a.

To Determine: The reasons that is economically justifiable among tax considerations, control, synergy, risk reduction and buying of assets at below-replacement cost.

Introduction: A merger is the mix of two organizations into one by either shutting the old entities into one new entity or by one organization engrossing the other. In other terms, at least two organizations are united into one organization to form a merger.

a.

Explanation of Solution

The reasons that are economically justifiable among tax considerations, control, synergy, risk reduction and purchase of assets at below-replacement cost is as follows:

The rationale that is economically justifiable for mergers are synergy and tax consequences. Synergy happens when the estimation of the joined firm surpasses the total of the estimations of the organizations taken independently. A synergistic merger makes value that must be allotted between the stockholders of the merging organizations.

Synergy can emerge from the below four sources:

- Through expanded market control because of decreased rivalry. The operating and money related economies are socially appropriate, as mergers that increase the administrative effectiveness, but mergers that decrease rivalry are both unattractive and unlawful.

- Through financial economies, this might incorporate higher debt limit, decreasing transaction expenses, or better inclusion by securities’ examiners that can prompt greater demand and thus greater costs.

- Through operating economies of scale in administration, creation, marketing or conveyance.

- Through differential management effectiveness, which suggests that new administration can expand the value of a firm's assets.

Another legitimate justification behind mergers is tax consideration. For instance, a firm that is extremely cost-effective and thusly in the most noteworthy corporate-tax section could procure an organization with huge accumulated tax losses, and promptly utilize those losses to protect its present and future revenue. Without the merger, the carry forwards may inevitably be utilized, yet their value will be greater whenever utilized now as opposed to the future.

The thought processes that are usually less sustainable on economic positions are risk reduction, buy of assets at lower replacement cost, regulator, and globalization. Managers regularly express that expansion balances out an organization's profit stream and in this manner lessens total risk, and henceforth benefits investors. Equilibrium of profit is absolutely helpful to an organization's workers, providers, clients, and directors. But, if a stock investor is worried about earnings changeability, the concerned investor can diversify more effectively than the firm can.

Occasionally a firm will be publicized as a conceivable procurement contender on the grounds that the replacement value of its assets is extensively higher than it’s fairly market value. Currently, numerous hostile takeovers have happened. In order to preserve their organizations self-regulating and furthermore to secure their occupations, earlier build cautious or defensive mergers which make their organizations harder to "process." Moreover, those defensive mergers are typically debt financed, which makes it tougher for a potential purchaser to utilize debt financing to fund the purchaser. When all is said in done, defensive mergers seem, by all accounts, to be planned more to serve managers than for investors.

An expanded want to end up globalized has brought about numerous mergers. To merge just to end up worldwide is not a financially supported explanation behind a merger; in any case, expanded globalization has prompted expanded economies of scale. Along these lines, synergism regularly results or in other words legitimate purpose behind mergers. Synergy seems, by all accounts, to be the explanation behind this merger.

b.

To Determine: The similarities between hostile merger and friendly merger.

b.

Explanation of Solution

The similarities between hostile merger and friendly merger are as follows:

In a friendly merger, the administration of one firm or also called as the acquirer consents to purchase another firm. In several cases, the activity is started by the acquiring firm, but in a few circumstances the target may start the merger. The administrations of the two firms get together and exercise terms that they accept to be gainful to the two sets of investors. At that point they issue declarations to their investors prescribing that they consent to the merger. Obviously, the shareholders of the target firm ordinarily should vote on the merger, yet administration's help for the most part guarantees that the votes will be advantageous.

If a target company's administration opposes the merger, at that point the purchasing firm's advances are said to be hostile as opposed to friendly. For this situation, the acquirer decides to make an immediate interest to the target firm's shareholders. This appears as a tender offer, whereby the target firm's investors are requested to "tender" their shares to the purchasing firm in return for money, stock, securities, or a mix of the three. In the event that at least 51% of the target firm's shareholders tender their shares, at that point the merger will be finished over administration's opposition.

c.

To Determine: The cash flow statement of Division HH’s from 2015 to 2018, the reasons on why the interest expense deducted in merger cash flow statement and the reasons on why earnings retentions deducted in cash flow statement.

c.

Explanation of Solution

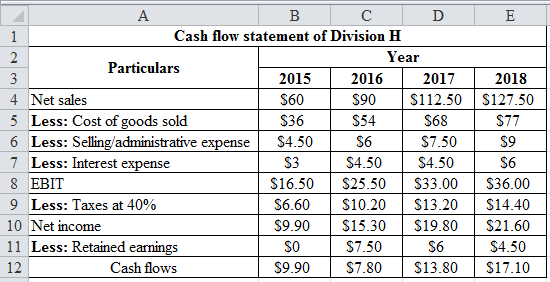

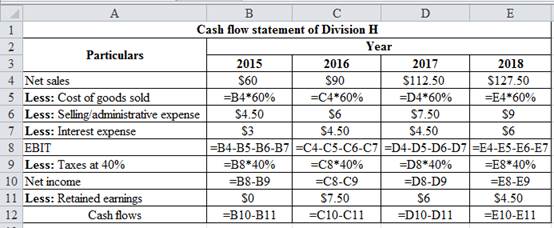

Determine the cash flow statement of Division HH’s from 2015 to 2018

Using a excel spreadsheet, the cash flow statement of Division HH’s from 2015 to 2018 is determined.

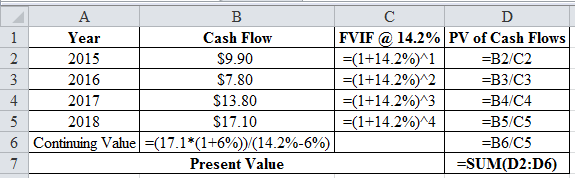

Excel Spreadsheet:

Excel Workings:

The reasons on why the interest expense deducted in merger cash flow statement is as follows:

It is necessary to note that these declarations are indistinguishable to ordinary capital budgeting cash flow statements with the exception of that both interest expense and maintenances are incorporated into merger examination. In straight capital budgeting, all debt included is new debt that is issued to finance the asset accompaniments. Consequently, the debt included all costs the equivalent, the rate of debt (rd) and this expense is represented by reducing or discounting the cash streams at the company's weighted average cost of capital.

But, in a merger the procuring firms normally both expect the current debt of the target and issues new debt to fund the takeover. In this way, the debt included has diverse expenses, and consequently cannot be represented as a solitary expense in the weighted average cost of capital. The most effortless clarification is to unequivocally incorporate interest expense in the cash flow statement.

The reasons on why earnings retentions deducted in cash flow statement is as follows:

Concerning to the retentions, the majority of the cash streams from an individual project are accessible for use all through the firm, however a portion of the cash streams produced by a procuring are for the most part held with the new partition to assist its growth. Since such retentions are not accessible to the parent organization for utilize somewhere else, they should be removed in the cash flow statement. With interest expense and retentions incorporated into the cash flow statements, the cash streams are residuals that are accessible to the obtaining company's equity holders. Company SHR’s administration could pay these out as dividends or reinvest them in different partitions of the firm.

d.

To Determine: The appropriate discount rate to apply to the cash flows developed in the previous part and the actual estimate of the discount rate.

d.

Answer to Problem 8IC

The actual estimate of the discount rate is 14.2%.

Explanation of Solution

The appropriate discount rate to apply to the cash flows developed in the previous part is as follows:

From the above discussions, the cash streams are residuals, and they have a place with the obtaining company's shareholders. Since interest expense has just been measured, the cash streams are more risky than the characteristic capital budgeting cash streams, and they should be discounted utilizing the

Though, the market risk of the Division HH is not the equivalent as the market risk of Company HH working freely, in light of the fact that the merger influences Company HH’s leverage and tax rate. Company SHR’s investment bankers have assessed the Division HH’s beta will be 1.3 after the merger and the extra leverage has been utilized.

Determine the actual estimate of the discount rate

Here,

rF - Risk free rate

rM - Market risk premium

B - Beta of stock

Therefore the actual estimate of the discount rate is 14.20%.

e.

To Determine: The estimated continuing value of acquisition and the value of Company HH to Company SHR and whether it would be the same value if another firm evaluating Company HH as acquisition.

e.

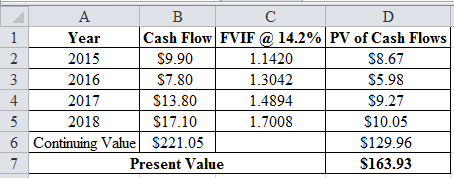

Answer to Problem 8IC

The estimated continuing value of acquisition is $221.05 million and the value of Company HH to Company SHR is $163.93 million.

Explanation of Solution

Determine the estimated continuing value of acquisition

Here,

g – Growth rate

rs – Discount rate

Therefore the estimated continuing value of acquisition is $221.05 million.

Determine the value of Company HH to Company SHR

Using a excel spreadsheet, the value of Company HH to Company SHR is determined as $163.93 million.

Excel Spreadsheet:

Excel Workings:

Therefore the value of Company HH to Company SHR is $163.93 million.

The reasons on whether it would be the same value if another firm evaluating Company HH as acquisition is as follows:

In the event that another firm was valuing Company HH, they would most likely acquire an estimate not quite the same as $163.93 million. Most imperative, the synergies included would probably be dissimilar, and henceforth the cash flow estimates would contrast. Likewise, another potential acquirer may utilize diverse financing methods, or have an alternate tax rate, and consequently determine an alternate discount rate.

f.

To Determine: Whether Company SHR makes an offer for Company H, if offered the share price.

f.

Explanation of Solution

Determine the current market value of Company HH

Therefore the current market value of Company HH is $90 million.

Determine the difference of value

Since Company HH's expected value to Company SHR’s is $163.9 million, it creates the impression that the merger would be valuable to the two sets of investors.

Therefore the difference of value is $73.93 million.

Determine the range of share price

The price of the share several weeks ago was $9.

Therefore the range of share price is between $9 and $16.393

The reasons on whether Company SHR makes an offer for Company H is as follows:

At a share price of $9, the majority of the advantage of the merger goes to Company SHR’s investors, while with a share price of $16.39, the majority of the value made goes to Company HH's investors. If Company SHR’s offers more than $16.39 per share, at that point the wealth would be exchanged from Company SHR’s investors to Company HH's investors. With regards to the real offering value, Company SHR’s should make the offer as low as could reasonably be expected, yet adequate to Company HH's investors. A low starting offer, roughly $9.50 per share, would likely be rejected and the exertion squandered.

Additionally, the offer may impact other potential suitors to think about Company HH, and they could emerge outbidding Company SHR’s. On the other hand, a high value, roughly $16, passes the majority of the gain to Company HH's investors, and Company SHR’s administrators ought to hold however much of the synergistic value as could be expected for their very own investors. It is also necessary to note that this argument expect that Company HH's price of $9 as "reasonable," equilibrium value without a merger. As the stock trades irregularly, the share price of $9 may not signify to a reasonable least cost. Company HH's administration should make an assessment of a reasonable cost and utilize this data in its transactions with Company SHR.

g.

To Determine: The merger related activities that are undertaken by investment bankers.

g.

Explanation of Solution

The merger related activities that are undertaken by investment bankers are as follows:

- Risk arbitrage conjecturing in the stocks of organizations that are expected to takeover targets

- Assisting target organizations in creating and applying cautious strategies

- Assisting to value target organizations

- Assisting to organize mergers

- Assisting in financing mergers

Want to see more full solutions like this?

Chapter 21 Solutions

Bundle: Fundamentals of Financial Management, 14th + LMS Integrated for MindTap Finance, 1 term (6 months) Printed Access Card

- Wilbur and Orville are brothers. They're both serious investors, but they have different approaches to valuing stocks. Wilbur, the older brother, likes to use the dividend valuation model. Orville prefers the free cash flow to equity valuation model. As it turns out, right now, both of them are looking at the same stock-Wright First Aerodynmaics, Inc. (WFA). The company has been listed on the NYSE for over 50 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about WFA's stock: Current dividend (D) = $2.30/share Current free cash flow (FCF) = $1.5 million Expected growth rate of dividends and cash flows (g) = 5% Required rate of return (r) = 14% Shares outstanding 500,000 shares How would Wilbur and Orville each value this stock?arrow_forwardCompany P/S Multiples Facebook 13.33 Snap 18.22 Twitter 13.27arrow_forwardThe Perez Company has the opportunity to invest in one of two mutually exclusive machines that will produce a product it will need for the foreseeable future. Machine A costs $8 million but realizes after-tax inflows of $4.5 million per year for 4 years. After 4 years, the machine must be replaced. Machine B costs $17 million and realizes after-tax inflows of $4 million per year for 8 years, after which it must be replaced. Assume that machine prices are not expected to rise because inflation will be offset by cheaper components used in the machines. The cost of capital is 13%. Using the replacement chain approach to project analysis, by how much would the value of the company increase if it accepted the better machine? Round your answer to two decimal places. 1.) $ millionarrow_forward

- Wilbur and Orville are brothers. They're both serious investors, but they have different approaches to valuing stocks. Wilbur, the older brother, likes to use the dividend valuation model. Orville prefers the free cash flow to equity valuation model. As it turns out, right now, both of them are looking at the same stock-Wright First Aerodynmaics, Inc. (WFA). The company has been listed on the NYSE for over 50 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about WFA's stock: Current dividend (D) = $3.30/share Current free cash flow (FCF) = $1.5 million Expected growth rate of dividends and cash flows (g)=8% Required rate of return (r) = 13% Shares outstanding 500,000 shares How would Wilbur and Orville each value this stock? The stock price from Wilbur's valuation is $ (Round to the nearest cent.)arrow_forwardThe Perez Company has the opportunity to invest in one of two mutually exclusive machines that will produce a product it will need for the foreseeable future. Machine A costs $8 million but realizes after-tax inflows of $4.5 million per year for 4 years. After 4 years, the machine must be replaced. Machine B costs $17 million and realizes after-tax inflows of $4 million per year for 8 years, after which it must be replaced. Assume that machine prices are not expected to rise because inflation will be offset by cheaper components used in the machines. The cost of capital is 13%. Using the replacement chain approach to project analysis, by how much would the value of the company increase if it accepted the better machine? Round your answer to two decimal places. 1.) $ million What is the equivalent annual annuity for each machine? Do not round intermediate calculations. Round your answers to two decimal places. 2.) Machine A: $ million 3.) Machine B: $ millionarrow_forwardYou expect to have $29,865. You plan to make X savings contribution of $1,690 per month. The expected return is 0.92 percent per month and the first regular savings contribution will be made later today. What is X? Round to 2 decimal places.arrow_forward

- Company P/S Multiples Facebook 13.67 Snap 18.76 Twitter 13.55arrow_forwardEnergy Resources generated an EPS of $4.38 over the last 12 months. The company's earnings are expected to grow by 30.7% next year, and because there will be no significant change in the number of shares outstanding, EPS should grow at about the same rate. You feel the stock should trade at a P/E of around 30 times earnings. Use the P/E approach to set a value on this stock. Using the P/E approach, the value on this stock is $ (Round to the nearest cent.)arrow_forwardThe Anderson Company has a net profits of $20 million, sales of $226 million, and 3.9 million shares of common stock outstanding. The company has total assets of $139 million and total stockholders' equity of $74 million. It pays $2.31 per share in common dividends, and the stock trades at $40 per share. Given this information, determine the following: a. Anderson's EPS. b. Anderson's book value per share and price-to-book-value ratio. c. The firm's P/E ratio. d. The company's net profit margin. e. The stock's dividend payout ratio and its dividend yield. f. The stock's PEG ratio, given that the company's earnings have been growing at an average annual rate of 8.2%. a. Anderson's EPS is $ (Round to the nearest cent.)arrow_forward

- Davis Industries must choose between a gas-powered and an electric-powered forklift truck for moving materials in its factory. Because both forklifts perform the same function, the firm will choose only one. (They are mutually exclusive investments.) The electric-powered truck will cost more, but it will be less expensive to operate; it will cost $23,000, whereas the gas-powered truck will cost $17,100. The cost of capital that applies to both investments is 11%. The life for both types of truck is estimated to be 6 years, during which time the net cash flows for the electric-powered truck will be $6,500 per year, and those for the gas-powered truck will be $4,750 per year. Annual net cash flows include depreciation expenses. Calculate the NPV and IRR for each type of truck, and decide which to recommend. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places. Electric-poweredforklift truck…arrow_forwardA project has an initial cost of $45,000, expected net cash inflows of $9,000 per year for 11 years, and a cost of capital of 14%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardA project has an initial cost of $45,000, expected net cash inflows of $9,000 per year for 11 years, and a cost of capital of 14%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning