1.

Prepare a spreadsheet to support the

1.

Explanation of Solution

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of cash flows: Statement of cash flow reports all the cash transactions which are responsible for inflow and outflow of cash and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

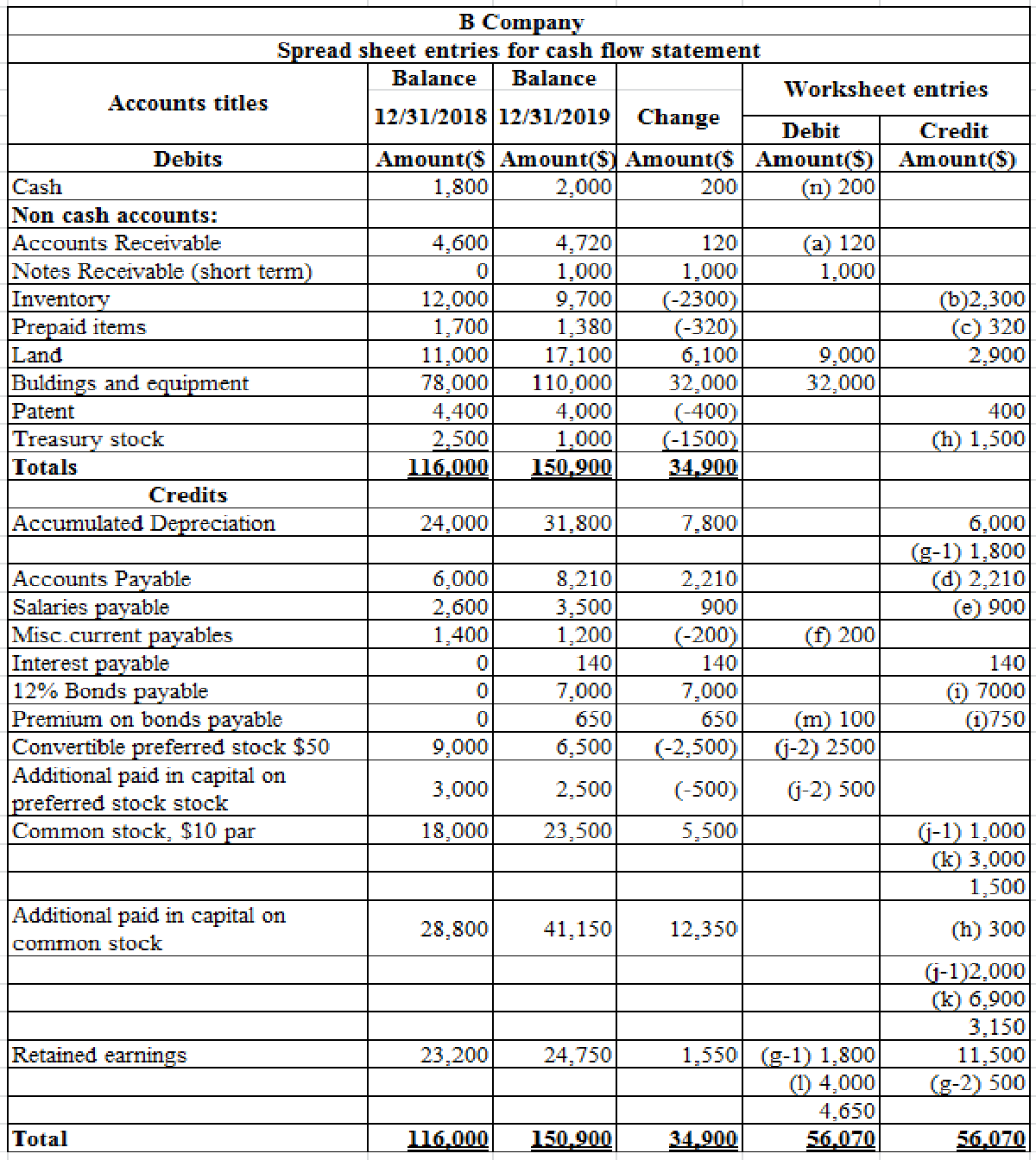

Prepare a spreadsheet entry to support the cash flow statement.

Table (1)

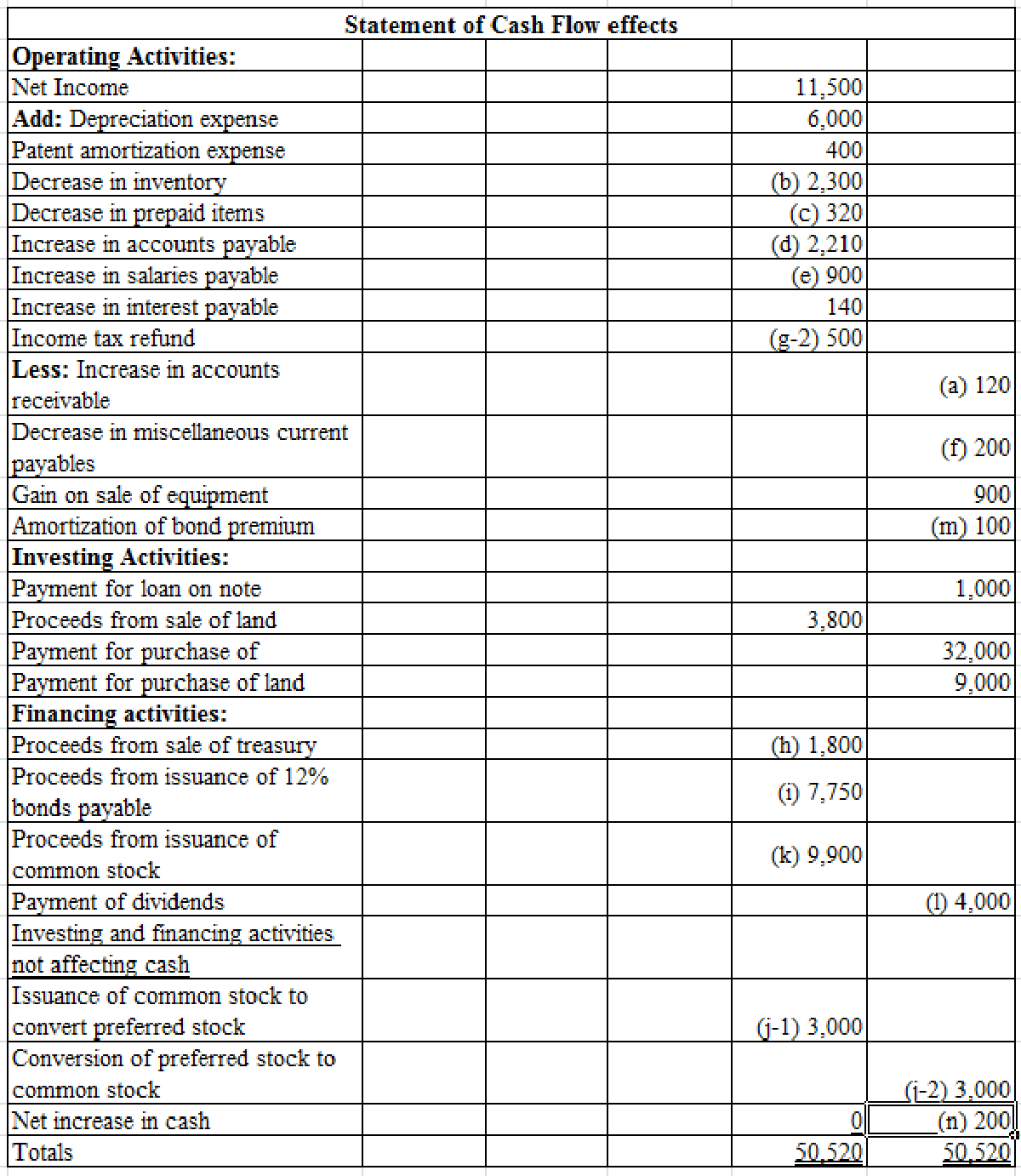

Table (2)

Working notes:

a. Calculate the Changes in

b. Calculate the changes in inventory.

c. Calculate the change in prepaid item.

d. Calculate the changes in accounts payable.

e. Calculate the changes in salaries payable.

f. Calculate the changes in miscellaneous current payable.

g-1) Understated of depreciation expenses for the last year by $1,800.

g-2) Received income tax refund of $500.

h) Calculate the additional paid in capital received through treasury stock.

i). Calculate the premium on bonds payable.

j-1) Common stock issued to convert the preferred stock by $3,000.

j-2) Preferred stock converted into common stock for $3,000.

k) Calculate the Premium on common stock.

l) Cash dividend paid by $4,000.

m) Amortization of premium on bonds payable by $100.

n) Cash increased by $200.

2.

Prepare a cash flow statement under indirect method of B Company for the year 2019 and show operating cash flow in the separate schedule.

2.

Explanation of Solution

Operating activities: Operating activities include

Financing activities: Financing activities includes cash inflows and outflows from issuance of common stock and debt, payment of debt and dividends.

Investing activities: Investing activities includes cash inflows and

Prepare the cash flow statement under indirect method.

| B company | ||

| Statement of cash flow | ||

| For the year end 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Operating activities: | ||

| Net cash provided by operating activities ( schedule 1) | $22,950 | |

| Investing activities: | ||

| Proceeds from sale of land | $3,800 | |

| Payment for loan on note receivable | (1,000) | |

| Payment for purchase of land | (9,000) | |

| Payment for purchase of equipment | (32,000) | |

| Net cash used for investing activities | ($38,200) | |

| Financing activities: | ||

| Proceeds from sale of | $ 1,800 | |

| Proceeds from issuance of 12% bonds payable | 7,750 | |

| Proceeds from issuance of common stock | 9,900 | |

| Payment of dividends | (4,000) | |

| Net cash provided by financing activities | 15,450 | |

| Net increase in cash (Schedule 2) | $200 | |

| Cash, January 1, 2019 | 1,800 | |

| Cash, December 31, 2019 | $2,000 | |

| Schedule 1: Cash flows from operating activities | ||

| Net income | $11,500 | |

| Adjustment for non-cash income items: | ||

| Add: | 6,000 | |

| Patent amortization expense | 400 | |

| Less: Amortization of bond premium | (100) | |

| Gain on sale of equipment | (900) | |

| Adjustment for cash flow effects from | ||

| Increase in accounts receivable | (120) | |

| Decrease in inventories | 2,300 | |

| Decrease in prepaid items | 320 | |

| Increase in accounts payable | 2,210 | |

| Increase in salaries payable | 900 | |

| Increase in interest payable | 140 | |

| Decrease in miscellaneous current payables | (200) | |

| Income tax refund | 500 | |

| Net cash provided by operating activities | $22,950 | |

| Schedule 2: Investing and Financing activities not affecting cash | ||

| Financing activities: | ||

| Conversion of | ($3,000) | |

| Issuance of common stock to convert preferred stock | 3,000 | |

Table (3)

Therefore cash balance as on December 31, 2019 is $2,000.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,