Concept explainers

Statement of

• LO21–3, LO21–8

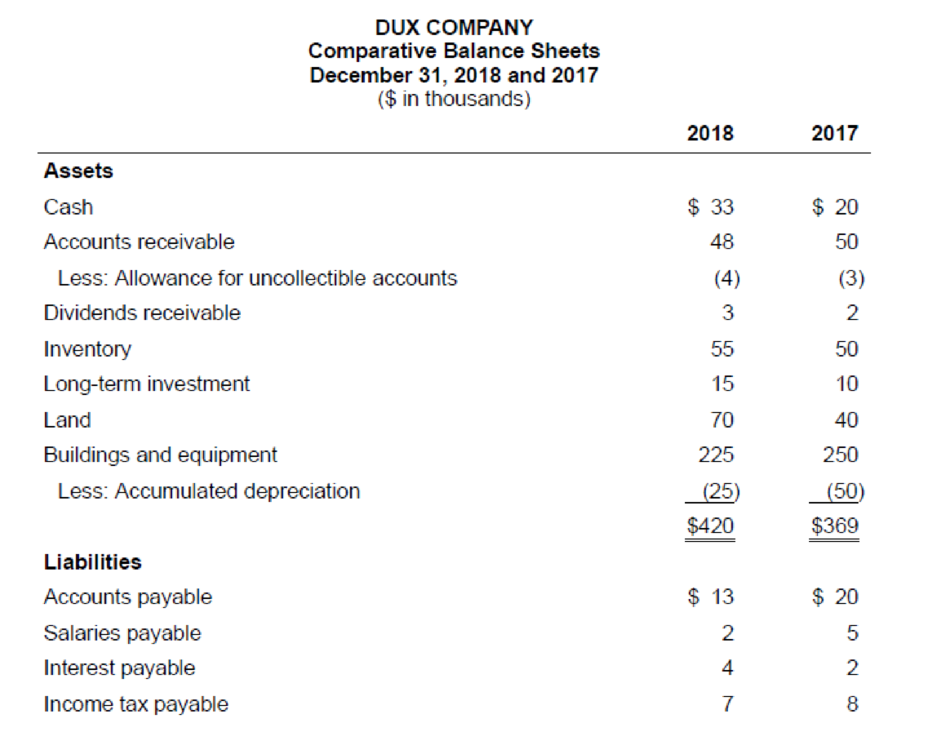

The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Dux Company. Additional information from Dux’s accounting records is provided also.

Additional information from the accounting records:

a. A building that originally cost $40,000, and which was three-fourths

b. The common stock of Byrd Corporation was purchased for $5,000 as a long-term investment.

c. Property was acquired by issuing a 13%, seven-year, $30,000 note payable to the seller.

d. New equipment was purchased for $15,000 cash.

e. On January 1, 2018, bonds were sold at their $25,000 face value.

f. On January 19, Dux issued a 5% stock dividend (1,000 shares). The market price of the $10 par value common stock was $14 per share at that time.

g. Cash dividends of $13,000 were paid to shareholders.

h. On November 12, 500 shares of common stock were repurchased as

Required:

Prepare the statement of cash flows of Dux Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as the ending balance of cash at the end of the accounting period.

Direct method:

This method uses the basis of cash for preparing the cash flows of statement.

Operating activities:

Operating activities refer to the normal activities of a company to carry out the business. The examples for operating activities are purchase of inventory, payment of salary, sales, and others.

Investing activities:

Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities:

Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

To prepare: The statement of cash flow of Company D under direct method for the year ended December 31, 2018.

Explanation of Solution

Spreadsheet:

The spreadsheet is a supplementary device which helps to prepare the adjusting entries and the statement of cash flows easier. The spreadsheet is a working tool of the accountant but it is not a permanent accounting record.

Spreadsheet for the Statement of cash flows of DUX Company:

| DUX Company | ||||

| Spreadsheet for the Statement of Cash Flows | ||||

| Amount in Millions | ||||

| Particulars | December 31,2017 Amount ($) | Changes | December 31,2018 Amount ($) | |

| Debit ($) | Credit ($) | |||

| Assets | ||||

| Assets | ||||

| Cash | 20 | (17) 13 | 33 | |

| Accounts receivable | 50 | (1) 2 | 48 | |

| Less: Allowance | (3) | (1) 1 | (4) | |

| Dividends receivable | 2 | (2) 1 | 3 | |

| Inventory | 50 | (3) 5 | 55 | |

| Long term investment | 10 | (10) 5 | 15 | |

| Land | 40 | (11) 30 X | 70 | |

| Buildings and equipment | 250 | (12) 15 | (7) 40 | 225 |

| Less: Acc. depreciation | (50) | (7) 30 | (5) 5 | (25) |

| Total assets | 369 | 420 | ||

| Liabilities and Stockholders’ Equity | ||||

| Liabilities | ||||

| Accounts payable | 20 | (3) 7 | 13 | |

| salaries payable | 5 | (4) 3 | 2 | |

| Interest payable | 2 | (6) 2 | 4 | |

| Income tax payable | 8 | (8) 1 | 7 | |

| Notes payable | 0 | X (11) 30 | 30 | |

| Bonds payable | 70 | (13) 25 | 95 | |

| Less: Discount on bonds | (3) | (6) 1 | (2) | |

| Stockholders’ equity | ||||

| Common Stock | 200 | (14) 10 | 210 | |

| Paid in capital –ex of par | 20 | (14) 4 | 24 | |

| Retained Earnings | 47 | (14) 14 | ||

| (15) 13 | (9) 25 | 45 | ||

| Less: Treasury stock | 0 | (16) 8 | (8) | |

| Total liabilities and stockholders’ equity | 369 | 420 | ||

| Income Statement | ||||

| Revenues | ||||

| Sales revenue | (1) 200 | 200 | ||

| Dividend revenue | (2) 3 | 3 | ||

| Expenses | ||||

| Cost of goods sold | (3) 120 | (120) | ||

| Salaries expense | (4) 25 | (25) | ||

| Depreciation expense | (5) 5 | (5) | ||

| Bad debt expense | (1) 1 | (1) | ||

| Interest expenses | (6) 8 | (8) | ||

| Loss on sale of building | (7) 3 | (3) | ||

| Income tax expense | (8) 16 | (16) | ||

| Net income | (9) 25 | 25 | ||

| Statement of Cash Flows | ||||

| Operating activities: | ||||

| Cash Inflows: | ||||

| From customers | (1) 202 | |||

| From dividends received | (2) 2 | |||

| Cash Outflows: | ||||

| To suppliers of goods | (3) 132 | |||

| To employees | (4) 28 | |||

| For interest | (6) 5 | |||

| For income taxes | (8) 17 | |||

| Net cash flows | 22 | |||

| Investing activities: | ||||

| Sale of building | (7) 7 | |||

| Purchase of long term investment | (10) 5 | |||

| Purchase of equipment | (12) 15 | |||

| Net cash flows | (13) | |||

| Financing activities: | ||||

| Sale of bonds payable | (13) 25 | |||

| Payment of cash dividends | (15) 13 | |||

| Purchase of treasury stock | (16) 8 | |||

| Net cash flows | 4 | |||

| Net increase in cash | (17) 13 | 13 | ||

| Total | 584 | 584 | ||

Table (1)

Note (X):

Purchase $30,000 worth of land by issuing a 13%, 7-year note is considered as non cash investing and financing activities.

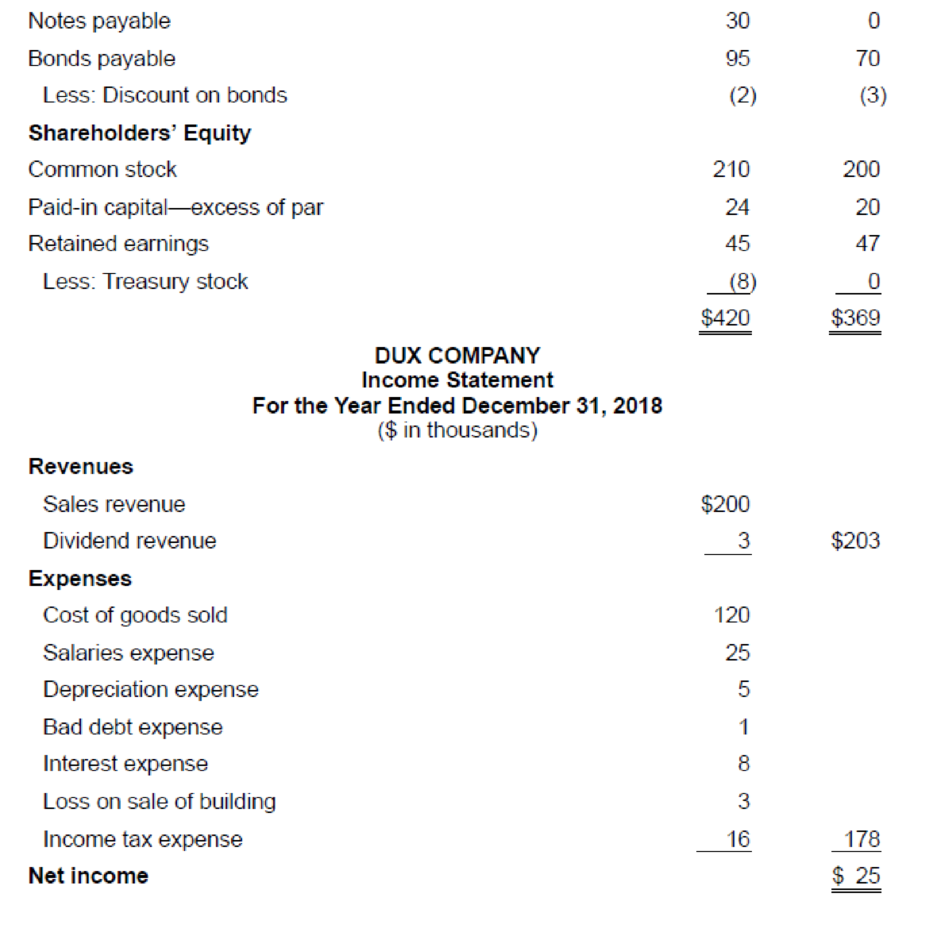

The spreadsheet of Company D shows the analysis of cash flows in the reporting year 2018:

| DUX Company | ||

| Statement of Cash Flows (Direct Method) | ||

| Year Ended December 31, 2018 | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash inflows: | ||

| From customers | 202 | |

| From dividends received | 2 | |

| Cash outflows: | ||

| To suppliers of goods | (132) | |

| To employees | (28) | |

| For interest | (5) | |

| For income taxes | (17) | |

| Net cash flows from operating activities | 22 | |

| Cash flows from investing activities: | ||

| Sale of building | 7 | |

| Purchase of long-term investment | (5) | |

| Purchase of equipment | (15) | |

| Net cash flows from investing activities | (13) | |

| Cash flows from financing activities: | ||

| Sale of bonds payable | 25 | |

| Purchase of treasury stock | (8) | |

| Payment of cash dividends | (13) | |

| Net cash flows from financing activities | 4 | |

| Net increase in cash | 13 | |

| Cash balance, January 1, | 20 | |

| Cash balance, December 31, | 33 | |

Table (2)

Note (X):

| Schedule of Non Cash Investing and Financing Activities: | ||

| Purchase of land issuing notes payable | $30 |

Table (3)

Hence, the opening cash balance is $20 million and closing cash balance is $33 million.

Want to see more full solutions like this?

Chapter 21 Solutions

Loose Leaf Intermediate Accounting

- If someone tracks, tallys and totals a current liabilities for an accounting period, and then seeks to apply this value in a calculation to assess our liquidity, what’s the difference between the current ratio and the “acid-test” (or “quick”) ratio? Does the difference between these two metrics even matter?arrow_forwardDear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- Don't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- No chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning