introduction:

Decision tree is a tree-like graph which helps to identify strategies which are most likely to achieve goals. A decision tree comprises decision support tools.

Explanation of Solution

Given information:

A company is planning on opening an office in Japan. Company profit depends on Japanʼs economyʼs recovery from its current recession. The chance of recovery from recession is 50.00%.

Possible decision:

Possible decision in the decision tree:

- 1. To open office

- 2. To not open office

If to open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office and economy recover, then two possible decisions:

- 1. To open office

- 2. To not open office

If to not open office and the economy does not recover, then two possible decisions:

- 1. To open office

- 2. To not open office

Diagram from decision tree:

Want to see more full solutions like this?

Chapter 22 Solutions

Corporate Finance

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Principles Of Taxation For Business And Investment Planning 2020 Edition

Financial Accounting: Tools for Business Decision Making, 8th Edition

Operations Management

Accounting For Governmental & Nonprofit Entities

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Which of the following formulas represents compound interest? A) I = PRTB) A = P(1 + rt)C) A = P(1 + r/n)^(nt)D) A = P - Iarrow_forwardA bond pays annual coupons of $60 and is currently priced at $1,050. What is its current yield? A) 6.0% B) 5.7% C) 5.5% D) 5.0% explainarrow_forward8. A bond pays annual coupons of $60 and is currently priced at $1,050. What is its current yield? A) 6.0%B) 5.7%C) 5.5%D) 5.0% helparrow_forward

- 8. A bond pays annual coupons of $60 and is currently priced at $1,050. What is its current yield? A) 6.0%B) 5.7%C) 5.5%D) 5.0%arrow_forwardWhat is the effective annual rate (EAR) if the nominal rate is 12% compounded quarterly? A) 12.55%B) 12.00%C) 12.36%D) 12.82% need help!arrow_forwardWhat is the effective annual rate (EAR) if the nominal rate is 12% compounded quarterly? A) 12.55%B) 12.00%C) 12.36%D) 12.82%arrow_forward

- A loan of $10,000 is to be repaid in equal annual installments over 4 years at 5% interest. What is the annual installment? A) $2,564.57B) $2,856.44C) $2,312.49D) $2,775.60arrow_forward1. What is the simple interest on a loan of $5,000 at 6% per annum for 3 years? A) $900B) $750C) $1,200D) $600arrow_forwardWhat is the monthly payment on a $12,000 loan at 6% annual interest, to be repaid over 1 year? A) $1,030.33B) $1,033.00C) $1,035.45D) $1,050.00need help!!arrow_forward

- What is the monthly payment on a $12,000 loan at 6% annual interest, to be repaid over 1 year? A) $1,030.33B) $1,033.00C) $1,035.45D) $1,050.00arrow_forward4. A stock pays an annual dividend of $3 and is currently priced at $60. What is the dividend yield? A) 4%B) 5%C) 6%D) 3%arrow_forward4. A stock pays an annual dividend of $3 and is currently priced at $60. What is the dividend yield? A) 4%B) 5%C) 6%D) 3%need help!!arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College