Concept explainers

1.

To prepare: Sale budget of I Corporation.

1.

Explanation of Solution

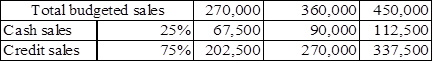

Statement that shows the sales budget of I Incorporation

| I Incorporation | ||||

| Sales Budget | ||||

| Particulars | January ($) | February ($) | March ($) | Total ($) |

| Sales unit (A) | 6,000 | 8,000 | 10,000 | 24,000 |

| Selling price Per unit (B) | 45 | 45 | 45 | 45 |

| Total sales | 270,000 | 360,000 | 450,000 | 1,080,000 |

| Table (1) | ||||

2.

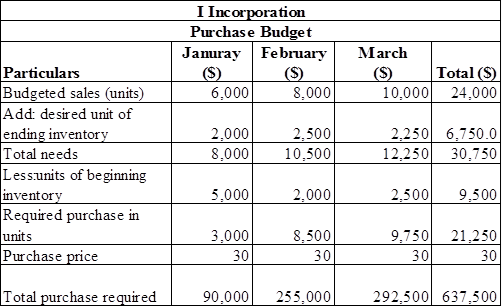

To prepare: Purchase budget of I Corporation.

2.

Explanation of Solution

Statement that shows the purchase budget of I Incorporation

Table (2)

3.

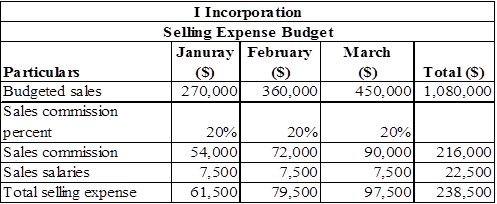

To prepare: Selling expense budget of I Incorporation.

3.

Explanation of Solution

Statement that shows the selling expense budget of I Incorporation,

Table (3)

4.

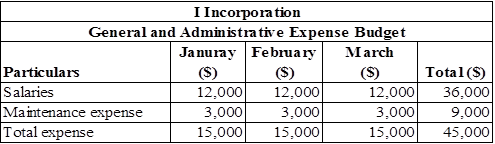

To prepare: General and administrative expense budget of I Incorporation.

4.

Explanation of Solution

Statement that shows the General and administrative expense budget of I Incorporation

Table (4)

5.

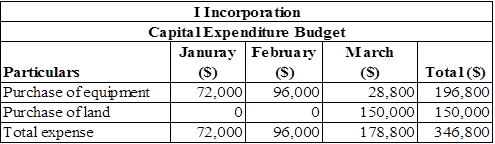

To prepare: Capital expenditure budget of I Incorporation.

5.

Explanation of Solution

Statement that shows the capital expenditure budget of I Incorporation

Table (5)

6.

To prepare:

6.

Explanation of Solution

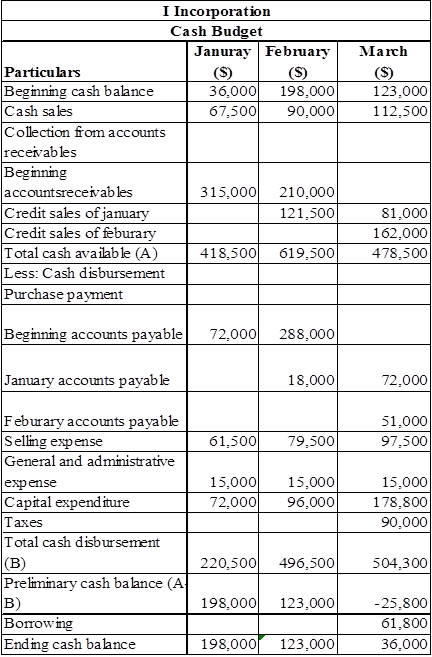

Statement that shows the Cash budget of I Incorporation

Table (6)

Working Notes:

Calculation of expected cash collection

Table (7)

7.

To prepare:

7.

Explanation of Solution

Prepare income statement.

| I Incorporation | ||||

| Income Statement | ||||

| For three months ended March 31,2018 | ||||

| Particulars | Amount ($) | Amount ($) | ||

| Sales | 1,080,000 | |||

| Less: Cost of goods sold | 720,000 | |||

| Gross profit | 360,000 | |||

| Less: Operating expenses | ||||

| Total selling expense | 238,500 | |||

| General administrative salary | 45,000 | |||

| 21,425 | ||||

| Total operating expense | 304,925 | |||

| Earnings before taxes (A) | 55,075 | |||

| Less: Income tax | 22,030 | |||

| Net income | 33,045 | |||

| Table (8) | ||||

Thus, budgeted net income of I Incorporation is $33,045.

8.

To prepare: Budgeted

8.

Explanation of Solution

Prepare balance sheet

| I Incorporation | ||||

| Balance sheet | ||||

| For three months ended March 31,2018 | ||||

| Particulars | Amount ($) | |||

| Assets | ||||

| Cash | 36,000 | |||

| Account Receivables | 445,500 | |||

| Inventory | 67,500 | |||

| Total current assets | 549,000 | |||

| Equipment | 647,875 | |||

| Land | 150,000 | |||

| Net equipment | ||||

| Total Assets | 1,346,875 | |||

| Liabilities and | ||||

| Liabilities | ||||

| Accounts Payable | 496,500 | |||

| Bank loan payable | 76,800 | |||

| Income tax payable | 22,030 | |||

| Total liabilities | 595,330 | |||

| Stockholder’s Equity | ||||

| Common Stock | 472,500 | |||

| 279,045 | ||||

| Total stockholders’ equity | 751,545 | |||

| Total Liabilities and Stockholder’s equity | 1,346,875 | |||

| Table (9) | ||||

Working note:

Calculation of retained earnings,

Hence, the total of the balance sheet of the D Company as on March 31, 2018 is of $1,568,650.

Want to see more full solutions like this?

Chapter 20 Solutions

FIN & MANAGERIAL ACCT VOL 2 W/CONNECT

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardJulius provided consulting services amounting to P420, 000. His total expenses were 25%. His net income is: A. P105,000 B. P300,000 C. P315,000 D. P120,000arrow_forwardWhat is the cost of goods soldarrow_forward

- SnapGallery Inc. sells one digital poster frame. The sales price per unit is $12. The variable cost per unit is $7. Fixed costs per annum are $13,500 and having a sales volume of 5,000 digital poster frames would result in: 1. a profit of $11,500 2. a loss of $2,500 3. breaking even 4. a profit of $8,000arrow_forwardWhat would be the bas debt expense for the yeararrow_forwardHow much overhead was applied during the year?arrow_forward

- Calculate the predetermined overhead rate per machine hourarrow_forwardOn June 1, SunDial Corporation's board of directors declares common stock dividends totaling $35,000. The dividends are payable on December 31 to shareholders of record on September 1. What entry will SunDial make on June 1?arrow_forwardWhat is the net income?arrow_forward

- Brightway Corp. purchased land, a building, and equipment for one price of $900,000. The estimated fair values of the land, building, and equipment are $150,000, $600,000, and $250,000, respectively. At what amount would the company record the land?arrow_forwardCan you explain the correct approach to solve this financial accounting question?arrow_forwardPlease explain the correct approach for solving this financial accounting question.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education