To determine:

The effect on real consumption during retirement of a 1% increase in the rate of inflation to a 1% increase in the tax rate as per given spread sheet 21.5.

Introduction:

Tax shelters are ways and means by which it is possible to postpone the payment of liability for as long as possible.

Answer to Problem 10PS

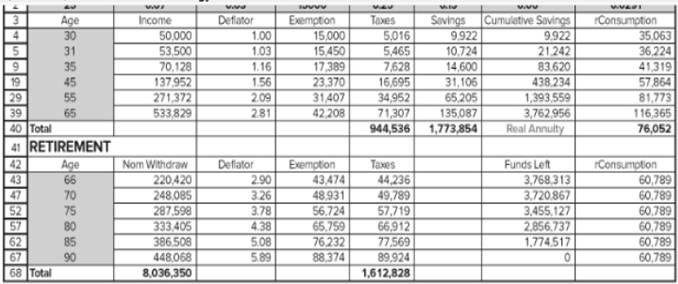

To determine the effect of desired revision and compare the results of such changes, first we will consider the spreadsheet 21.5 as it will form the base of our answer.

This sheet is prepared with the assumption that desired real consumption is taken as input from previous spreadsheet. Taxes are then calculated on nominal consumption minus the necessary exemption. Thus, savings comes as a residuary information nominal income minus the tax minus the nominal consumption. The retirement section specifies that all funds in the retirement account are subject to tax.

Explanation of Solution

Given Information:

Following spreadsheet is given:

The detailed spreadsheet of the same would be produced as under:

| Retirement years | Income growth | Rate of inflation | Exemption now | Tax rate | Savings rate | ROR | rROR |

| 25 | 0.07 | 0.03 | 15,000 | 0.25 | 0.15 | 0.06 | 0.0291 |

| AGE | INCOME | DEFLATOR | EXEMPTION | TAXES | SAVINGS | CUMMULATIVE SAVINGS | CONSUMPTION |

| 30 |

50,000 |

1.00 |

15,000 |

5,016 |

9,922 |

9,922 |

35,063 |

| 31 |

53,500 |

1.03 |

15,450 |

5,465 |

10,724 |

21,242 |

36,224 |

| 32 |

57,245 |

1.06 |

15,914 |

5,949 |

11,589 |

34,105 |

37,428 |

| 33 |

61,252 |

1.09 |

16,391 |

6,468 |

12,519 |

48,671 |

38,678 |

| 34 |

65,540 |

1.13 |

16,883 |

7,027 |

13,522 |

65,112 |

39,974 |

| 35 |

70,128 |

1.16 |

17,389 |

7,628 |

14,600 |

83,620 |

41,319 |

| 36 |

75,037 |

1.19 |

17,911 |

8,273 |

15,762 |

104,399 |

42,713 |

| 37 |

80,289 |

1.23 |

18,448 |

8,966 |

17,012 |

127,674 |

44,160 |

| 38 |

85,909 |

1.27 |

19,002 |

9,710 |

18,357 |

153,692 |

45,661 |

| 39 |

91,923 |

1.30 |

19,572 |

10,509 |

19,804 |

182,718 |

47,218 |

| 40 |

98,358 |

1.34 |

20,159 |

11,367 |

21,362 |

215,043 |

48,834 |

| 41 |

105,243 |

1.38 |

20,764 |

12,288 |

23,037 |

250,982 |

50,509 |

| 42 |

112,610 |

1.43 |

21,386 |

13,277 |

24,840 |

290,881 |

52,248 |

| 43 |

120,492 |

1.47 |

22,028 |

14,337 |

26,778 |

335,113 |

54,052 |

| 44 |

128,927 |

1.51 |

22,689 |

15,475 |

28,864 |

384,083 |

55,923 |

| 45 |

137,952 |

1.56 |

23,370 |

16,695 |

31,106 |

438,234 |

57,864 |

| 46 |

147,608 |

1.60 |

24,071 |

18,004 |

33,517 |

498,044 |

59,878 |

| 47 |

157,941 |

1.65 |

24,793 |

19,408 |

36,109 |

564,036 |

61,968 |

| 48 |

168,997 |

1.70 |

25,536 |

20,913 |

38,896 |

636,775 |

64,136 |

| 49 |

180,826 |

1.75 |

26,303 |

22,526 |

41,892 |

716,874 |

66,386 |

| 50 |

193,484 |

1.81 |

27,092 |

24,256 |

45,113 |

804,999 |

68,720 |

| 51 |

207,028 |

1.86 |

27,904 |

26,110 |

48,574 |

901,873 |

71,141 |

| 52 |

221,520 |

1.92 |

28,742 |

28,097 |

52,295 |

1,008,281 |

73,654 |

| 53 |

237,026 |

1.97 |

29,604 |

30,226 |

56,293 |

1,125,070 |

76,261 |

| 54 |

253,618 |

2.03 |

30,492 |

32,507 |

60,589 |

1,253,163 |

78,966 |

| 55 |

271,372 |

2.09 |

31,407 |

34,952 |

65,205 |

1,393,559 |

81,773 |

| 56 |

290,368 |

2.16 |

32,349 |

37,571 |

70,165 |

1,547,337 |

84,685 |

| 57 |

310,693 |

2.22 |

33,319 |

40,376 |

75,494 |

1,715,671 |

87,707 |

| 58 |

332,442 |

2.29 |

34,319 |

43,381 |

81,218 |

1,899,829 |

90,843 |

| 59 |

355,713 |

2.36 |

35,348 |

46,599 |

87,367 |

2,101,186 |

94,097 |

| 60 |

380,613 |

2.43 |

36,409 |

50,046 |

93,972 |

2,321,229 |

97,474 |

| 61 |

407,256 |

2.50 |

37,501 |

53,738 |

101,066 |

2,561,568 |

100,978 |

| 62 |

435,764 |

2.58 |

38,626 |

57,691 |

108,684 |

2,823,947 |

104,614 |

| 63 |

466,267 |

2.65 |

39,785 |

61,923 |

116,866 |

3,110,250 |

108,387 |

| 64 |

498,906 |

2.73 |

40,979 |

66,455 |

125,653 |

3,422,517 |

112,302 |

| 65 |

533,829 |

2.81 |

42,208 |

71,307 |

135,087 |

3,762,956 |

116,365 |

| TOTAL | 944,536 | 1,773,854 | REAL |

76,052 | |||

| RETIREMENT | |||||||

| AGE | WITHDRAWN | DEFLATOR | EXEMPTION | TAXES | SAVINGS | ROR | rROR |

| 66 |

220,420 |

2.90 |

43,474 |

44,236 |

3,768,313 |

60,789 |

|

| 67 |

227,033 |

2.99 |

44,778 |

45,564 |

3,767,379 |

60,789 |

|

| 68 |

233,844 |

3.07 |

46,122 |

46,930 |

3,759,578 |

60,789 |

|

| 69 |

240,859 |

3.17 |

47,505 |

48,338 |

3,744,294 |

60,789 |

|

| 70 |

248,085 |

3.26 |

48,931 |

49,789 |

3,720,867 |

60,789 |

|

| 71 |

255,527 |

3.36 |

50,398 |

51,282 |

3,688,592 |

60,789 |

|

| 72 |

263,193 |

3.46 |

51,910 |

52,821 |

3,646,715 |

60,789 |

|

| 73 |

271,089 |

3.56 |

53,468 |

54,405 |

3,594,429 |

60,789 |

|

| 74 |

279,221 |

3.67 |

55,072 |

56,037 |

3,530,873 |

60,789 |

|

| 75 |

287,598 |

3.78 |

56,724 |

57,719 |

3,455,127 |

60,789 |

|

| 76 |

296,226 |

3.90 |

58,426 |

59,450 |

3,366,209 |

60,789 |

|

| 77 |

305,113 |

4.01 |

60,178 |

61,234 |

3,263,069 |

60,789 |

|

| 78 |

314,266 |

4.13 |

61,984 |

63,071 |

3,144,587 |

60,789 |

|

| 79 |

323,694 |

4.26 |

63,843 |

64,963 |

3,009,568 |

60,789 |

|

| 80 |

333,405 |

4.38 |

65,759 |

66,912 |

2,856,737 |

60,789 |

|

| 81 |

343,407 |

4.52 |

67,731 |

68,919 |

2,684,734 |

60,789 |

|

| 82 |

353,709 |

4.65 |

69,763 |

70,987 |

2,492,108 |

60,789 |

|

| 83 |

364,321 |

4.79 |

71,856 |

73,116 |

2,277,314 |

60,789 |

|

| 84 |

375,250 |

4.93 |

74,012 |

75,310 |

2,038,703 |

60,789 |

|

| 85 |

386,508 |

5.08 |

76,232 |

77,569 |

1,774,517 |

60,789 |

|

| 86 |

398,103 |

5.23 |

78,519 |

79,896 |

1,482,885 |

60,789 |

|

| 87 |

410,046 |

5.39 |

80,875 |

82,293 |

1,161,812 |

60,789 |

|

| 88 |

422,347 |

5.55 |

83,301 |

84,762 |

809,174 |

60,789 |

|

| 89 |

435,018 |

5.72 |

85,800 |

87,304 |

422,706 |

60,789 |

|

| 90 |

448,068 |

5.89 |

88,374 |

89,924 |

- |

60,789 |

|

| TOTAL | 8,036,350 | 1,612,828 |

For the first part of the answer where we have to calculate effect of 1% increase in inflation on real consumption, we have considered the following assumption:

| Number of retirement years |

25 |

| Income growth rate |

7% |

| 6% |

|

| Income at age 30 |

50,000 |

| Savings Rate |

15% |

| Inflation Rate |

4% |

| Exemption |

$15,000 |

| Tax rate |

25% |

The ANSWER will be as followed:

| Retirement years | Income growth | Rate of inflation | Exemption now | Tax rate | Savings rate | ROR | rROR |

| 25 | 0.07 | 0.04 | 15,000 | 0.25 | 0.15 | 0.06 | 0.0192 |

| AGE | INCOME | DEFLATOR | EXEMPTION | TAXES | SAVINGS | CUMMULATIVE SAVINGS | CONSUMPTION |

| 30 |

50,000 |

1.00 |

15,000 |

5,016 |

9,922 |

9,922 |

35,063 |

| 31 |

53,500 |

1.04 |

15,600 |

5,518 |

10,309 |

20,826 |

36,224 |

| 32 |

57,245 |

1.08 |

16,224 |

6,065 |

10,698 |

32,774 |

37,428 |

| 33 |

61,252 |

1.12 |

16,873 |

6,659 |

11,086 |

45,826 |

38,678 |

| 34 |

65,540 |

1.17 |

17,548 |

7,304 |

11,472 |

60,048 |

39,974 |

| 35 |

70,128 |

1.22 |

18,250 |

8,005 |

11,852 |

75,503 |

41,319 |

| 36 |

75,037 |

1.27 |

18,980 |

8,767 |

12,224 |

92,257 |

42,713 |

| 37 |

80,289 |

1.32 |

19,739 |

9,593 |

12,584 |

110,376 |

44,160 |

| 38 |

85,909 |

1.37 |

20,529 |

10,490 |

12,928 |

129,927 |

45,661 |

| 39 |

91,923 |

1.42 |

21,350 |

11,464 |

13,253 |

150,976 |

47,218 |

| 40 |

98,358 |

1.48 |

22,204 |

12,521 |

13,551 |

173,586 |

48,834 |

| 41 |

105,243 |

1.54 |

23,092 |

13,666 |

13,819 |

197,820 |

50,509 |

| 42 |

112,610 |

1.60 |

24,015 |

14,909 |

14,050 |

223,739 |

52,248 |

| 43 |

120,492 |

1.67 |

24,976 |

16,256 |

14,236 |

251,400 |

54,052 |

| 44 |

128,927 |

1.73 |

25,975 |

17,716 |

14,370 |

280,854 |

55,923 |

| 45 |

137,952 |

1.80 |

27,014 |

19,299 |

14,442 |

312,148 |

57,864 |

| 46 |

147,608 |

1.87 |

28,095 |

21,014 |

14,443 |

345,320 |

59,878 |

| 47 |

157,941 |

1.95 |

29,219 |

22,872 |

14,361 |

380,400 |

61,968 |

| 48 |

168,997 |

2.03 |

30,387 |

24,885 |

14,183 |

417,407 |

64,136 |

| 49 |

180,826 |

2.11 |

31,603 |

27,065 |

13,896 |

456,348 |

66,386 |

| 50 |

193,484 |

2.19 |

32,867 |

29,427 |

13,484 |

497,213 |

68,720 |

| 51 |

207,028 |

2.28 |

34,182 |

31,983 |

12,930 |

539,976 |

71,141 |

| 52 |

221,520 |

2.37 |

35,549 |

34,751 |

12,215 |

584,590 |

73,654 |

| 53 |

237,026 |

2.46 |

36,971 |

37,748 |

11,317 |

630,982 |

76,261 |

| 54 |

253,618 |

2.56 |

38,450 |

40,991 |

10,213 |

679,054 |

78,966 |

| 55 |

271,372 |

2.67 |

39,988 |

44,501 |

8,877 |

728,674 |

81,773 |

| 56 |

290,368 |

2.77 |

41,587 |

48,300 |

7,280 |

779,674 |

84,685 |

| 57 |

310,693 |

2.88 |

43,251 |

52,411 |

5,390 |

831,845 |

87,707 |

| 58 |

332,442 |

3.00 |

44,981 |

56,858 |

3,172 |

884,927 |

90,843 |

| 59 |

355,713 |

3.12 |

46,780 |

61,669 |

587 |

938,610 |

94,097 |

| 60 |

380,613 |

3.24 |

48,651 |

66,874 |

-2,408 |

992,519 |

97,474 |

| 61 |

407,256 |

3.37 |

50,597 |

72,504 |

-5,859 |

1,046,211 |

100,978 |

| 62 |

435,764 |

3.51 |

52,621 |

78,592 |

-9,819 |

1,099,164 |

104,614 |

| 63 |

466,267 |

3.65 |

54,726 |

85,177 |

-14,346 |

1,150,768 |

108,387 |

| 64 |

498,906 |

3.79 |

56,915 |

92,299 |

-19,502 |

1,200,312 |

112,302 |

| 65 |

533,829 |

3.95 |

59,191 |

99,999 |

-25,356 |

1,246,974 |

116,365 |

| TOTAL | 1,203,168 | 265,856 | REAL ANNUITY | 16,040 | |||

| RETIREMENT | |||||||

| AGE | WITHDRAWN | DEFLATOR | EXEMPTION | TAXES | SAVINGS | ROR | rROR |

| 66 |

65,827 |

4.10 |

61,559 |

1,067 |

1,255,966 |

15,780 |

|

| 67 |

68,460 |

4.27 |

64,021 |

1,110 |

1,262,864 |

15,780 |

|

| 68 |

71,199 |

4.44 |

66,582 |

1,154 |

1,267,437 |

15,780 |

|

| 69 |

74,046 |

4.62 |

69,245 |

1,200 |

1,269,437 |

15,780 |

|

| 70 |

77,008 |

4.80 |

72,015 |

1,248 |

1,268,594 |

15,780 |

|

| 71 |

80,089 |

4.99 |

74,896 |

1,298 |

1,264,621 |

15,780 |

|

| 72 |

83,292 |

5.19 |

77,892 |

1,350 |

1,257,206 |

15,780 |

|

| 73 |

86,624 |

5.40 |

81,007 |

1,404 |

1,246,015 |

15,780 |

|

| 74 |

90,089 |

5.62 |

84,248 |

1,460 |

1,230,687 |

15,780 |

|

| 75 |

93,692 |

5.84 |

87,618 |

1,519 |

1,210,836 |

15,780 |

|

| 76 |

97,440 |

6.07 |

91,122 |

1,579 |

1,186,046 |

15,780 |

|

| 77 |

101,338 |

6.32 |

94,767 |

1,643 |

1,155,871 |

15,780 |

|

| 78 |

105,391 |

6.57 |

98,558 |

1,708 |

1,119,832 |

15,780 |

|

| 79 |

109,607 |

6.83 |

102,500 |

1,777 |

1,077,415 |

15,780 |

|

| 80 |

113,991 |

7.11 |

106,600 |

1,848 |

1,028,069 |

15,780 |

|

| 81 |

118,551 |

7.39 |

110,864 |

1,922 |

971,202 |

15,780 |

|

| 82 |

123,293 |

7.69 |

115,299 |

1,999 |

906,181 |

15,780 |

|

| 83 |

128,225 |

7.99 |

119,911 |

2,078 |

832,327 |

15,780 |

|

| 84 |

133,354 |

8.31 |

124,707 |

2,162 |

748,914 |

15,780 |

|

| 85 |

138,688 |

8.65 |

129,696 |

2,248 |

655,161 |

15,780 |

|

| 86 |

144,235 |

8.99 |

134,883 |

2,338 |

550,235 |

15,780 |

|

| 87 |

150,005 |

9.35 |

140,279 |

2,431 |

433,245 |

15,780 |

|

| 88 |

156,005 |

9.73 |

145,890 |

2,529 |

303,235 |

15,780 |

|

| 89 |

162,245 |

10.12 |

151,725 |

2,630 |

159,184 |

15,780 |

|

| 90 |

168,735 |

10.52 |

157,794 |

2,735 |

- |

15,780 |

|

| TOTAL | 2,741,427 | 44,437 |

For the second part of the answer where we have to calculate effect of 1% increase in tax rate on real consumption, we have considered the following assumption:

| Number of retirement years |

25 |

| Income growth rate |

7% |

| Rate of return |

6% |

| Income at age 30 |

50,000 |

| Savings Rate |

15% |

| Inflation Rate |

3% |

| Exemption |

$15,000 |

| Tax rate |

26% |

| Retirement years | Income growth | Rate of inflation | Exemption now | Tax rate | Savings rate | ROR | rROR |

| 25 | 0.07 | 0.03 | 15,000 | 0.26 | 0.15 | 0.06 | 0.0291 |

| AGE | INCOME | DEFLATOR | EXEMPTION | TAXES | SAVINGS | CUMMULATIVE SAVINGS | CONSUMPTION |

| 30 |

50,000 |

1.00 |

15,000 |

5,216 |

9,721 |

9,721 |

35,063 |

| 31 |

53,500 |

1.03 |

15,450 |

5,684 |

10,506 |

20,810 |

36,224 |

| 32 |

57,245 |

1.06 |

15,914 |

6,187 |

11,351 |

33,410 |

37,428 |

| 33 |

61,252 |

1.09 |

16,391 |

6,727 |

12,261 |

47,675 |

38,678 |

| 34 |

65,540 |

1.13 |

16,883 |

7,308 |

13,240 |

63,776 |

39,974 |

| 35 |

70,128 |

1.16 |

17,389 |

7,933 |

14,295 |

81,898 |

41,319 |

| 36 |

75,037 |

1.19 |

17,911 |

8,604 |

15,431 |

102,243 |

42,713 |

| 37 |

80,289 |

1.23 |

18,448 |

9,324 |

16,653 |

125,030 |

44,160 |

| 38 |

85,909 |

1.27 |

19,002 |

10,099 |

17,969 |

150,501 |

45,661 |

| 39 |

91,923 |

1.30 |

19,572 |

10,930 |

19,384 |

178,915 |

47,218 |

| 40 |

98,358 |

1.34 |

20,159 |

11,822 |

20,907 |

210,557 |

48,834 |

| 41 |

105,243 |

1.38 |

20,764 |

12,780 |

22,546 |

245,736 |

50,509 |

| 42 |

112,610 |

1.43 |

21,386 |

13,808 |

24,309 |

284,789 |

52,248 |

| 43 |

120,492 |

1.47 |

22,028 |

14,911 |

26,205 |

328,082 |

54,052 |

| 44 |

128,927 |

1.51 |

22,689 |

16,094 |

28,245 |

376,011 |

55,923 |

| 45 |

137,952 |

1.56 |

23,370 |

17,363 |

30,438 |

429,010 |

57,864 |

| 46 |

147,608 |

1.60 |

24,071 |

18,724 |

32,797 |

487,547 |

59,878 |

| 47 |

157,941 |

1.65 |

24,793 |

20,184 |

35,333 |

552,133 |

61,968 |

| 48 |

168,997 |

1.70 |

25,536 |

21,749 |

38,060 |

623,320 |

64,136 |

| 49 |

180,826 |

1.75 |

26,303 |

23,427 |

40,991 |

701,711 |

66,386 |

| 50 |

193,484 |

1.81 |

27,092 |

25,226 |

44,143 |

787,956 |

68,720 |

| 51 |

207,028 |

1.86 |

27,904 |

27,154 |

47,530 |

882,764 |

71,141 |

| 52 |

221,520 |

1.92 |

28,742 |

29,221 |

51,171 |

986,900 |

73,654 |

| 53 |

237,026 |

1.97 |

29,604 |

31,435 |

55,084 |

1,101,198 |

76,261 |

| 54 |

253,618 |

2.03 |

30,492 |

33,808 |

59,289 |

1,226,559 |

78,966 |

| 55 |

271,372 |

2.09 |

31,407 |

36,350 |

63,807 |

1,363,959 |

81,773 |

| 56 |

290,368 |

2.16 |

32,349 |

39,074 |

68,662 |

1,514,459 |

84,685 |

| 57 |

310,693 |

2.22 |

33,319 |

41,991 |

73,879 |

1,679,205 |

87,707 |

| 58 |

332,442 |

2.29 |

34,319 |

45,116 |

79,483 |

1,859,440 |

90,843 |

| 59 |

355,713 |

2.36 |

35,348 |

48,463 |

85,503 |

2,056,510 |

94,097 |

| 60 |

380,613 |

2.43 |

36,409 |

52,048 |

91,970 |

2,271,870 |

97,474 |

| 61 |

407,256 |

2.50 |

37,501 |

55,887 |

98,916 |

2,507,098 |

100,978 |

| 62 |

435,764 |

2.58 |

38,626 |

59,998 |

106,377 |

2,763,901 |

104,614 |

| 63 |

466,267 |

2.65 |

39,785 |

64,400 |

114,389 |

3,044,125 |

108,387 |

| 64 |

498,906 |

2.73 |

40,979 |

69,113 |

122,994 |

3,349,766 |

112,302 |

| 65 |

533,829 |

2.81 |

42,208 |

74,159 |

132,235 |

3,682,987 |

116,365 |

| TOTAL | 982,317 | 1,736,072 | REAL ANNUITY | 74,436 | |||

| RETIREMENT | |||||||

| AGE | WITHDRAWN | DEFLATOR | EXEMPTION | TAXES | SAVINGS | ROR | rROR |

| 66 |

215,736 |

2.90 |

43,474 |

44,788 |

3,688,231 |

58,983 |

|

| 67 |

222,208 |

2.99 |

44,778 |

46,132 |

3,687,317 |

58,983 |

|

| 68 |

228,874 |

3.07 |

46,122 |

47,516 |

3,679,682 |

58,983 |

|

| 69 |

235,740 |

3.17 |

47,505 |

48,941 |

3,664,723 |

58,983 |

|

| 70 |

242,812 |

3.26 |

48,931 |

50,409 |

3,641,793 |

58,983 |

|

| 71 |

250,097 |

3.36 |

50,398 |

51,922 |

3,610,204 |

58,983 |

|

| 72 |

257,600 |

3.46 |

51,910 |

53,479 |

3,569,217 |

58,983 |

|

| 73 |

265,328 |

3.56 |

53,468 |

55,084 |

3,518,042 |

58,983 |

|

| 74 |

273,288 |

3.67 |

55,072 |

56,736 |

3,455,837 |

58,983 |

|

| 75 |

281,486 |

3.78 |

56,724 |

58,438 |

3,381,701 |

58,983 |

|

| 76 |

289,931 |

3.90 |

58,426 |

60,191 |

3,294,672 |

58,983 |

|

| 77 |

298,629 |

4.01 |

60,178 |

61,997 |

3,193,724 |

58,983 |

|

| 78 |

307,588 |

4.13 |

61,984 |

63,857 |

3,077,760 |

58,983 |

|

| 79 |

316,815 |

4.26 |

63,843 |

65,773 |

2,945,610 |

58,983 |

|

| 80 |

326,320 |

4.38 |

65,759 |

67,746 |

2,796,027 |

58,983 |

|

| 81 |

336,109 |

4.52 |

67,731 |

69,778 |

2,627,679 |

58,983 |

|

| 82 |

346,193 |

4.65 |

69,763 |

71,872 |

2,439,148 |

58,983 |

|

| 83 |

356,578 |

4.79 |

71,856 |

74,028 |

2,228,918 |

58,983 |

|

| 84 |

367,276 |

4.93 |

74,012 |

76,249 |

1,995,378 |

58,983 |

|

| 85 |

378,294 |

5.08 |

76,232 |

78,536 |

1,736,806 |

58,983 |

|

| 86 |

389,643 |

5.23 |

78,519 |

80,892 |

1,451,372 |

58,983 |

|

| 87 |

401,332 |

5.39 |

80,875 |

83,319 |

1,137,122 |

58,983 |

|

| 88 |

413,372 |

5.55 |

83,301 |

85,818 |

791,977 |

58,983 |

|

| 89 |

425,773 |

5.72 |

85,800 |

88,393 |

413,723 |

58,983 |

|

| 90 |

438,546 |

5.89 |

88,374 |

91,045 |

- |

58,983 |

|

| TOTAL | 7,865,566 | 1,632,938 |

On comparing the above results, by keeping all the conditions remaining same, and revising the given rates we reach the following conclusion:

| AS PER ACTUAL STATED CONDITION |

AS PER ACTUAL STATED CONDITION AND INCREASING INFALTION RATE TO 4% |

AS PER ACTUAL STATED CONDITION AND INCREASING TAX RATE TO 26% |

|

| REAL CONSUMPTION |

76,052.00 |

16,040.00 |

74,436.00 |

| REAL CONSUMPTION ON RETIREMENT |

60,789.00 |

15,780.00 |

58,983.00 |

Hence we can say, on increasing inflation rate by 1%, the real consumption decreases marginally.

Want to see more full solutions like this?

Chapter 21 Solutions

Loose-Leaf Essentials of Investments

- High Hand Nursery has total assests of $900,000, current liabilities of $202,000, and long-term liabilities of $104,000. There is $90,000 in preferred stock outstanding. Twenty thousand shares of common stock have been issued. a. Compute book value (net worth) per share. b. If there is $40,000 in earnings available to common stockholders for dividends, and the firm's stock has a P/E of 22 times earnings per share, what is the current price of the stock? c. What is the ratio of market value per share to book value per share?arrow_forwardNeed the WACC % WACC and Optimal Capital Structure F. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: Market Debt-to-Value Ratio (wd) Market Equity-to-Value Ratio (ws) Market Debt-toEquity Ratio (D/S) Before-Tax Cost ofDebt (rd) 0.0 1.0 0.00 6.0 % 0.10 0.90 0.1111 6.4 0.20 0.80 0.2500 7.0 0.30 0.70 0.4286 8.2 0.40 0.60 0.6667 10.0 F. Pierce uses the CAPM to estimate its cost of common equity, rs, and at the time of the analaysis the risk-free rate is 5%, the market risk premium is 7%, and the company's tax rate is 25%. F. Pierce estimates that its beta now (which is "unlevered" because it currently has no debt) is 1.4. Based on this information, what…arrow_forwardNed's Co. has an average collection period of 45 days and an operating cycle of 130 days. It has a policy of keeping at least $10 on hand as a minimum cash balance, and has a beginning cash balance for the first quarter of $20. Beginning receivables for the quarter amount to $35. Sales for the first and second quarters are expected to be $110 and $125, respectively, while purchases amount to 80% of the next quarter's forecast sales. The accounts payable period is 90 days. What are the cash disbursements for the first quarter? Question 4 options: $92 $88 $76 $100 $110arrow_forward

- Liberal credit terms for customers is associated with a restrictive short-term financial policy. Question 3 options: True Falsearrow_forwardAn accounts payable period decrease would increase the length of a firm's cash cycle. Consider each in isolation. Question 6 options: True Falsearrow_forwardWhich of the following is the best definition of cash budget? Question 10 options: Costs that rise with increases in the level of investment in current assets. A forecast of cash receipts and disbursements for the next planning period. A secured short-term loan that involves either the assignment or factoring of the receivable. The time between sale of inventory and collection of the receivable. The time between receipt of inventory and payment for it.arrow_forward

- Short-term financial decisions are typically defined to include cash inflows and outflows that occur within __ year(s) or less. Question 9 options: Four Two Three Five Onearrow_forwardA national firm has sales of $575,000 and cost of goods sold of $368,000. At the beginning of the year, the inventory was $42,000. At the end of the year, the inventory balance was $45,000. What is the inventory turnover rate? Question 8 options: 8.46 times 13.22 times 43.14 times 12.78 times 28.56 timesarrow_forwardThe formula (Cash cycle + accounts payable period) correctly defines the operating cycle. Question 7 options: False Truearrow_forward

- An accounts payable period decrease would increase the length of a firm's cash cycle. Consider each in isolation. Question 6 options: True Falsearrow_forwardWhich of the following issues is/are NOT considered a part of short-term finance? Question 5 options: The amount of credit that should be extended to customers The firm determining whether to issue commercial paper or obtain a bank loan The amount of the firms current income that should be paid out as dividends The amount the firm should borrow short-term A reasonable level of cash for the firm to maintainarrow_forwardLiberal credit terms for customers is associated with a restrictive short-term financial policy. Question 3 options: True Falsearrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education