Concept explainers

Statement of

• LO21–3, LO21–8

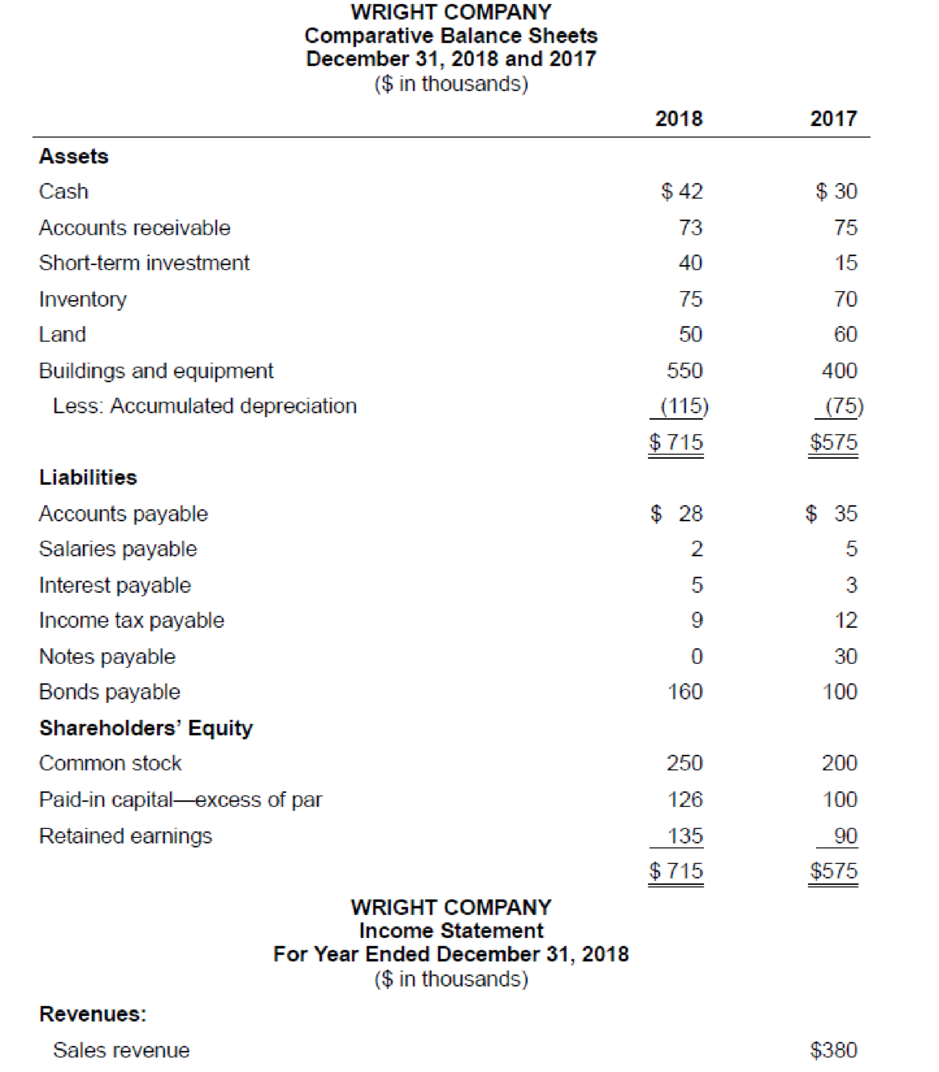

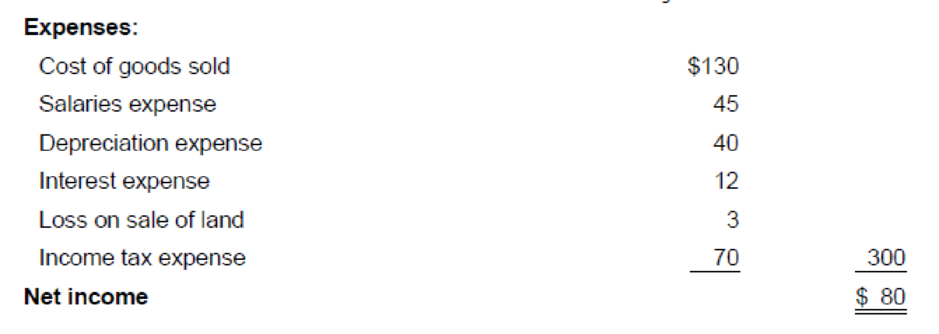

The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Wright Company. Additional information from Wright’s accounting records is provided also.

Additional information from the accounting records:

a. Land that originally cost $10,000 was sold for $7,000.

b. The common stock of Microsoft Corporation was purchased for $25,000 as a short-term investment not classified as a cash equivalent.

c. New equipment was purchased for $150,000 cash.

d. A $30,000 note was paid at maturity on January 1.

e. On January 1, 2018, bonds were sold at their $60,000 face value.

f. Common stock ($50,000 par) was sold for $76,000.

g. Net income was $80,000 and cash dividends of $35,000 were paid to shareholders.

Required:

Prepare the statement of cash flows of Wright Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income with cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

INTERMEDIATE ACTG+CONNECT <LOOSE>

- Which basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingneed helparrow_forwardWhich basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingarrow_forward9. Which of the following best describes deferred revenue?A. Cash received before revenue is earnedB. Cash paid after expense is incurredC. Revenue earned but not yet receivedD. Expense incurred but not paidarrow_forward

- Need help. 2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forwardDont use AI 2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

- No chatgpt What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardI need help 10. What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsneed answerarrow_forward

- dont use ai What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardFill in the attached balance sheet with the data provided on the SEC for years 2020, 2021 and 22 NIKE, INC BALANCE SHEET Financial Statements 2020 2021 2022 Assets Current Assets Cash and Cash Equivalents [insert value] [insert value] [insert value] Accounts Receivable Net [insert value] [insert value] [insert value] Inventory [insert value] [insert value] [insert value] Other Current Assets [insert value] [insert value] [insert value] Total Current Assets $ - $ - $ - Non-Current Assets Property, Plant and Equipment Net [insert value] [insert value] [insert value] Intangibles [insert value] [insert value] [insert value] Other Assets [insert value] [insert value] [insert value] Total Non-Current/Fixed Assets $ - $…arrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets helparrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning