Variable costs and activity bases in decision making

Sales volume has been dropping at Mumford Industries. During this time, however, the Shipping Department manager has been under severe financial constraints. The manager knows that most of the Shipping Department's effort is related to pulling Inventory from the warehouse for each order and performing the paperwork. The paperwork involves preparing shipping documents for each order. Thus, the pulling and paperwork effort associated with each sales order is essentially the same, regardless of the size of the order. The Shipping Department manager has discussed the financial situation with senior management. Senior management has responded by pointing out that because sales volume has been dropping, the amount of work in the Shipping Department also should be dropping. Thus, senior management told the Shipping Department manager that costs should be decreasing in the department.

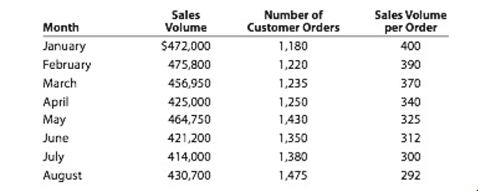

The Shipping Department manager prepared the following information:

Given tills information, how would you respond to senior management?

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Working Papers, Chapters 1-17 for Warren/Reeve/Duchac’s Accounting, 27th and Financial Accounting, 15th

- How can the results from the accounts receivable visualizations be used to estimate bad debts expense and allowance for doubtful accounts? Using the Top 5 Customers by Accounts Receivable Amount Due visualization, which customer has the lowest allowance for doubtful accounts value?arrow_forwardBased on the results of the Sales Order Aging as of December 31, 2022 visualization, what conclusion can be made regarding the outstanding sales orders? a. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 31-60 days. b. The 90+ days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. c. The 61-90 days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. d. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 61-90 days.arrow_forwardPlease solve this General accounting questions step by steparrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning