Concept explainers

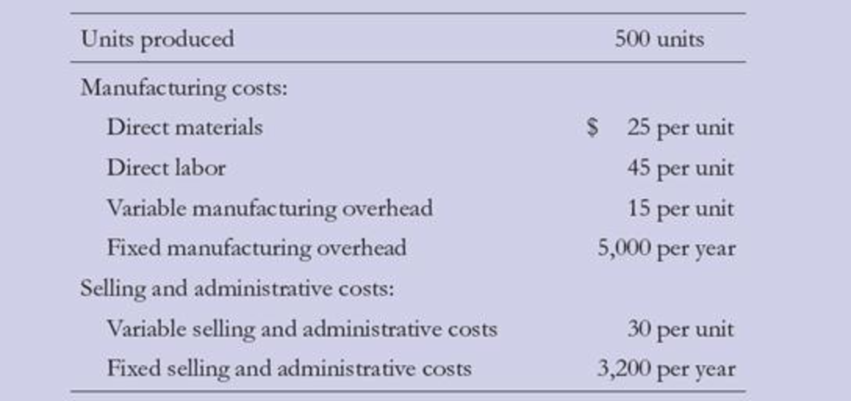

Pierce Company had the following costs:

Calculate the unit product cost using absorption costing and variable costing.

Compute the unit product cost using absorption costing and variable costing.

Explanation of Solution

Absorption Costing: “Absorption costing is a method that allocates “direct labor, direct materials, fixed manufacturing overhead and variable manufacturing overhead” to products and it is required by GAAP for the purpose of external reporting”.

Variable Costing: “Variable costing is a method that allocates only variable manufacturing costs to products; “direct labor, direct materials and variable manufacturing overhead” and it is used for internal reporting”.

Cost per unit: Cost per unit is the cost incurred by the company for producing one unit of product. The unit cost is computed by dividing the units produced with the total cost.

Calculate the unit product cost using absorption costing and variable costing:

| Particulars | Absorption costing | Variable costing |

| Direct Materials | $25 | $25 |

| Direct labor | $45 | $45 |

| Variable manufacturing overhead | $15 | $15 |

| Fixed manufacturing overhead | (1)$10 | |

| Total unit cost | $95 | $85 |

Table (1)

Therefore the total unit cost under absorption costing is $95 and the total unit cost under variable costing is $85.

Working note:

(1)Calculate the amount of fixed manufacturing overhead:

Want to see more full solutions like this?

Chapter 21 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Foundations Of Finance

Intermediate Accounting (2nd Edition)

FUNDAMENTALS OF CORPORATE FINANCE

Macroeconomics

Operations Management

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- On January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to O decimal places, eg. 5,275.) Weighted average number of shares outstandingarrow_forwardOn January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31 Assume that Pharoah earned net income of $3,441,340 during 2023. In addition, it had 90,000 of 10%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2023. Calculate earnings per share for 2023, using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings per sharearrow_forwardI want to correct answer general accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning