Concept explainers

Problem 20-7BA

FIFO: Process cost summary, equivalent units, cost estimates

C2 C3 C4 P4

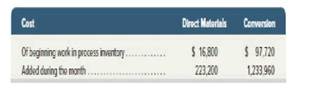

Belda Co. mates organic juice in two departments: cutting and blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of

Required

- Prepare the cutting departments process cost summary for March using the FIFO method.

- Prepare the

journal entry dated March 31 to transfer the cost of completed units to the blending department, - The company provides incentives to department managers by paying monthly bonuses based on their success in controlling costs per equivalent unit of production, Assume that the production department overestimates the percentage of completion for units in ending inventory with the result that its

equivalent units of production for March are overstated, What impact does this error have on bonuses paid to the managers of the production department? What impact, if any, does this error have on these managers' April bonuses?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

FUND.ACCT.PRIN.(LOOSELEAF)

- A company purchased for cash a machine with a list price of $85,000. The machine was shipped FOB shipping point at a cost of $6,500. Installation and test runs of the machine cost $4,500. The recorded acquisition cost of the machine is which amount? a. $96,000 b. $126,000 c. $85,000 d. $92,000arrow_forwardBaxter Industries reported the following financial data for one of its divisions for the year: • Average invested assets = $600,000 • Sales = $1,200,000 Income = $140,000 What is the investment turnover? a) 2.75 b) 3.40 c) 2.00 d) 4.25 e) 5.00arrow_forwardChapter: Work in process - Vicky Company has beginning work in process inventory of $216,000 and total manufacturing costs of $954,000. If cost of goods manufactured is $980,000, what is the cost of the ending work in process inventory? Don't want wrong answerarrow_forward

- A company bought a new cooling system for $150,000 and was given a trade-in of $95,000 on an old cooling system, so the company paid $55,000 cash with the trade-in. The old system had an original cost of $140,000 and accumulated depreciation of $60,000. If the transaction has commercial substance, the company should record the new cooling system at _. Solvearrow_forwardFinancial accountingarrow_forwardCorrect Answerarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub