To determine:

The effect on real consumption during retirement of a 1% increase in the rate of inflation to a 1% increase in the tax rate as per given spread sheet 21.5.

Introduction:

Tax shelters are ways and means by which it is possible to postpone the payment of liability for as long as possible.

Answer to Problem 10PS

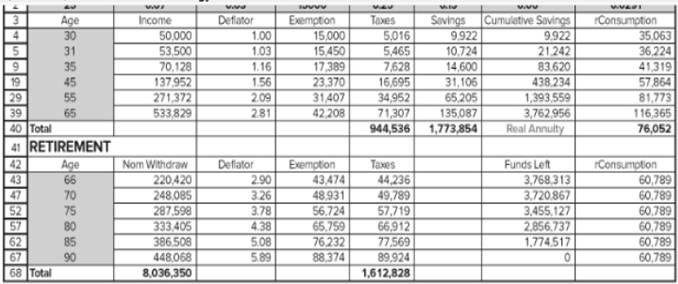

To determine the effect of desired revision and compare the results of such changes, first we will consider the spreadsheet 21.5 as it will form the base of our answer.

This sheet is prepared with the assumption that desired real consumption is taken as input from previous spreadsheet. Taxes are then calculated on nominal consumption minus the necessary exemption. Thus, savings comes as a residuary information nominal income minus the tax minus the nominal consumption. The retirement section specifies that all funds in the retirement account are subject to tax.

Explanation of Solution

Given Information:

Following spreadsheet is given:

The detailed spreadsheet of the same would be produced as under:

| Retirement years | Income growth | Rate of inflation | Exemption now | Tax rate | Savings rate | ROR | rROR |

| 25 | 0.07 | 0.03 | 15,000 | 0.25 | 0.15 | 0.06 | 0.0291 |

| AGE | INCOME | DEFLATOR | EXEMPTION | TAXES | SAVINGS | CUMMULATIVE SAVINGS | CONSUMPTION |

| 30 |

50,000 |

1.00 |

15,000 |

5,016 |

9,922 |

9,922 |

35,063 |

| 31 |

53,500 |

1.03 |

15,450 |

5,465 |

10,724 |

21,242 |

36,224 |

| 32 |

57,245 |

1.06 |

15,914 |

5,949 |

11,589 |

34,105 |

37,428 |

| 33 |

61,252 |

1.09 |

16,391 |

6,468 |

12,519 |

48,671 |

38,678 |

| 34 |

65,540 |

1.13 |

16,883 |

7,027 |

13,522 |

65,112 |

39,974 |

| 35 |

70,128 |

1.16 |

17,389 |

7,628 |

14,600 |

83,620 |

41,319 |

| 36 |

75,037 |

1.19 |

17,911 |

8,273 |

15,762 |

104,399 |

42,713 |

| 37 |

80,289 |

1.23 |

18,448 |

8,966 |

17,012 |

127,674 |

44,160 |

| 38 |

85,909 |

1.27 |

19,002 |

9,710 |

18,357 |

153,692 |

45,661 |

| 39 |

91,923 |

1.30 |

19,572 |

10,509 |

19,804 |

182,718 |

47,218 |

| 40 |

98,358 |

1.34 |

20,159 |

11,367 |

21,362 |

215,043 |

48,834 |

| 41 |

105,243 |

1.38 |

20,764 |

12,288 |

23,037 |

250,982 |

50,509 |

| 42 |

112,610 |

1.43 |

21,386 |

13,277 |

24,840 |

290,881 |

52,248 |

| 43 |

120,492 |

1.47 |

22,028 |

14,337 |

26,778 |

335,113 |

54,052 |

| 44 |

128,927 |

1.51 |

22,689 |

15,475 |

28,864 |

384,083 |

55,923 |

| 45 |

137,952 |

1.56 |

23,370 |

16,695 |

31,106 |

438,234 |

57,864 |

| 46 |

147,608 |

1.60 |

24,071 |

18,004 |

33,517 |

498,044 |

59,878 |

| 47 |

157,941 |

1.65 |

24,793 |

19,408 |

36,109 |

564,036 |

61,968 |

| 48 |

168,997 |

1.70 |

25,536 |

20,913 |

38,896 |

636,775 |

64,136 |

| 49 |

180,826 |

1.75 |

26,303 |

22,526 |

41,892 |

716,874 |

66,386 |

| 50 |

193,484 |

1.81 |

27,092 |

24,256 |

45,113 |

804,999 |

68,720 |

| 51 |

207,028 |

1.86 |

27,904 |

26,110 |

48,574 |

901,873 |

71,141 |

| 52 |

221,520 |

1.92 |

28,742 |

28,097 |

52,295 |

1,008,281 |

73,654 |

| 53 |

237,026 |

1.97 |

29,604 |

30,226 |

56,293 |

1,125,070 |

76,261 |

| 54 |

253,618 |

2.03 |

30,492 |

32,507 |

60,589 |

1,253,163 |

78,966 |

| 55 |

271,372 |

2.09 |

31,407 |

34,952 |

65,205 |

1,393,559 |

81,773 |

| 56 |

290,368 |

2.16 |

32,349 |

37,571 |

70,165 |

1,547,337 |

84,685 |

| 57 |

310,693 |

2.22 |

33,319 |

40,376 |

75,494 |

1,715,671 |

87,707 |

| 58 |

332,442 |

2.29 |

34,319 |

43,381 |

81,218 |

1,899,829 |

90,843 |

| 59 |

355,713 |

2.36 |

35,348 |

46,599 |

87,367 |

2,101,186 |

94,097 |

| 60 |

380,613 |

2.43 |

36,409 |

50,046 |

93,972 |

2,321,229 |

97,474 |

| 61 |

407,256 |

2.50 |

37,501 |

53,738 |

101,066 |

2,561,568 |

100,978 |

| 62 |

435,764 |

2.58 |

38,626 |

57,691 |

108,684 |

2,823,947 |

104,614 |

| 63 |

466,267 |

2.65 |

39,785 |

61,923 |

116,866 |

3,110,250 |

108,387 |

| 64 |

498,906 |

2.73 |

40,979 |

66,455 |

125,653 |

3,422,517 |

112,302 |

| 65 |

533,829 |

2.81 |

42,208 |

71,307 |

135,087 |

3,762,956 |

116,365 |

| TOTAL | 944,536 | 1,773,854 | REAL |

76,052 | |||

| RETIREMENT | |||||||

| AGE | WITHDRAWN | DEFLATOR | EXEMPTION | TAXES | SAVINGS | ROR | rROR |

| 66 |

220,420 |

2.90 |

43,474 |

44,236 |

3,768,313 |

60,789 |

|

| 67 |

227,033 |

2.99 |

44,778 |

45,564 |

3,767,379 |

60,789 |

|

| 68 |

233,844 |

3.07 |

46,122 |

46,930 |

3,759,578 |

60,789 |

|

| 69 |

240,859 |

3.17 |

47,505 |

48,338 |

3,744,294 |

60,789 |

|

| 70 |

248,085 |

3.26 |

48,931 |

49,789 |

3,720,867 |

60,789 |

|

| 71 |

255,527 |

3.36 |

50,398 |

51,282 |

3,688,592 |

60,789 |

|

| 72 |

263,193 |

3.46 |

51,910 |

52,821 |

3,646,715 |

60,789 |

|

| 73 |

271,089 |

3.56 |

53,468 |

54,405 |

3,594,429 |

60,789 |

|

| 74 |

279,221 |

3.67 |

55,072 |

56,037 |

3,530,873 |

60,789 |

|

| 75 |

287,598 |

3.78 |

56,724 |

57,719 |

3,455,127 |

60,789 |

|

| 76 |

296,226 |

3.90 |

58,426 |

59,450 |

3,366,209 |

60,789 |

|

| 77 |

305,113 |

4.01 |

60,178 |

61,234 |

3,263,069 |

60,789 |

|

| 78 |

314,266 |

4.13 |

61,984 |

63,071 |

3,144,587 |

60,789 |

|

| 79 |

323,694 |

4.26 |

63,843 |

64,963 |

3,009,568 |

60,789 |

|

| 80 |

333,405 |

4.38 |

65,759 |

66,912 |

2,856,737 |

60,789 |

|

| 81 |

343,407 |

4.52 |

67,731 |

68,919 |

2,684,734 |

60,789 |

|

| 82 |

353,709 |

4.65 |

69,763 |

70,987 |

2,492,108 |

60,789 |

|

| 83 |

364,321 |

4.79 |

71,856 |

73,116 |

2,277,314 |

60,789 |

|

| 84 |

375,250 |

4.93 |

74,012 |

75,310 |

2,038,703 |

60,789 |

|

| 85 |

386,508 |

5.08 |

76,232 |

77,569 |

1,774,517 |

60,789 |

|

| 86 |

398,103 |

5.23 |

78,519 |

79,896 |

1,482,885 |

60,789 |

|

| 87 |

410,046 |

5.39 |

80,875 |

82,293 |

1,161,812 |

60,789 |

|

| 88 |

422,347 |

5.55 |

83,301 |

84,762 |

809,174 |

60,789 |

|

| 89 |

435,018 |

5.72 |

85,800 |

87,304 |

422,706 |

60,789 |

|

| 90 |

448,068 |

5.89 |

88,374 |

89,924 |

- |

60,789 |

|

| TOTAL | 8,036,350 | 1,612,828 |

For the first part of the answer where we have to calculate effect of 1% increase in inflation on real consumption, we have considered the following assumption:

| Number of retirement years |

25 |

| Income growth rate |

7% |

| 6% |

|

| Income at age 30 |

50,000 |

| Savings Rate |

15% |

| Inflation Rate |

4% |

| Exemption |

$15,000 |

| Tax rate |

25% |

The ANSWER will be as followed:

| Retirement years | Income growth | Rate of inflation | Exemption now | Tax rate | Savings rate | ROR | rROR |

| 25 | 0.07 | 0.04 | 15,000 | 0.25 | 0.15 | 0.06 | 0.0192 |

| AGE | INCOME | DEFLATOR | EXEMPTION | TAXES | SAVINGS | CUMMULATIVE SAVINGS | CONSUMPTION |

| 30 |

50,000 |

1.00 |

15,000 |

5,016 |

9,922 |

9,922 |

35,063 |

| 31 |

53,500 |

1.04 |

15,600 |

5,518 |

10,309 |

20,826 |

36,224 |

| 32 |

57,245 |

1.08 |

16,224 |

6,065 |

10,698 |

32,774 |

37,428 |

| 33 |

61,252 |

1.12 |

16,873 |

6,659 |

11,086 |

45,826 |

38,678 |

| 34 |

65,540 |

1.17 |

17,548 |

7,304 |

11,472 |

60,048 |

39,974 |

| 35 |

70,128 |

1.22 |

18,250 |

8,005 |

11,852 |

75,503 |

41,319 |

| 36 |

75,037 |

1.27 |

18,980 |

8,767 |

12,224 |

92,257 |

42,713 |

| 37 |

80,289 |

1.32 |

19,739 |

9,593 |

12,584 |

110,376 |

44,160 |

| 38 |

85,909 |

1.37 |

20,529 |

10,490 |

12,928 |

129,927 |

45,661 |

| 39 |

91,923 |

1.42 |

21,350 |

11,464 |

13,253 |

150,976 |

47,218 |

| 40 |

98,358 |

1.48 |

22,204 |

12,521 |

13,551 |

173,586 |

48,834 |

| 41 |

105,243 |

1.54 |

23,092 |

13,666 |

13,819 |

197,820 |

50,509 |

| 42 |

112,610 |

1.60 |

24,015 |

14,909 |

14,050 |

223,739 |

52,248 |

| 43 |

120,492 |

1.67 |

24,976 |

16,256 |

14,236 |

251,400 |

54,052 |

| 44 |

128,927 |

1.73 |

25,975 |

17,716 |

14,370 |

280,854 |

55,923 |

| 45 |

137,952 |

1.80 |

27,014 |

19,299 |

14,442 |

312,148 |

57,864 |

| 46 |

147,608 |

1.87 |

28,095 |

21,014 |

14,443 |

345,320 |

59,878 |

| 47 |

157,941 |

1.95 |

29,219 |

22,872 |

14,361 |

380,400 |

61,968 |

| 48 |

168,997 |

2.03 |

30,387 |

24,885 |

14,183 |

417,407 |

64,136 |

| 49 |

180,826 |

2.11 |

31,603 |

27,065 |

13,896 |

456,348 |

66,386 |

| 50 |

193,484 |

2.19 |

32,867 |

29,427 |

13,484 |

497,213 |

68,720 |

| 51 |

207,028 |

2.28 |

34,182 |

31,983 |

12,930 |

539,976 |

71,141 |

| 52 |

221,520 |

2.37 |

35,549 |

34,751 |

12,215 |

584,590 |

73,654 |

| 53 |

237,026 |

2.46 |

36,971 |

37,748 |

11,317 |

630,982 |

76,261 |

| 54 |

253,618 |

2.56 |

38,450 |

40,991 |

10,213 |

679,054 |

78,966 |

| 55 |

271,372 |

2.67 |

39,988 |

44,501 |

8,877 |

728,674 |

81,773 |

| 56 |

290,368 |

2.77 |

41,587 |

48,300 |

7,280 |

779,674 |

84,685 |

| 57 |

310,693 |

2.88 |

43,251 |

52,411 |

5,390 |

831,845 |

87,707 |

| 58 |

332,442 |

3.00 |

44,981 |

56,858 |

3,172 |

884,927 |

90,843 |

| 59 |

355,713 |

3.12 |

46,780 |

61,669 |

587 |

938,610 |

94,097 |

| 60 |

380,613 |

3.24 |

48,651 |

66,874 |

-2,408 |

992,519 |

97,474 |

| 61 |

407,256 |

3.37 |

50,597 |

72,504 |

-5,859 |

1,046,211 |

100,978 |

| 62 |

435,764 |

3.51 |

52,621 |

78,592 |

-9,819 |

1,099,164 |

104,614 |

| 63 |

466,267 |

3.65 |

54,726 |

85,177 |

-14,346 |

1,150,768 |

108,387 |

| 64 |

498,906 |

3.79 |

56,915 |

92,299 |

-19,502 |

1,200,312 |

112,302 |

| 65 |

533,829 |

3.95 |

59,191 |

99,999 |

-25,356 |

1,246,974 |

116,365 |

| TOTAL | 1,203,168 | 265,856 | REAL ANNUITY | 16,040 | |||

| RETIREMENT | |||||||

| AGE | WITHDRAWN | DEFLATOR | EXEMPTION | TAXES | SAVINGS | ROR | rROR |

| 66 |

65,827 |

4.10 |

61,559 |

1,067 |

1,255,966 |

15,780 |

|

| 67 |

68,460 |

4.27 |

64,021 |

1,110 |

1,262,864 |

15,780 |

|

| 68 |

71,199 |

4.44 |

66,582 |

1,154 |

1,267,437 |

15,780 |

|

| 69 |

74,046 |

4.62 |

69,245 |

1,200 |

1,269,437 |

15,780 |

|

| 70 |

77,008 |

4.80 |

72,015 |

1,248 |

1,268,594 |

15,780 |

|

| 71 |

80,089 |

4.99 |

74,896 |

1,298 |

1,264,621 |

15,780 |

|

| 72 |

83,292 |

5.19 |

77,892 |

1,350 |

1,257,206 |

15,780 |

|

| 73 |

86,624 |

5.40 |

81,007 |

1,404 |

1,246,015 |

15,780 |

|

| 74 |

90,089 |

5.62 |

84,248 |

1,460 |

1,230,687 |

15,780 |

|

| 75 |

93,692 |

5.84 |

87,618 |

1,519 |

1,210,836 |

15,780 |

|

| 76 |

97,440 |

6.07 |

91,122 |

1,579 |

1,186,046 |

15,780 |

|

| 77 |

101,338 |

6.32 |

94,767 |

1,643 |

1,155,871 |

15,780 |

|

| 78 |

105,391 |

6.57 |

98,558 |

1,708 |

1,119,832 |

15,780 |

|

| 79 |

109,607 |

6.83 |

102,500 |

1,777 |

1,077,415 |

15,780 |

|

| 80 |

113,991 |

7.11 |

106,600 |

1,848 |

1,028,069 |

15,780 |

|

| 81 |

118,551 |

7.39 |

110,864 |

1,922 |

971,202 |

15,780 |

|

| 82 |

123,293 |

7.69 |

115,299 |

1,999 |

906,181 |

15,780 |

|

| 83 |

128,225 |

7.99 |

119,911 |

2,078 |

832,327 |

15,780 |

|

| 84 |

133,354 |

8.31 |

124,707 |

2,162 |

748,914 |

15,780 |

|

| 85 |

138,688 |

8.65 |

129,696 |

2,248 |

655,161 |

15,780 |

|

| 86 |

144,235 |

8.99 |

134,883 |

2,338 |

550,235 |

15,780 |

|

| 87 |

150,005 |

9.35 |

140,279 |

2,431 |

433,245 |

15,780 |

|

| 88 |

156,005 |

9.73 |

145,890 |

2,529 |

303,235 |

15,780 |

|

| 89 |

162,245 |

10.12 |

151,725 |

2,630 |

159,184 |

15,780 |

|

| 90 |

168,735 |

10.52 |

157,794 |

2,735 |

- |

15,780 |

|

| TOTAL | 2,741,427 | 44,437 |

For the second part of the answer where we have to calculate effect of 1% increase in tax rate on real consumption, we have considered the following assumption:

| Number of retirement years |

25 |

| Income growth rate |

7% |

| Rate of return |

6% |

| Income at age 30 |

50,000 |

| Savings Rate |

15% |

| Inflation Rate |

3% |

| Exemption |

$15,000 |

| Tax rate |

26% |

| Retirement years | Income growth | Rate of inflation | Exemption now | Tax rate | Savings rate | ROR | rROR |

| 25 | 0.07 | 0.03 | 15,000 | 0.26 | 0.15 | 0.06 | 0.0291 |

| AGE | INCOME | DEFLATOR | EXEMPTION | TAXES | SAVINGS | CUMMULATIVE SAVINGS | CONSUMPTION |

| 30 |

50,000 |

1.00 |

15,000 |

5,216 |

9,721 |

9,721 |

35,063 |

| 31 |

53,500 |

1.03 |

15,450 |

5,684 |

10,506 |

20,810 |

36,224 |

| 32 |

57,245 |

1.06 |

15,914 |

6,187 |

11,351 |

33,410 |

37,428 |

| 33 |

61,252 |

1.09 |

16,391 |

6,727 |

12,261 |

47,675 |

38,678 |

| 34 |

65,540 |

1.13 |

16,883 |

7,308 |

13,240 |

63,776 |

39,974 |

| 35 |

70,128 |

1.16 |

17,389 |

7,933 |

14,295 |

81,898 |

41,319 |

| 36 |

75,037 |

1.19 |

17,911 |

8,604 |

15,431 |

102,243 |

42,713 |

| 37 |

80,289 |

1.23 |

18,448 |

9,324 |

16,653 |

125,030 |

44,160 |

| 38 |

85,909 |

1.27 |

19,002 |

10,099 |

17,969 |

150,501 |

45,661 |

| 39 |

91,923 |

1.30 |

19,572 |

10,930 |

19,384 |

178,915 |

47,218 |

| 40 |

98,358 |

1.34 |

20,159 |

11,822 |

20,907 |

210,557 |

48,834 |

| 41 |

105,243 |

1.38 |

20,764 |

12,780 |

22,546 |

245,736 |

50,509 |

| 42 |

112,610 |

1.43 |

21,386 |

13,808 |

24,309 |

284,789 |

52,248 |

| 43 |

120,492 |

1.47 |

22,028 |

14,911 |

26,205 |

328,082 |

54,052 |

| 44 |

128,927 |

1.51 |

22,689 |

16,094 |

28,245 |

376,011 |

55,923 |

| 45 |

137,952 |

1.56 |

23,370 |

17,363 |

30,438 |

429,010 |

57,864 |

| 46 |

147,608 |

1.60 |

24,071 |

18,724 |

32,797 |

487,547 |

59,878 |

| 47 |

157,941 |

1.65 |

24,793 |

20,184 |

35,333 |

552,133 |

61,968 |

| 48 |

168,997 |

1.70 |

25,536 |

21,749 |

38,060 |

623,320 |

64,136 |

| 49 |

180,826 |

1.75 |

26,303 |

23,427 |

40,991 |

701,711 |

66,386 |

| 50 |

193,484 |

1.81 |

27,092 |

25,226 |

44,143 |

787,956 |

68,720 |

| 51 |

207,028 |

1.86 |

27,904 |

27,154 |

47,530 |

882,764 |

71,141 |

| 52 |

221,520 |

1.92 |

28,742 |

29,221 |

51,171 |

986,900 |

73,654 |

| 53 |

237,026 |

1.97 |

29,604 |

31,435 |

55,084 |

1,101,198 |

76,261 |

| 54 |

253,618 |

2.03 |

30,492 |

33,808 |

59,289 |

1,226,559 |

78,966 |

| 55 |

271,372 |

2.09 |

31,407 |

36,350 |

63,807 |

1,363,959 |

81,773 |

| 56 |

290,368 |

2.16 |

32,349 |

39,074 |

68,662 |

1,514,459 |

84,685 |

| 57 |

310,693 |

2.22 |

33,319 |

41,991 |

73,879 |

1,679,205 |

87,707 |

| 58 |

332,442 |

2.29 |

34,319 |

45,116 |

79,483 |

1,859,440 |

90,843 |

| 59 |

355,713 |

2.36 |

35,348 |

48,463 |

85,503 |

2,056,510 |

94,097 |

| 60 |

380,613 |

2.43 |

36,409 |

52,048 |

91,970 |

2,271,870 |

97,474 |

| 61 |

407,256 |

2.50 |

37,501 |

55,887 |

98,916 |

2,507,098 |

100,978 |

| 62 |

435,764 |

2.58 |

38,626 |

59,998 |

106,377 |

2,763,901 |

104,614 |

| 63 |

466,267 |

2.65 |

39,785 |

64,400 |

114,389 |

3,044,125 |

108,387 |

| 64 |

498,906 |

2.73 |

40,979 |

69,113 |

122,994 |

3,349,766 |

112,302 |

| 65 |

533,829 |

2.81 |

42,208 |

74,159 |

132,235 |

3,682,987 |

116,365 |

| TOTAL | 982,317 | 1,736,072 | REAL ANNUITY | 74,436 | |||

| RETIREMENT | |||||||

| AGE | WITHDRAWN | DEFLATOR | EXEMPTION | TAXES | SAVINGS | ROR | rROR |

| 66 |

215,736 |

2.90 |

43,474 |

44,788 |

3,688,231 |

58,983 |

|

| 67 |

222,208 |

2.99 |

44,778 |

46,132 |

3,687,317 |

58,983 |

|

| 68 |

228,874 |

3.07 |

46,122 |

47,516 |

3,679,682 |

58,983 |

|

| 69 |

235,740 |

3.17 |

47,505 |

48,941 |

3,664,723 |

58,983 |

|

| 70 |

242,812 |

3.26 |

48,931 |

50,409 |

3,641,793 |

58,983 |

|

| 71 |

250,097 |

3.36 |

50,398 |

51,922 |

3,610,204 |

58,983 |

|

| 72 |

257,600 |

3.46 |

51,910 |

53,479 |

3,569,217 |

58,983 |

|

| 73 |

265,328 |

3.56 |

53,468 |

55,084 |

3,518,042 |

58,983 |

|

| 74 |

273,288 |

3.67 |

55,072 |

56,736 |

3,455,837 |

58,983 |

|

| 75 |

281,486 |

3.78 |

56,724 |

58,438 |

3,381,701 |

58,983 |

|

| 76 |

289,931 |

3.90 |

58,426 |

60,191 |

3,294,672 |

58,983 |

|

| 77 |

298,629 |

4.01 |

60,178 |

61,997 |

3,193,724 |

58,983 |

|

| 78 |

307,588 |

4.13 |

61,984 |

63,857 |

3,077,760 |

58,983 |

|

| 79 |

316,815 |

4.26 |

63,843 |

65,773 |

2,945,610 |

58,983 |

|

| 80 |

326,320 |

4.38 |

65,759 |

67,746 |

2,796,027 |

58,983 |

|

| 81 |

336,109 |

4.52 |

67,731 |

69,778 |

2,627,679 |

58,983 |

|

| 82 |

346,193 |

4.65 |

69,763 |

71,872 |

2,439,148 |

58,983 |

|

| 83 |

356,578 |

4.79 |

71,856 |

74,028 |

2,228,918 |

58,983 |

|

| 84 |

367,276 |

4.93 |

74,012 |

76,249 |

1,995,378 |

58,983 |

|

| 85 |

378,294 |

5.08 |

76,232 |

78,536 |

1,736,806 |

58,983 |

|

| 86 |

389,643 |

5.23 |

78,519 |

80,892 |

1,451,372 |

58,983 |

|

| 87 |

401,332 |

5.39 |

80,875 |

83,319 |

1,137,122 |

58,983 |

|

| 88 |

413,372 |

5.55 |

83,301 |

85,818 |

791,977 |

58,983 |

|

| 89 |

425,773 |

5.72 |

85,800 |

88,393 |

413,723 |

58,983 |

|

| 90 |

438,546 |

5.89 |

88,374 |

91,045 |

- |

58,983 |

|

| TOTAL | 7,865,566 | 1,632,938 |

On comparing the above results, by keeping all the conditions remaining same, and revising the given rates we reach the following conclusion:

| AS PER ACTUAL STATED CONDITION |

AS PER ACTUAL STATED CONDITION AND INCREASING INFALTION RATE TO 4% |

AS PER ACTUAL STATED CONDITION AND INCREASING TAX RATE TO 26% |

|

| REAL CONSUMPTION |

76,052.00 |

16,040.00 |

74,436.00 |

| REAL CONSUMPTION ON RETIREMENT |

60,789.00 |

15,780.00 |

58,983.00 |

Hence we can say, on increasing inflation rate by 1%, the real consumption decreases marginally.

Want to see more full solutions like this?

Chapter 21 Solutions

Essentials Of Investments

- Anthony jacksons proarrow_forwardHello tutor this is himlton biotech problem.arrow_forwardYan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.7 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 5.05 percent. What is the dollar price of the bond?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education