Concept explainers

Statement of

• LO21–3, LO21–8

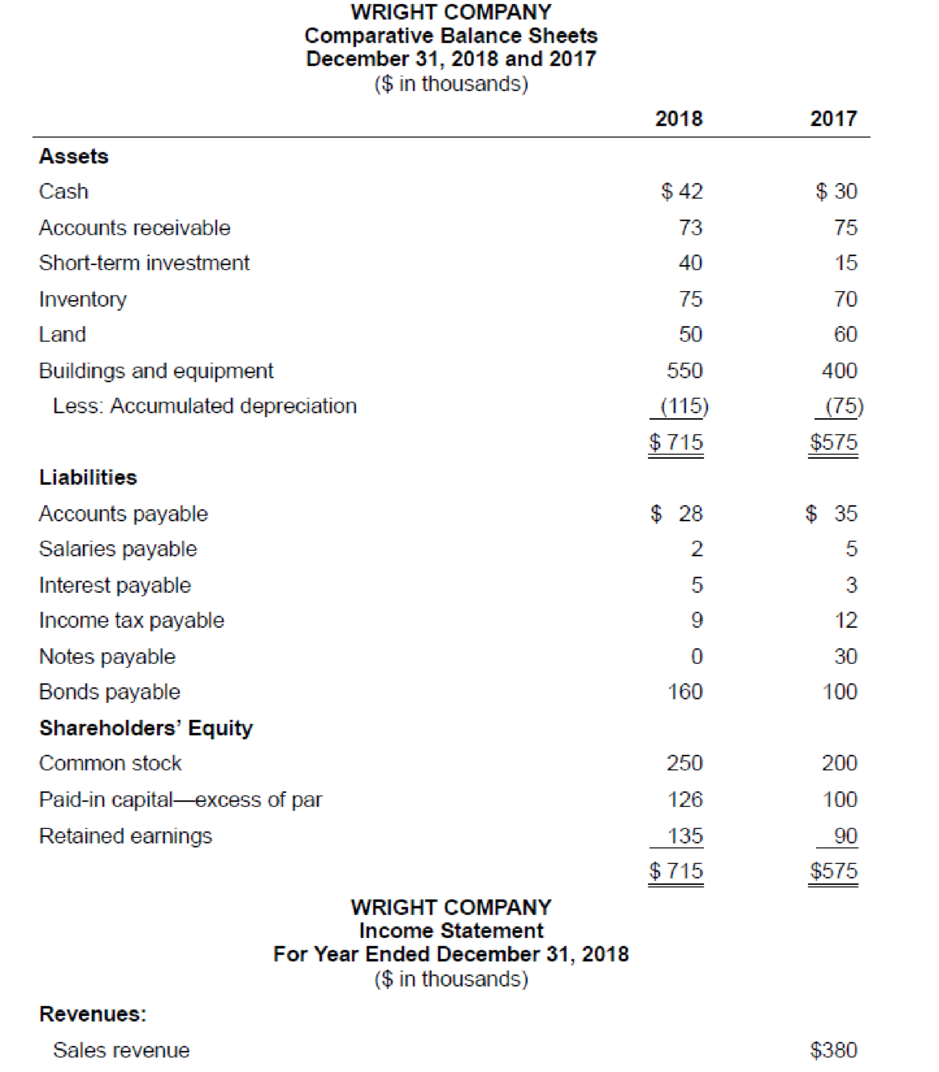

The comparative

Additional information from the accounting records:

a. Land that originally cost $10,000 was sold for $7,000.

b. The common stock of Microsoft Corporation was purchased for $25,000 as a short-term investment not classified as a cash equivalent.

c. New equipment was purchased for $150,000 cash.

d. A $30,000 note was paid at maturity on January 1.

e. On January 1, 2018, bonds were sold at their $60,000 face value.

f. Common stock ($50,000 par) was sold for $76,000.

g. Net income was $80,000 and cash dividends of $35,000 were paid to shareholders.

Required:

Prepare the statement of cash flows of Wright Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income with cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

SPICELAND GEN CMB LL INTRM ACCTG; CNCT

- provide correct answer accounting questionarrow_forwardSmith's Saddles has a weighted average cost of capital (WACC) of 10.5%. The company's cost of equity is 12.5%, and its pretax cost of debt is 8.5%. The tax rate is 35%. What is the company's target debt-equity ratio?arrow_forwardHow much is direct labour cost ?arrow_forward

- I don't need ai answer general accounting questionarrow_forwardAccurate Answerarrow_forwardCarter Inc. had $3,000 of supplies on hand on January 1. During the year, the company purchased $4,800 of supplies, and on December 31, determined that only $1,200 of supplies were still on hand. The adjusting entry for Carter Inc. on December 31 will include: a. Debit Supplies $4,800 b. Credit Supplies Expense $6,600 c. Debit Supplies Expense $6,600 d. Debit Supplies Expense $2,800arrow_forward

- Summit Corporation provided the following financial details: Financial Data: Beginning Total Assets: $600,000 Ending Total Assets: $640,000 • Net Income: $125,000 • Tax Rate: 30% Calculate: Return on Total Assets (ROA)arrow_forwardSubject general accountingarrow_forwardBig Company purchased Small Company for $1,450,000. Small Company had assets with a fair value of $1,150,000, and liabilities with a fair value of $200,000. Use this information to determine the dollar value of good will.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning