Concept explainers

Statement of

• LO21–3, LO21–8

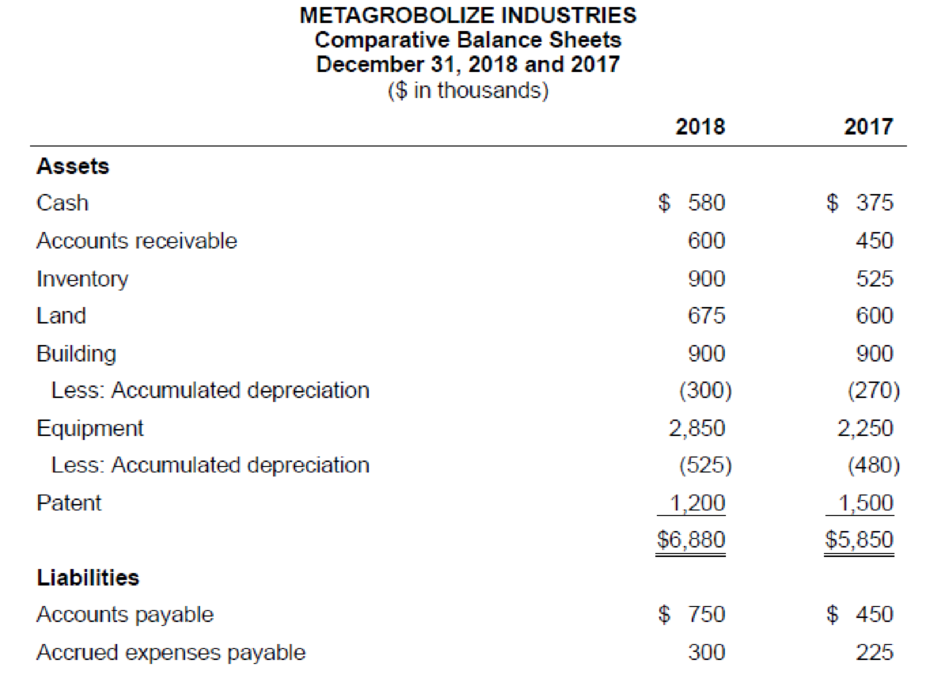

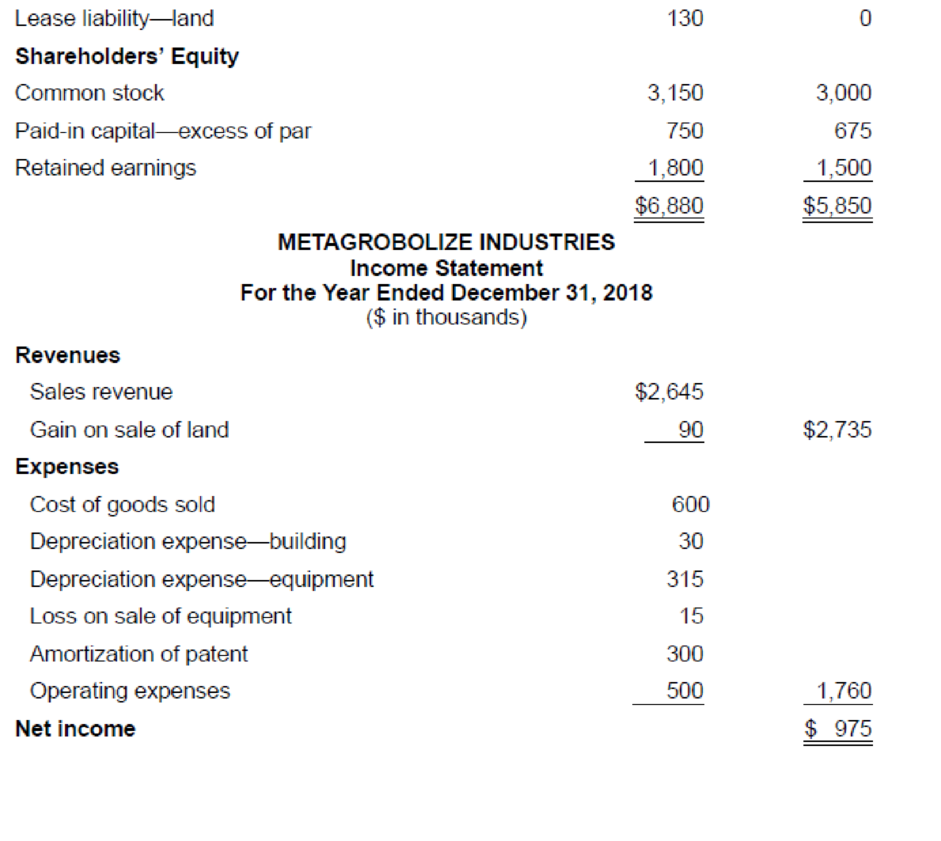

Comparative

Additional information from the accounting records:

a. Annual payments of $20,000 on the finance lease liability are paid each January 1, beginning in 2018.

b. During 2018, equipment with a cost of $300,000 (90%

c. The statement of shareholders’ equity reveals reductions of $225,000 and $450,000 for stock dividends and cash dividends, respectively.

Required:

Prepare the statement of cash flows of Metagrobolize for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Connect Access Card for Intermediate Accounting

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardCan you explain the correct methodology to solve this financial accounting problem?arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forward

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning