INTERMEDIATE FINAN...-MINDTAP(1 TERM)

14th Edition

ISBN: 9780357516720

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 21, Problem 17P

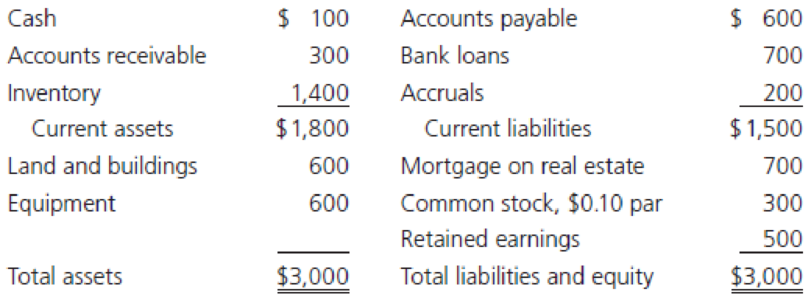

The Raattama Corporation had sales of $3.5 million last year, and it earned a 5% return (after taxes) on sales. Recently, the company has fallen behind in its accounts payable. Although its terms of purchase are net 30 days, its accounts payable represents 60 days’ purchases. The company’s treasurer is seeking to increase bank borrowing in order to become current in meeting its trade obligations (that is, to have 30 days’ payables outstanding). The company’s balance sheet is as follows (in thousands of dollars):

- a. How much bank financing is needed to eliminate the past-due accounts payable?

- b. Assume that the bank will lend the firm the amount calculated in part a. The terms of the loan offered are 8%, simple interest, and the bank uses a 360-day year for the interest calculation. What is the interest charge for 1 month? (Assume there are 30 days in a month.)

- c. Now ignore part b and assume that the bank will lend the firm the amount calculated in part a. The terms of the loan are 7.5%, add-on interest, to be repaid in 12 monthly installments.

- (1) What is the total loan amount?

- (2) What are the monthly installments?

- (3) What is the APR of the loan?

- (4) What is the effective rate of the loan?

- d. Would you, as a bank loan officer, make this loan? Why or why not?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please give me answer with financial accounting question

I need help with financial accounting question

Solve this question with financial accounting question

Chapter 21 Solutions

INTERMEDIATE FINAN...-MINDTAP(1 TERM)

Ch. 21 - a. Working capital; net working capital; net...Ch. 21 - Prob. 2QCh. 21 - Is it true that, when one firm sells to another on...Ch. 21 - What are the four elements of a firm’s credit...Ch. 21 - Prob. 5QCh. 21 - Prob. 6QCh. 21 - Prob. 7QCh. 21 - Is it true that most firms are able to obtain some...Ch. 21 - What kinds of firms use commercial paper?Ch. 21 - Prob. 1P

Ch. 21 - Medwig Corporation has a DSO of 17 days. The...Ch. 21 - What are the nominal and effective costs of trade...Ch. 21 - A large retailer obtains merchandise under the...Ch. 21 - A chain of appliance stores, APP Corporation,...Ch. 21 - Prob. 6PCh. 21 - Calculate the nominal annual cost of nonfree trade...Ch. 21 - Prob. 8PCh. 21 - Grunewald Industries sells on terms of 2/10, net...Ch. 21 - The D.J. Masson Corporation needs to raise...Ch. 21 - Negus Enterprises has an inventory conversion...Ch. 21 - Strickler Technology is considering changes in its...Ch. 21 - Dorothy Koehl recently leased space in the...Ch. 21 - Suppose a firm makes purchases of $3.65 million...Ch. 21 - The Thompson Corporation projects an increase in...Ch. 21 - The Raattama Corporation had sales of $3.5 million...Ch. 21 - Karen Johnson, CFO for Raucous Roasters (RR), a...Ch. 21 - Prob. 2MCCh. 21 - Prob. 3MCCh. 21 - Prob. 4MCCh. 21 - Prob. 5MCCh. 21 - Prob. 6MCCh. 21 - Prob. 7MCCh. 21 - Prob. 8MCCh. 21 - What is the impact of higher levels of accruals,...Ch. 21 - Prob. 10MCCh. 21 - Prob. 11MCCh. 21 - Prob. 12MCCh. 21 - Prob. 13MCCh. 21 - Prob. 14MCCh. 21 - Prob. 15MCCh. 21 - Prob. 16MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need help with this situation and financial accounting questionarrow_forwardRemaining Time: 50 minutes, 26 seconds. * Question Completion Status: A Moving to the next question prevents changes to this answer. Question 9 Question 9 of 20 5 points Save Answer A currency speculator wants to speculate on the future movements of the €. The speculator expects the € to appreciate in the near future and decides to concentrate on the nearby contract. The broker requires a 2% Initial Margin (IM) and the Maintenance Margin (MM) is 75% of IM. Following € Futures quotes are currently available from the Chicago Mercantile Exchange (CME). Euro (CME)- €125,000; $/€ Open High Low Settle Change Open Interest June 1.2216 1.2276 1.2175 1.2259 -0.0018 Sept 1.2229 1.2288 1.2189 1.2269 0.0018 255,420 19,335 In addition to the information provided above, consider the following CME quotes that are available at the end of day one's trading: Euro (CME) - €125,000; $/€ Open High Low June 1.2216 Sept 1.2229 1.2276 1.2288 Settle Change Open Interest 1.2175 1.2176 -0.0083 255,420 1.2189…arrow_forwardI need help with this problem and financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

The management of receivables Introduction - ACCA Financial Management (FM); Author: OpenTuition;https://www.youtube.com/watch?v=tLmePnbC3ZQ;License: Standard YouTube License, CC-BY