Concept explainers

1.

To prepare:

The sales budget of D Company.

1.

Explanation of Solution

Prepare the sales budget of D Company as shown below.

| Sales Budget | ||||

|---|---|---|---|---|

| Particulars | January ($) |

February ($) |

March ($) |

Total ($) |

| Sales unit (A) | 7,000 | 9,000 | 11,000 | 27,000 |

| Selling price per unit (B) | 55 | 55 | 55 | 55 |

| Total sales |

385,000 | 495,000 | 605,000 | 1,485,000 |

Table (1)

2.

To prepare:

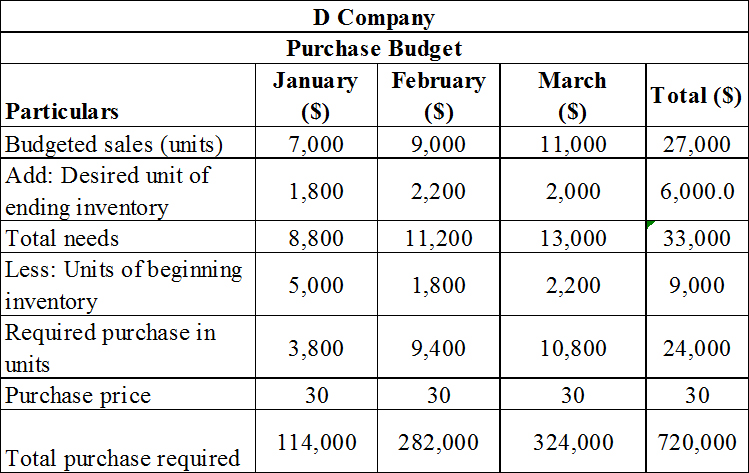

The purchase budget of D Company.

2.

Explanation of Solution

Prepare the purchase budget of D Company as shown below.

Table (2)

3.

To prepare:

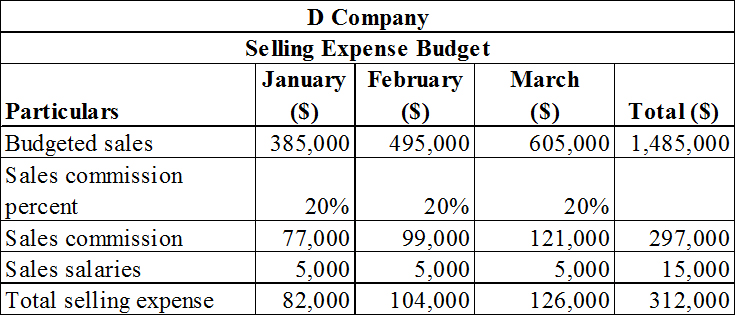

The selling expense budget of D Company.

3.

Explanation of Solution

Prepare the selling expense budget of D Company as shown below.

Table (3)

4.

To prepare:

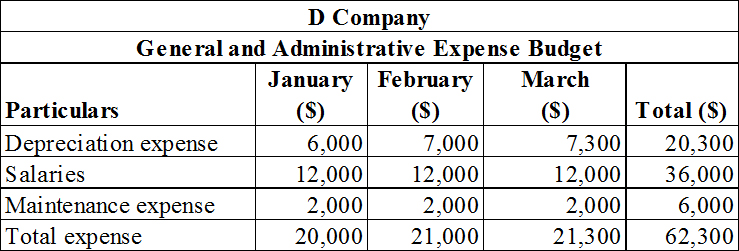

The general and administrative expense budget of D Company.

4.

Explanation of Solution

Prepare the general and administrative expense budget of D Company as shown below.

Table (4)

5.

To prepare:

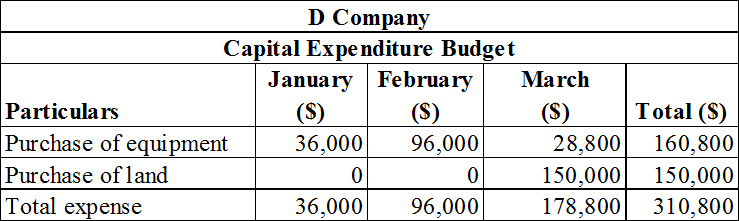

The capital expenditure budget of D Company.

5.

Explanation of Solution

Prepare the capital expenditure budget of D Company as shown below.

Table (5)

6.

To prepare:

The

6.

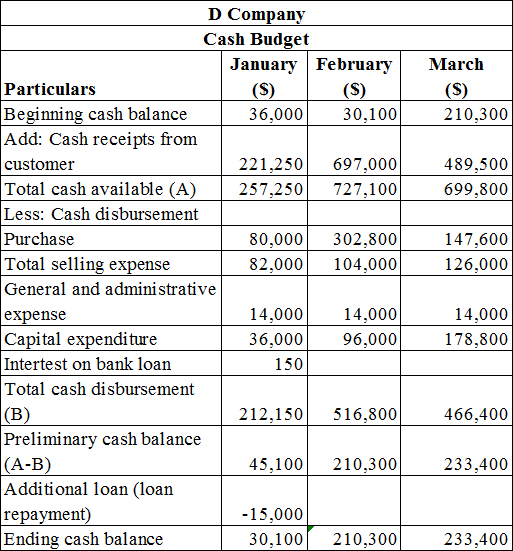

Explanation of Solution

Prepare the cash budget of D Company as shown below.

Table (6)

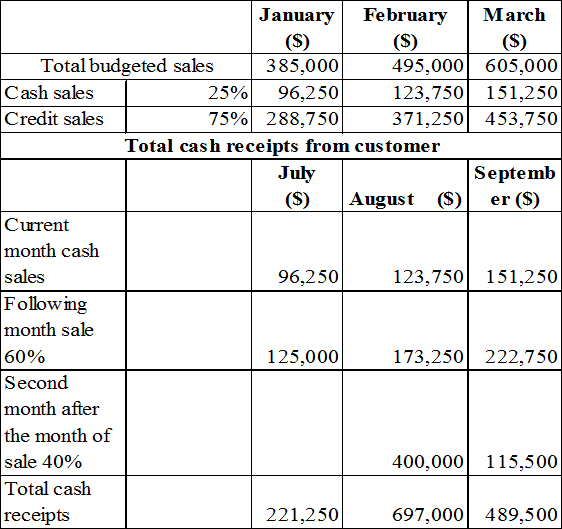

Working notes:

1. Calculate the expected cash collection.

Table (7)

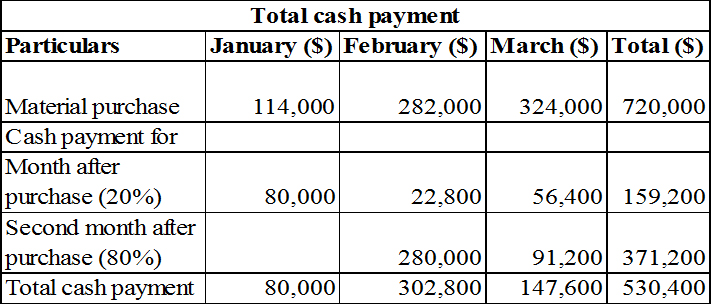

2. Calculate the cash payment from purchase.

Table (8)

7.

To prepare:

The

7.

Explanation of Solution

Prepare the income statement as shown below.

| Income Statement | ||

|---|---|---|

| For three months ended March 31, 2016 | ||

| Particulars | Amount ($) |

Amount ($) |

| Sales | 1,485,000 | |

| Less: Cost of goods sold |

810,000 | |

| Gross profit | 675,000 | |

| Less: Operating expenses | ||

| Total selling expense | 312,000 | |

| General administrative salary | 62,300 | |

| Interest on bank loan | 150 | |

| Total operating expense | 374,450 | |

| Earnings before taxes (A) | 300,550 | |

| Less: Income tax | 120,220 | |

| Net income | 180,330 | |

Table (9)

Thus, the budgeted net income of D Company is $180,330.

8.

To prepare:

The budgeted

8.

Explanation of Solution

Prepare the balance sheet for the first quarter as shown below.

| Balance sheet | ||

|---|---|---|

| For three months ended March 31, 2016 | ||

| Particulars | Amount ($) |

Amount ($) |

| Assets | ||

| Cash | 233,400 | |

| 602,250 | ||

| Inventory | 60,000 | |

| Total current assets | 895,650 | |

| Equipment | 523,000 | |

| Land | 150,000 | |

| Net equipment | ||

| Total Assets | 1,568,650 | |

| Liabilities and |

||

| Liabilities | ||

| Accounts payable | 549,600 | |

| Income tax payable | 120,220 | |

| Total liabilities | 669,820 | |

| Stockholder’s Equity | ||

| Common Stock | 472,500 | |

| 426,330 | ||

| Total stockholders’ equity | 898,830 | |

| Total Liabilities and stockholder’s equity | 1,568,650 | |

Table (10)

Working note:

Calculate the retained earnings.

Hence, the total amount appearing on the balance sheet of D Company as on March 31, 2016 is $1,568,650.

Want to see more full solutions like this?

Chapter 20 Solutions

Connect 2 Semester Access Card for Financial and Managerial Accounting

- Please help mearrow_forwardDo fast answer of this accounting questionsarrow_forwardNick and Partners, a law firm, worked on a total of 1,000 cases this month, 800 of which were completed during the period. The remaining cases were 40% complete. The firm incurred $180,000 in direct labor and overhead costs during the period and had $4,800 in direct labor and overhead costs in beginning inventory. Using the weighted average method, what was the total cost of cases completed during the period?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education