a.

To Determine: The reasons that is economically justifiable among tax considerations, control, synergy, risk reduction and buying of assets at a below-replacement cost.

Introduction: A merger is the mix of two organizations into one by either shutting the old entities into one new entity or by one organization engrossing the other. In other terms, at least two organizations are united into one organization to form a merger.

a.

Explanation of Solution

The reasons that are economically justifiable among tax considerations, control, synergy, risk reduction and buying of assets at below-replacement cost is as follows:

The rationale that is economically justifiable for mergers are synergy and tax consequences. Synergy happens when the estimation of the joined firm surpasses the total of the estimations of the organizations taken independently. A synergistic merger makes value that must be allotted between the stockholders of the merging organizations.

Synergy can emerge from the below four sources:

- Through expanded market control because of decreased rivalry. The operating and money related economies are socially appropriate, as mergers that increase the administrative effectiveness, but mergers that decrease rivalry are both unattractive and unlawful.

- Through financial economies, this might incorporate higher debt limit, decreasing transaction expenses, or better inclusion by securities’ examiners that can prompt greater demand and thus greater costs.

- Through operating economies of scale in administration, creation, marketing or conveyance.

- Through differential management effectiveness, which suggests that new administration can expand the value of a firm's assets.

Another legitimate justification behind mergers is tax consideration. For instance, a firm that is extremely cost-effective and thusly in the most noteworthy corporate-tax section could procure an organization with huge accumulated tax losses, and promptly utilize those losses to protect its present and future revenue. Without the merger, the carry forwards may inevitably be utilized, yet their value would be greater whenever utilized now as opposed to the future.

The thought processes that are usually less sustainable on economic positions are risk reduction, buy of assets at lower replacement cost, regulator, and globalization. Managers regularly express that expansion balances out an organization's profit stream and in this manner lessens total risk, and henceforth benefits investors. Equilibrium of profit is absolutely helpful to an organization's workers, providers, clients, and directors. But, if a stock investor is worried about earnings changeability, the concerned investor can diversify more effectively than the firm can.

Occasionally a firm will be publicized as a conceivable procurement contender on the grounds that the replacement value of its assets is extensively higher than it’s fairly market value. Currently, numerous hostile takeovers have happened. In order to preserve their organizations self-regulating and furthermore to secure their occupations, earlier build cautious or defensive mergers which make their organizations harder to "process." Also, such defensive mergers are typically debt financed, which makes it tougher for a potential purchaser to utilize debt financing to fund the purchaser. When all is said in done, defensive mergers seem, by all accounts, to be planned more to serve managers than for investors.

An expanded want to end up globalized has brought about numerous mergers. To merge just to end up worldwide is not a financially supported explanation behind a merger; in any case, expanded globalization has prompted expanded economies of scale. Along these lines, synergism regularly results or in other words legitimate purpose behind mergers. Synergy seems, by all accounts, to be the explanation behind this merger.

b.

To Determine: The similarities between hostile merger and friendly merger.

b.

Explanation of Solution

The similarities between hostile merger and friendly merger are as follows:

In a friendly merger, the administration of one firm or also called as the acquirer consents to purchase another firm. In several cases, the activity is started by the acquiring firm, but in a few circumstances the target may start the merger. The administrations of the two firms get together and exercise terms that they accept to be gainful to the two sets of investors. At that point they issue declarations to their investors prescribing that they consent to the merger. Obviously, the shareholders of the target firm ordinarily should vote on the merger, yet administration's help for the most part guarantees that the votes will be advantageous.

If a target company's administration opposes the merger, at that point the purchasing firm's advances are said to be hostile as opposed to friendly. For this situation, the acquirer decides to make an immediate interest to the shareholders of the target firm. This appears as a tender offer, whereby the target firm's investors are requested to "tender" their shares to the purchasing firm in return for money, stock, securities, or a mix of the three. In the event that at least 51% of the target firm's shareholders tender their shares, at that point the merger will be finished over administration's opposition.

c.

To Determine: The cash flow statement of Division HH’s from 2018 to 2021, the reasons on why the interest expense deducted in merger cash flow statement and the reasons on why earnings retentions deducted in cash flow statement.

c.

Explanation of Solution

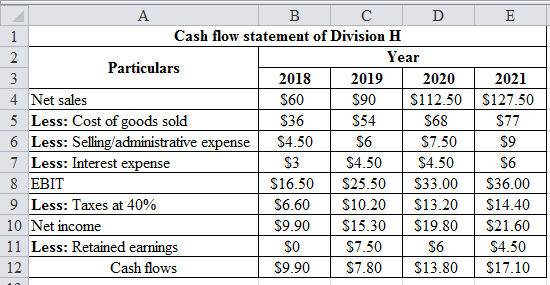

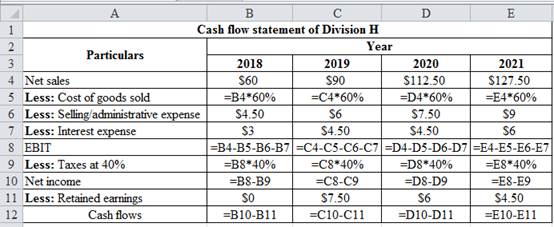

Determine the cash flow statement of Division HH’s from 2018 to 2021

Using a excel spreadsheet, the cash flow statement of Division HH’s from 2018 to 2021 is determined.

Excel Spreadsheet:

Excel Workings:

The reasons on why the interest expense deducted in merger cash flow statement is as follows:

It is necessary to note that these declarations are indistinguishable to ordinary capital budgeting cash flow statements with the exception of that both interest expense and maintenances are incorporated into merger examination. In straight capital budgeting, all debt included is new debt that is issued to finance the asset accompaniments. Consequently, the debt included all costs the equivalent, the rate of debt (rd) and this expense is represented by reducing or discounting the cash streams at the company's weighted average cost of capital.

But, in a merger the procuring firms normally both expect the current debt of the target and issues new debt to fund the takeover. In this way, the debt included has diverse expenses, and consequently cannot be represented as a solitary expense in the weighted average cost of capital. The most effortless clarification is to unequivocally incorporate interest expense in the cash flow statement.

The reasons on why earnings retentions deducted in cash flow statement is as follows:

Concerning to the retentions, the majority of the cash streams from an individual project are accessible for use all through the firm, however a portion of the cash streams produced by a procuring are for the most part held with the new partition to assist its growth. Since such retentions are not accessible to the parent organization for utilize somewhere else, they should be removed in the cash flow statement. With interest expense and retentions incorporated into the cash flow statements, the cash streams are residuals that are accessible to the obtaining company's equity holders. Company SHR’s administration could pay these out as dividends or reinvest them in different partitions of the firm.

d.

To Determine: The appropriate discount rate to apply to the cash flows developed in the previous part and the actual estimate of the discount rate.

d.

Answer to Problem 8IC

The actual estimate of the discount rate is 14.2%.

Explanation of Solution

The appropriate discount rate to apply to the cash flows developed in the previous part is as follows:

From the above discussions, the cash streams are residuals, and they have a place with the obtaining company's shareholders. Since interest expense has just been measured, the cash streams are more risky than the characteristic capital budgeting cash streams, and they should be discounted utilizing the

Though, the market risk of the Division HH is not the equivalent as the market risk of Company HH working freely, in light of the fact that the merger influences Company HH’s leverage and tax rate. Company SHR’s investment bankers have assessed the Division HH’s beta will be 1.3 after the merger and the extra leverage has been utilized.

Determine the actual estimate of the discount rate

Here,

rF - Risk free rate

rM - Market risk premium

B - Beta of stock

Therefore the actual estimate of the discount rate is 14.20%.

e.

To Determine: The estimated continuing value of acquisition and the value of Company HH to Company SHR and whether it would be the same value if another firm evaluating Company HH as acquisition.

e.

Answer to Problem 8IC

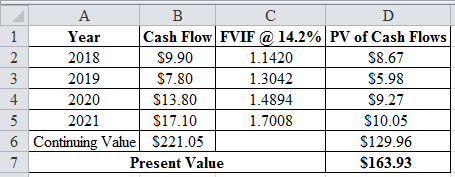

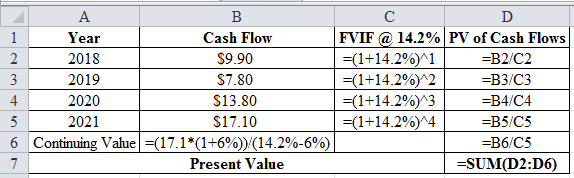

The estimated continuing value of acquisition is $221.05 million and the value of Company HH to Company SHR is $163.93 million.

Explanation of Solution

Determine the estimated continuing value of acquisition

Here,

g – Growth rate

rs – Discount rate

Therefore the estimated continuing value of acquisition is $221.05 million.

Determine the value of Company HH to Company SHR

Using a excel spreadsheet, the value of Company HH to Company SHR is determined as $163.93 million.

Excel Spreadsheet:

Excel Workings:

Therefore the value of Company HH to Company SHR is $163.93 million.

The reasons on whether it would be the same value if another firm evaluating Company HH as acquisition is as follows:

In the event that another firm was valuing Company HH, they would most likely acquire an estimate not quite the same as $163.93 million. Most imperative, the synergies included would probably be dissimilar, and henceforth the cash flow estimates would contrast. Likewise, another potential acquirer may utilize diverse financing methods, or have an alternate tax rate, and consequently determine an alternate discount rate.

f.

To Determine: Whether Company SHR makes an offer for Company H, if offered the share price.

f.

Explanation of Solution

Determine the current market value of Company HH

Therefore the current market value of Company HH is $90 million.

Determine the difference of value

Since Company HH's expected value to Company SHR’s is $163.9 million, it creates the impression that the merger would be valuable to the two sets of investors.

Therefore the difference of value is $73.93 million.

Determine the range of share price

The price of the share several weeks ago was $9.

Therefore the range of share price is between $9 and $16.393

The reasons on whether Company SHR makes an offer for Company H is as follows:

At a share price of $9, the majority of the advantage of the merger goes to Company SHR’s investors, while with a share price of $16.39, the majority of the value made goes to Company HH's investors. If Company SHR’s offers more than $16.39 per share, at that point the wealth would be exchanged from Company SHR’s investors to Company HH's investors. With regards to the real offering value, Company SHR’s should make the offer as low as could reasonably be expected, yet adequate to Company HH's investors. A low starting offer, roughly $9.50 per share, would likely be rejected and the exertion squandered.

Additionally, the offer may impact other potential suitors to think about Company HH, and they could emerge outbidding Company SHR’s. On the other hand, a high value, roughly $16, passes the majority of the gain to Company HH's investors, and Company SHR’s administrators ought to hold however much of the synergistic value as could be expected for their very own investors. It is also necessary to note that this argument expect that Company HH's price of $9 as "reasonable," equilibrium value without a merger. As the stock trades irregularly, the share price of $9 may not signify to a reasonable least cost. Company HH's administration should make an assessment of a reasonable cost and utilize this data in its transactions with Company SHR.

g.

To Determine: The merger related activities that are undertaken by investment bankers.

g.

Explanation of Solution

The merger related activities that are undertaken by investment bankers are as follows:

- Risk arbitrage conjecturing in the stocks of organizations that are expected to takeover targets

- Assisting target organizations in creating and applying cautious strategies

- Assisting to value target organizations

- Assisting to organize mergers

- Assisting in financing mergers

Want to see more full solutions like this?

Chapter 21 Solutions

Mindtapv2.0 Finance, 1 Term (6 Months) Printed Access Card For Brigham/houston's Fundamentals Of Financial Management, 15th (mindtap Course List)

- (Annual percentage yield) Compute the cost of the following trade credit terms using the compounding formula, or effective annual rate. Note: Assume a 30-day month and 360-day year. a. 3/5, net 30 b. 3/15, net 45 c. 4/10, net 75 d. 3/15, net 45 ... a. When payment is made on the net due date, the APR of the credit terms of 3/5, net 30 is decimal places.) %. (Round to twoarrow_forwardSuppose XYZ is a non-dividend-paying stock. Suppose S = $100, σ = 40%, δ = 0, and r = 0.06. What is the price of a 105-strike call option with 1 year to expiration? What is the 1-year forward price for the stock? What is the price of a 1-year 105-strike option, where the underlying asset is a futures contract maturing at the same time as the option?arrow_forwardCalifornia Construction Inc. is considering a 15 percent stock dividend. The capital accounts are: Common stock (6,000,000 shares at $10 par) ....... $60,000,000 Capital in excess of par* ...................................... 35,000,000 Retained earnings ................................................ 75,000,000 Net worth ......................................................... $170,000,000 *The increase in capital in excess of par as a result of a stock dividend is equal to the shares created times (Market price – Par value). The company’s stock is selling for $32 per share. The company had total earnings of $19,200,000 with 6,000,000 shares outstanding and earnings per share were $3.20. The firm has a P/E ratio of 10. a. Show the new capital accounts if a 15 percent stock dividend is given. b. What adjustments would be made to EPS and the stock price? (Assume the P/E ratio remains constant.) c. How many shares would an investor have if they originally had 80 shares? d. What…arrow_forward

- Refer to Table 10–6. Price quotes are stated in 1/64ths. What was the closing price of a May 3,990 call option on the S&P 500 Stock Index futures contract on January 13, 2023? Round your closing price answer to 1 decimal place and dollar price answer to the nearest whole number. TABLE 10-6 Option Quotes, January 13, 2023 Underlying Asset: S&P 500 Index (SPX) Closing Value: 3,999.09 Expiration Strike Price Calls Puts Last Volume Open Interest Last Volume Open Interest 04-21-23 3990 140 0 258 164.6 0 223 04-21-23 4010 164.3 257 18,244 144.3 100 17,166 05-19-23 3990 200.7 210 30 169.1 210 52 05-19-23 4010 186.1 303 3,552 279.2 2 3,965 06-16-23 3990 223.3 1 16 178.8 1 1 06-16-23 4010 152.9 0 46 183 1,665 42,159 12-15-23 3975 361 100 2,555 250.1 32 2,438 12-15-23 4025 349.3 0 2,416 268.2 4 2,149 OPTIONS ON INTEREST RATE FUTURES Underlying Asset: March 2023 30-Year Treasury Bond Future Prior Settle: 130'02 Expiration Strike Price Calls Puts…arrow_forwardTerrill Machining Inc. sells machine parts to auto mechanics. It has not paid a dividend in many years but is currently contemplating some kind of dividend. The capital accounts for the firm are as follows: Common stock (2,400,000 shares at $5 par) . Capital in excess of par* ............................... Retained earnings ......................................... Net worth ................................................... $12,000,000 5,000,000 23,000,000 $40,000,000 *The increase in capital in excess of par as a result of a stock dividend is equal to the new shares created times (Market price – Par value). The company’s stock is selling for $20 per share. The company had total earnings of $4,800,000 during the year. With 2,400,000 shares outstanding, earnings per share were $2.00. The firm has a P/E ratio of 10. a. What adjustments would have to be made to the capital accounts for a 10 percent stock dividend? Show the new capital accounts. b. What adjustments would be made to…arrow_forwardPat’s Video Games has been struggling recently as it has been rumored that the owners are secret Dodgers fans. As a result, its stock price is now only $4 per share. It is going to declare a one-for-two reverse stock split to increase the stock value. a. If an investor owns 90 shares, how many shares will he own after the reverse stock split? b. What is the anticipated price of the stock after the reverse stock split? c. Because it became public knowledge that the owners of Pat’s Video Games were Dodgers fans (and used company proceeds to purchase Dodger paraphernalia, the stock price continued to drop even after the stock split. If the stock price only goes up to 75 percent of the value computed in part b. What will the stock’s price be? d. How has the total value of an investor’s holdings changed from before the reverse stock split to after the reverse stock split (based on the stock value computed in part c)? e. What important lesson did the investor learn?arrow_forward

- Purrogi Cat Treats Inc. earned $500 million last year and retained $290 million in earnings. What is the payout ratio?arrow_forwardEthical dilemma: Republic Communications Corporation (RCC) has offered you an attractive position in its financial planning division. The new position would constitute a promotion with a $30,000 increase in salary compared to the job you now have at National Telecommunications, Inc. (NTI). The problem is that RCC wants you to bring the rate-setting software you developed at NTI, along with some rate data, with you to the new job. Even though NTI sells its software to other companies and information concerning telephone rates is available to the public, you know that such knowledge will help RCC significantly in its attempt to redesign its rate-setting system. In fact, according to the situation presented in the text, a new and improved rate-setting program could be worth as much as $200 million per year for RCC. Therefore, the question is whether the information RCC wants you to take with you to your new job is proprietary to NTI. Should the rate-setting program and the rate data be…arrow_forwardYour traditional IRA account has stock of GFH, which cost $2,000 20 years ago when you were 50 years old. You have been very fortunate, and the stock is now worth $23,000. You are in the 32 percent income tax bracket and pay 15 percent on long-term capital gains. a. What was the annual rate of growth in the value of the stock? b. What are the taxes owed if you withdraw the funds? Answer to part b. is $8,050 *Please display all work & needed formulasarrow_forward

- Can anyone figure this out correctly? I keep getting the wrong answers over and over? Cost of Trade Credit Grunewald Industries sells on terms of 3/10, net 40. Gross sales last year were $4,161,000 and accounts receivable averaged $370,500. Half of Grunewald's customers paid on the 10th day and took discounts. What are the nominal and effective costs of trade credit to Grunewald's nondiscount customers? (Hint: Calculate daily sales based on a 365-day year, calculate the average receivables for discount customers, and then find the DSO for the nondiscount customers.) Do not round intermediate calculations. Round your answers to two decimal places. 1.) Effective cost of trade credit:arrow_forwardExplain how an increase in interest rates by a central bank could affect bond prices and stock market performance. Explanation.arrow_forwardWhat is the purpose of diversification in an investment portfolio, and how does it reduce risk?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning