Cost Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText -- Access Card Package (15th Edition)

15th Edition

ISBN: 9780133781106

Author: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

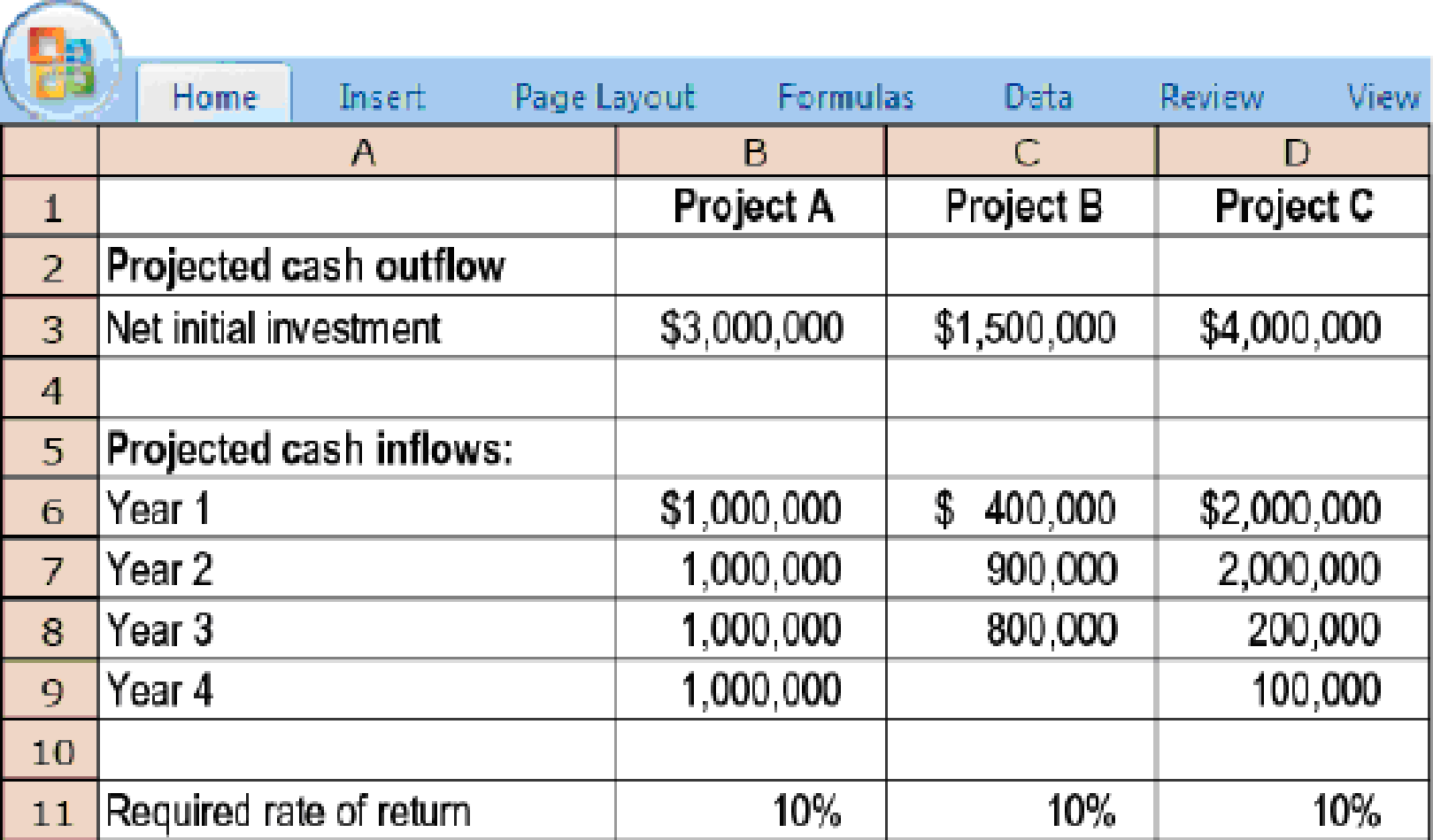

Chapter 21, Problem 21.22E

Payback and

- 1. Because the company’s cash is limited, Andrews thinks the payback method should be used to choose between the capital budgeting projects.

Required

- a. What are the benefits and limitations of using the payback method to choose between projects?

- b. Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Andrews choose?

- 2. Bart thinks that projects should be selected based on their NPVs. Assume all

cash flows occur at the end of the year except for initial investment amounts. Calculate the NPV for each project. Ignore income taxes. - 3. Which projects, if any, would you recommend funding? Briefly explain why.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial accounting question

Hello expert please given answer general accounting question

solve this question general accounting

Chapter 21 Solutions

Cost Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText -- Access Card Package (15th Edition)

Ch. 21 - Capital budgeting has the same focus as accrual...Ch. 21 - List and briefly describe each of the five stages...Ch. 21 - Prob. 21.3QCh. 21 - Only quantitative outcomes are relevant in capital...Ch. 21 - How can sensitivity analysis be incorporated in...Ch. 21 - Prob. 21.6QCh. 21 - Describe the accrual accounting rate-of-return...Ch. 21 - Prob. 21.8QCh. 21 - Lets be more practical. DCF is not the gospel....Ch. 21 - All overhead costs are relevant in NPV analysis....

Ch. 21 - Prob. 21.11QCh. 21 - Distinguish different categories of cash flows to...Ch. 21 - Prob. 21.13QCh. 21 - How can capital budgeting tools assist in...Ch. 21 - Distinguish the nominal rate of return from the...Ch. 21 - Prob. 21.16ECh. 21 - Prob. 21.17ECh. 21 - Capital budgeting methods, no income taxes. City...Ch. 21 - Prob. 21.19ECh. 21 - Capital budgeting with uneven cash flows, no...Ch. 21 - Prob. 21.21ECh. 21 - Payback and NPV methods, no income taxes. (CMA,...Ch. 21 - Prob. 21.23ECh. 21 - Prob. 21.24ECh. 21 - Prob. 21.25ECh. 21 - Prob. 21.26ECh. 21 - Prob. 21.27ECh. 21 - Prob. 21.28ECh. 21 - Prob. 21.29PCh. 21 - Prob. 21.30PCh. 21 - Prob. 21.31PCh. 21 - Prob. 21.32PCh. 21 - Prob. 21.33PCh. 21 - Prob. 21.34PCh. 21 - Recognizing cash flows for capital investment...Ch. 21 - Prob. 21.36PCh. 21 - NPV of information system, income taxes. Saina...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mit Distributors provided the following inventory-related data for the fiscal year: Purchases: $385,000 Purchase Returns and Allowances: $10,200 Purchase Discounts: $4,300 Freight In: $55,000 Beginning Inventory: $72,000 Ending Inventory: $95,500 What is the Cost of Goods Sold (COGS)?arrow_forwardanswer ? general accountingarrow_forwardBrightTech Corp. reported the following cost of goods sold (COGS) figures over three years: • 2023: $3,800,000 • 2022: $3,500,000 • 2021: $3,000,000 If 2021 is the base year, what is the percentage increase in COGS from 2021 to 2023?arrow_forward

- Sun Electronics operates a periodic inventory system. At the beginning of 2022, its inventory was $95,750. During the year, inventory purchases totaled $375,000, and its ending inventory was $110,500. What was the cost of goods sold (COGS) for Sun Electronics in 2022?arrow_forwardi want to this question answer of this general accountingarrow_forwardA clothing retailer provides the following financial data for the year. Determine the cost of goods sold (COGS): ⚫Total Sales: $800,000 • Purchases: $500,000 • Sales Returns: $30,000 • Purchases Returns: $40,000 • Opening Stock Value: $60,000 • Closing Stock Value: $70,000 Administrative Expenses: $250,000arrow_forward

- subject : general accounting questionarrow_forwardBrightTech Inc. had stockholders' equity of $1,200,000 at the beginning of June 2023. During the month, the company reported a net income of $300,000 and declared dividends of $175,000. What was BrightTech Inc.. s stockholders' equity at the end of June 2023?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio 1.25 fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% gross profit margin 25% return on investments 2% Use the given information to fill out the templates for incomestatement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $) Sales 100,000 Cost of goods sold gross profit other expenses earnings before tax tax @ 50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $) Liabilities Amount Assets Amount Equity Net fixed assets long term debt 50,000 Inventory short term debt debtors cash Total Totalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License