Study Guide for Working Papers for Heintz/Parry's College Accounting, Chapters 16-27, 23rd

23rd Edition

ISBN: 9781337913577

Author: HEINTZ, James A., Parry, Robert W.

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 12SPB

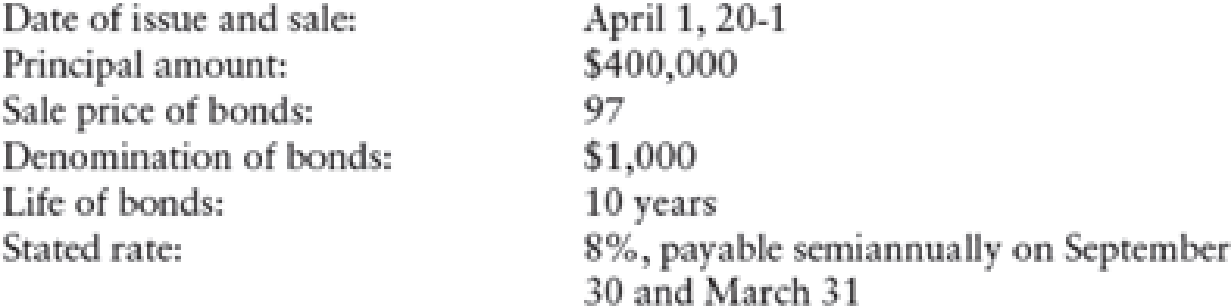

BONDS ISSUED AT A DISCOUNT, REDEEMED AT A GAIN Ellis & Co. issued the following bonds at a discount:

REQUIRED

Prepare

(a) Issuance of the bonds.

(b) Interest payment and discount amortization on the bonds on September 30, 20-1.

(c) Year-end adjustment on the bonds for 20-1.

(d) Reversing entry for the beginning of 20-2.

(e) Redemption of $50,000 of the bonds on April 1, 20-4, at 96.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the cost of goods sold on the sale?

I want Answer

I am trying to find the accurate solution to this general accounting problem with appropriate explanations.

Chapter 22 Solutions

Study Guide for Working Papers for Heintz/Parry's College Accounting, Chapters 16-27, 23rd

Ch. 22 - A secured bond is one that is backed by specific...Ch. 22 - Prob. 2TFCh. 22 - When bonds are issued at face value, the debit to...Ch. 22 - Prob. 4TFCh. 22 - Prob. 5TFCh. 22 - Bonds that give the holder the option of...Ch. 22 - Prob. 2MCCh. 22 - Prob. 3MCCh. 22 - Prob. 4MCCh. 22 - Bond sinking fund earnings are (a) subtracted from...

Ch. 22 - Prob. 1CECh. 22 - Prob. 2CECh. 22 - Prob. 3CECh. 22 - Prob. 4CECh. 22 - Prob. 5CECh. 22 - Prob. 1RQCh. 22 - Prob. 2RQCh. 22 - Prob. 3RQCh. 22 - Prob. 4RQCh. 22 - What accounts are affected when bonds are issued...Ch. 22 - Prob. 6RQCh. 22 - Prob. 7RQCh. 22 - Prob. 8RQCh. 22 - Prob. 9RQCh. 22 - When bonds are redeemed before maturity, how is...Ch. 22 - Prob. 11RQCh. 22 - How should sinking fund earnings be reported on...Ch. 22 - Prob. 13RQCh. 22 - Prob. 1SEACh. 22 - Prob. 2SEACh. 22 - Prob. 3SEACh. 22 - REDEMPTION OF BONDS ISSUED AT FACE VALUE Levesque...Ch. 22 - REDEMPTION OF BONDS ISSUED AT A PREMIUM Brighton...Ch. 22 - REDEMPTION OF BONDS ISSUED AT A DISCOUNT...Ch. 22 - BOND SINKING FUNDS M. J. Adams Corporation pays...Ch. 22 - BONDS ISSUED AT FACE VALUE Ito Co. issued the...Ch. 22 - Prob. 9SPACh. 22 - Prob. 10SPACh. 22 - Prob. 11SPACh. 22 - Prob. 12SPACh. 22 - Prob. 13SPACh. 22 - Prob. 1SEBCh. 22 - Prob. 2SEBCh. 22 - Prob. 3SEBCh. 22 - Prob. 4SEBCh. 22 - Prob. 5SEBCh. 22 - REDEMPTION OF BONDS ISSUED AT A DISCOUNT Medina...Ch. 22 - Prob. 7SEBCh. 22 - BONDS ISSUED AT FACE VALUE Ramona Arroyo Co....Ch. 22 - Prob. 9SPBCh. 22 - Prob. 10SPBCh. 22 - Prob. 11SPBCh. 22 - BONDS ISSUED AT A DISCOUNT, REDEEMED AT A GAIN...Ch. 22 - Prob. 13SPBCh. 22 - MANAGING YOUR WRITING The business where you work...Ch. 22 - Prob. 1ECCh. 22 - MASTERY PROBLEM Jackson, Inc.s fiscal year ends...Ch. 22 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate solution to this financial accounting question using valid calculations.arrow_forwardLast year the return on total assets in Jupiter Manufacturing was 15%. The total assets were 4.2 million at the beginning of the year and 4.6 million at the end of the year. The tax rate was 22%, and sales were $7.5 million. What was the net income for the year?arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forward

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain the correct methodology to solve this financial accounting problem?arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- The revaluation model for PPE requires? 1. Revaluations at regular intervals with sufficient frequency 2. Annual revaluations only 3. One-time revaluation at management's discretion 4. Revaluation only when asset is impaired Helparrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardA new machine with a purchase price of$90,000, transportation costs of $8,000, installation costs of $6,000, and special handling fees of $2,000, would have a cost basis of:arrow_forward

- A new machine with a purchase price of$90,000, transportation costs of $8,000, installation costs of $6,000, and special handling fees of $2,000, would have a cost basis of: Answerarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting - Long-term Liabilities - Bonds; Author: Finance & Accounting Videos by Prof Coram;https://www.youtube.com/watch?v=_1fwsJIGMos;License: Standard Youtube License