Concept explainers

1.

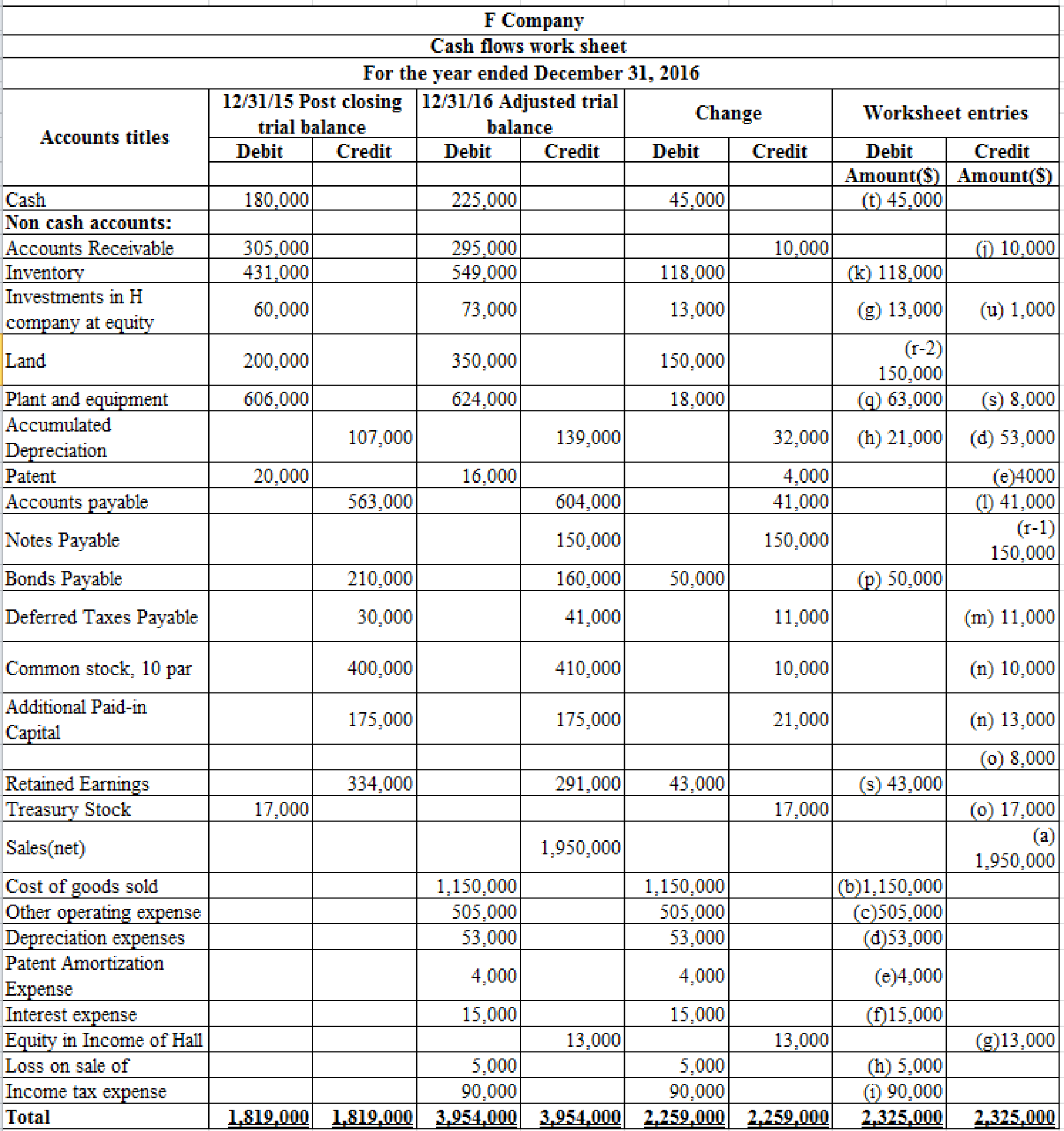

Prepare a spreadsheet to support the statement of

1.

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Direct method: Under direct method, cash receipts from customers (

Prepare a spreadsheet to support the statement of cash flows under direct method.

Table (1)

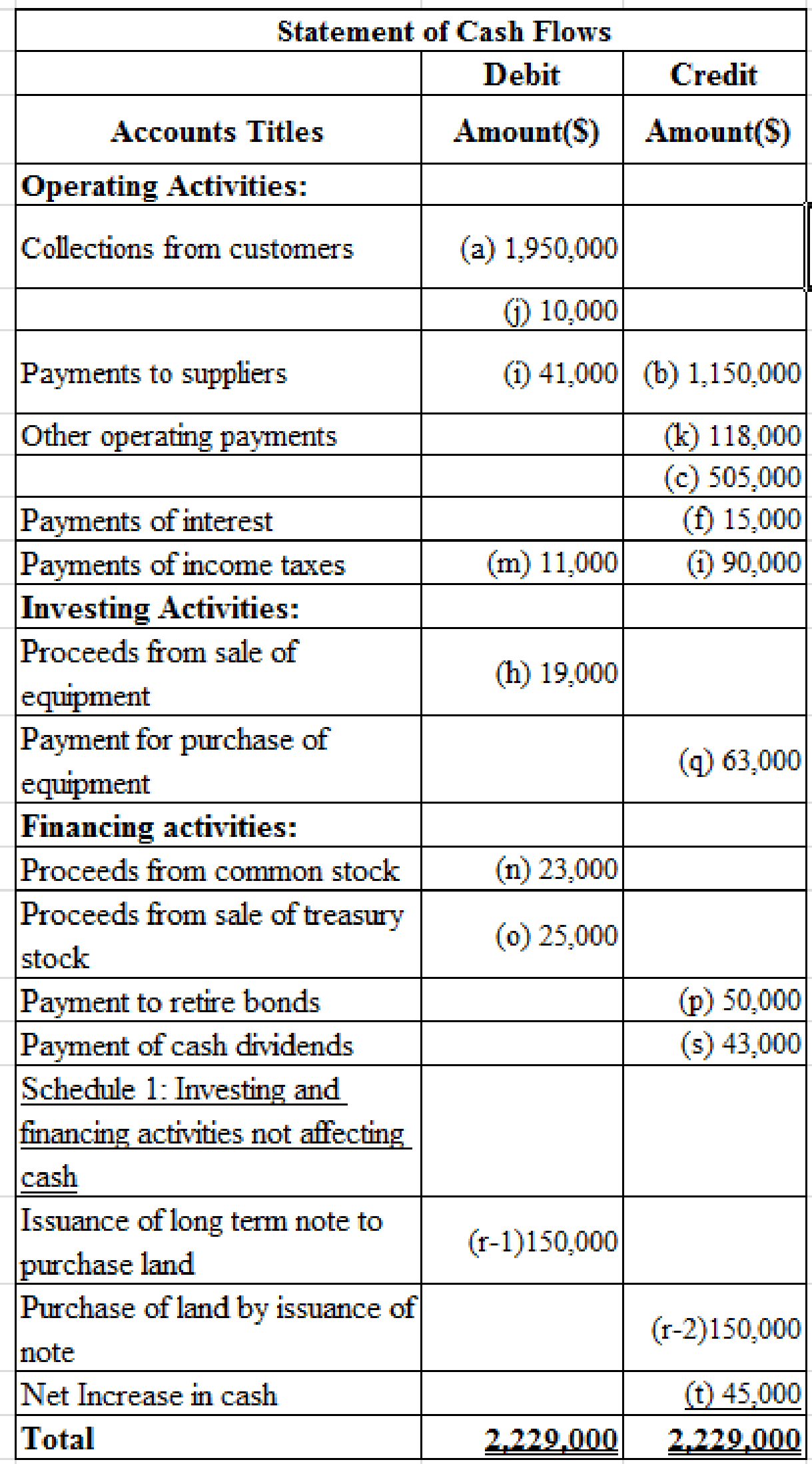

Table (2)

Working notes:

a) Net sales for the year is $1,950,000.

b) Cost of goods sold is $1,150,000.

c) Other operating expenses is $505,000.

f) Interest expense is $15,000.

h) Loss on sale of equipment is $5,000.

i) Income tax expense is $90,000.

j) Calculate the

k) Calculate the increase in inventory.

l) Calculate the accounts payable.

m) Calculate the

n) Calculate proceeds from sale of common stock.

o) Calculate proceeds from sale of

p) Calculate the payment to retire bonds.

q) Purchase of equipment is $63,000.

r-1) Issuance of long-term note is $150,000.

r-2) Calculate issuance of long-term note to purchase land.

s) Payment of cash dividends is $43,000.

t) Calculate net increase in cash.

Therefore, net increase in cash is $45,000.

2.

Prepare a statement of cash flows of F Company for the year 2016.

2.

Explanation of Solution

Prepare a statement of cash flows of F Company for the year 2016.

| F Company | ||

| Statement of cash flows | ||

| For Year Ended December 31, 2016 | ||

| Particulars | Amount($) | Amount($) |

| Operating Activities: | ||

| Cash inflows: | ||

| Collections from customers | 1,960,000 | |

| Cash inflows from operating activities | 1,960,000 | |

| Cash outflows: | ||

| Payments to suppliers | (1,227,000) | |

| Other operating payments | (505,000) | |

| Payments of interest | (15,000) | |

| Payments of income taxes | (79,000) | |

| Cash outflows from operating activities | (1,826,000) | |

| Net cash provided by operating activities | 134,000 | |

| Investing Activities: | ||

| Proceeds from sale of equipment | 19,000 | |

| Payment for purchase of equipment | (63,000) | |

| Net cash used for investing activities | (44,000) | |

| Financing Activities: | ||

| Proceeds from sale of common stock | 23,000 | |

| Proceeds from sale of treasury stock | 25,000 | |

| Payment to retire bonds | (50,000) | |

| Payment of cash dividend | (43,000) | |

| Net cash used for financing activities | (45,000) | |

| Net increase in cash (see Schedule 1) | 45,000 | |

| Cash, January 1, 2016 | 180,000 | |

| Cash, December 31,2016 | 225,000 | |

| Schedule 1: Investing and Financing Activities Not Affecting Cash | ||

| Investing Activities: | ||

| Purchase of land by issuance of long-term note | (150,000) | |

| Financing Activities: | ||

| Issuance of long-term note to purchase land | 150,000 | |

Table (3)

Therefore, the net increase in cash is $45,000.

Want to see more full solutions like this?

Chapter 21 Solutions

Bundle: Intermediate Accounting: Reporting and Analysis, 2017 Update, Loose-Leaf Version, 2nd + CengageNOWv2, 2 terms Printed Access Card

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning