Concept explainers

a.

To Determine: The exercise value of Company PII’s warrants if the common stock sells at $18, $21, $25 and $70.

Introduction: A warrant is securities that give the bondholder the right, yet not the obligation, to purchase a specific number of securities at a specific cost before a specific time. Warrants are not the equivalent as the call options or purchase rights of the stock.

a.

Answer to Problem 6P

The exercise value of Company PII’s warrants if the common stock sells at $18 is -$3, $21 is $0, $25 is $4 and $70 is $49.

Explanation of Solution

Determine the exercise value of company PII’s warrants

If the common stock sells at $18

If the common stock sells at $21

If the common stock sells at $25

If the common stock sells at $70

Therefore the exercise value of Company PII’s warrants if the common stock sells at $18 is -$3, $21 is $0, $25 is $4 and $70 is $49.

b.

To Determine: The approximate price and the premium implied the warrants to sell under each condition from part (a) based on guess or reasonable assumption.

b.

Explanation of Solution

Determine the approximate price, premium and warrant for each stock

Since there is no exact or approximate solutions are possible the below are the price, premium and warrant for each stock price which are purely based on reasonable assumption.

If the common stock sells at $18:

The approximate price will be $18, the premium will be $4.50 and the warrant will be $1.50.

If the common stock sells at $21:

The approximate price will be $21, the premium will be $3 and the warrant will be $3.

If the common stock sells at $25

The approximate price will be $25, the premium will be $1.50 and the warrant will be $5.50.

If the common stock sells at $70:

The approximate price will be $70, the premium will be $1 and the warrant will be $50.

c1.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the life of warrant in lengthened.

c1.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the life of warrant in lengthened is as follows:

The higher the value of warrant, the lengthier the life of the warrant.

c2.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the expected variability in stock's price decrease.

c2.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the expected variability in stock's price decrease is as follows:

The lesser the value of warrant, the lesser the variable of the stock price.

c3.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the growth rate in the stock's EPS increase.

c3.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the growth rate in the stock's EPS increase is as follows:

The greater the price of warrant, the greater the expected EPS growth rate.

c4.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the company paid no dividends and will pay out all earnings as dividends.

c4.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the company paid no dividends and will pay out all earnings as dividends is as follows:

Beginning from 0 to 100% payout would have two conceivable impacts. To start with, it may influence the price of stock creating an variation in the exercise value of the warrant, nonetheless, it is not certain that the price of stock would change, not to mention what the variations possible.

The expansion in the payout ratio would significantly bring down the expected growth rate. This would decrease the probability of the stock's cost expanding in the future. This would bring down the expected value of the warrant, consequently bring down the premium and the cost of the warrant.

d.

To Determine: The annual coupon interest rate and annual dollar coupon on the bonds.

d.

Answer to Problem 6P

The annual coupon interest rate is 9.11% and annual dollar coupon on the bonds is $91.19.

Explanation of Solution

Determine the

Therefore the value of bond is $925.

Determine the annual dollar coupon on the bonds

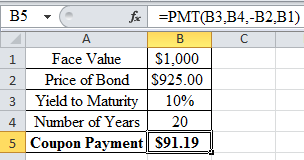

Using an excel spreadsheet and excel function =PMT, the annual dollar coupon on the bonds is calculated as $91.19.

Excel Spreadsheet:

Therefore the annual dollar coupon on the bonds is $91.19

Determine the annual coupon interest rate on the bonds

Therefore the annual coupon interest rate on the bonds is 9.11%.

Want to see more full solutions like this?

Chapter 20 Solutions

Study Guide For Brigham/houston's Fundamentals Of Financial Management, 14th

- 6. Calculate the price of a dividend paying stock using the following information, assuming the price is equal to the present value of all future dividends one will receive from owning the stock. (Hint: treat the stock as a growing perpetuity) Dividend $4.50 Growth rate 2% Required return 12% *arrow_forwardFinance question. None please listen if you deslike my answer i will give your also they change rule for sublitt. Also if you will give more deslike bartleby site will be shut down.arrow_forwardProvide true solution.arrow_forward

- Finance question. None please listen if you deslike my answer i will give your. Also if you will give more deslike bartleby site will be shut down.arrow_forwardFinance question. None please listen if you deslike my answer i will give your. Also if you will give more deslike bartleby site will be shut down.arrow_forwardCorrect solnarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning