Binomial model* Over the coming year, Ragwort’s stock price will halve to $50 from its current level of $100 or it will rise to $200. The one-year interest rate is 10%.

- a. What is the delta of a one-year call option on Ragwort stock with an exercise price of $100?

- b. Use the replicating-portfolio method to value this call.

- c. In a risk-neutral world, what is the probability that Ragwort stock will rise in price?

- d. Use the risk-neutral method to check your valuation of the Ragwort option.

- e. If someone told you that in reality there is a 60% chance that Ragwort’s stock price will rise to $200, would you change your view about the value of the option? Explain.

a.

To compute: The delta of one year call option on R stock with a strike price of $100.

Explanation of Solution

The formula to calculate delta is:

The calculation of delta is as follows:

b.

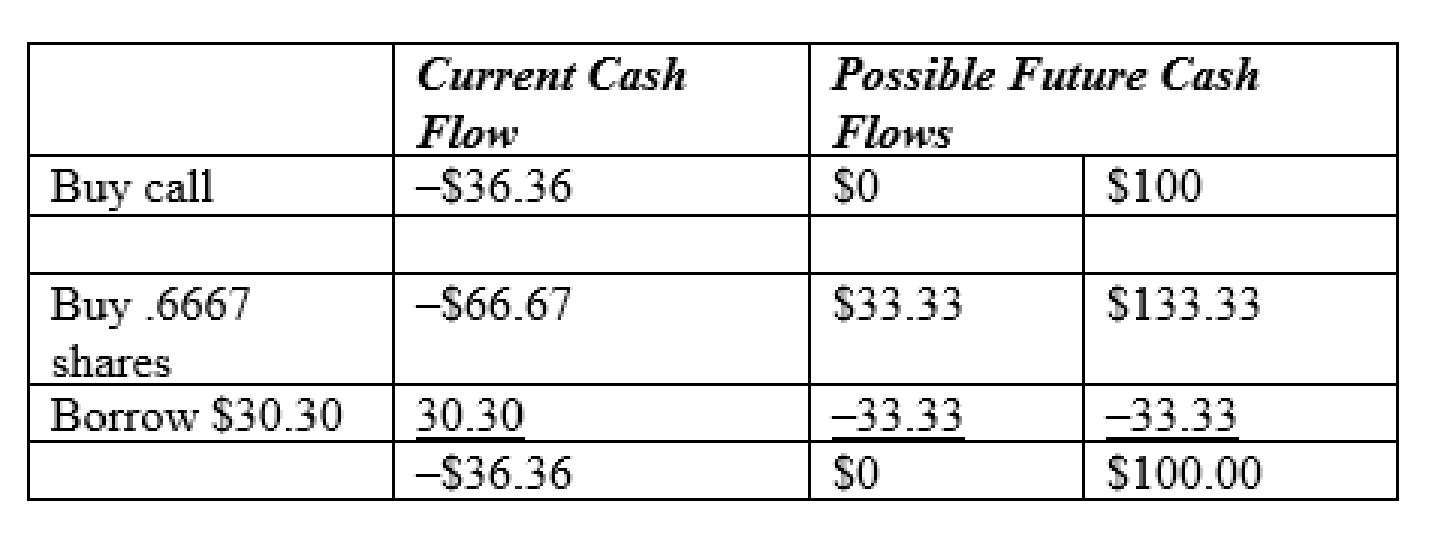

To discuss: Apply the replicating portfolio technique to value this call.

Explanation of Solution

The replicating portfolio technique of valuing call is as follows.

c.

To discuss: The probability of increasing stock R price in a risk neutral world.

Explanation of Solution

The probability of increasing stock R calculated as follows:

The computation as follows:

Foot note: The probability is calculated on the basis of expected return.

d.

To compute: The value of stock R using the risk neutral method.

Explanation of Solution

The option value is calculated using the following formula:

Hence, the value of call is $36.36

e.

To discuss: Whether person X change his option regarding the value of option.

Explanation of Solution

Person X does not change his opinion regarding the value of option. The chance of price increase is most likely higher than the risk- neutral probability, but it does not aid to value the option.

Want to see more full solutions like this?

Chapter 21 Solutions

PRIN.OF CORP.FINANCE-CONNECT ACCESS

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Principles Of Taxation For Business And Investment Planning 2020 Edition

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning