Concept explainers

The process of presenting partially completed units in terms of completed units is referred to as determination of equivalent units. It includes both, partially and completed units of inventory, in finished inventory.

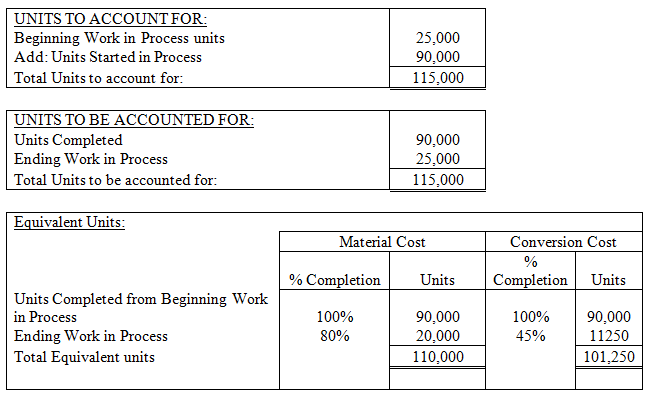

Requirement1: To compute the Equivalent units for Mixing department.

Solution:

Equivalent units of Material for Mixing department: 110,000 units.

Equivalent units of Conversion cost for Mixing department: 101,250 units.

Explanation: The computation of equivalent units for material and conversion cost for mixing department of L C Co. for May 2018 is as follows:

.

.

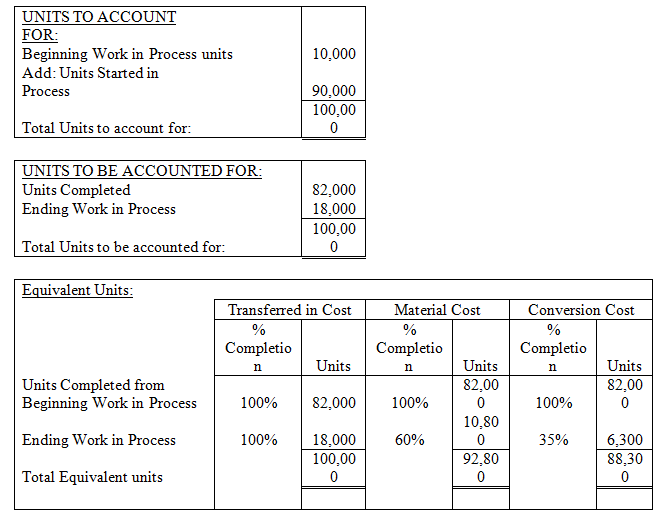

Requirement 2: The Equivalents units for Transferred-in cost, material and conversion cost for heating department.

Solution:

Equivalent units of transferred-in cost for heating department: 100,000 units

Equivalent units of Material cost for heating department: 92,800 units

Equivalent units of Conversion cost for heating department: 88,300 units

Explanation:

Now, the cost of units Completed and transferred out to Heating department is taken as Transferred-in cost for Heating department (another element of cost for department). The equivalent units for heating department of L C Co. are as follows:

.

.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Horngren's Accounting, Student Value Edition (12th Edition)

- Viggo Manufacturing estimates that overhead costs for the next year will be $2,800,000 for indirect labor and $750,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 100,000 machine hours are planned for this next year, what is the company's plantwide overhead rate?arrow_forwardAn asset was purchased for $72,000 with a salvage value of $6,000 on July 1, Year 1. It has an estimated useful life of 6 years. Using the straight-line method, how much depreciation expense should be recognized on December 31, Year 1?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

- What is its degree of operating leverage?arrow_forwardA firm reported wages expense of $607 million and cash paid for wages of $578 million. What was the change in wages payable for the period?arrow_forwardPlease provide the solution to this financial accounting question using proper accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education