Concept explainers

1.

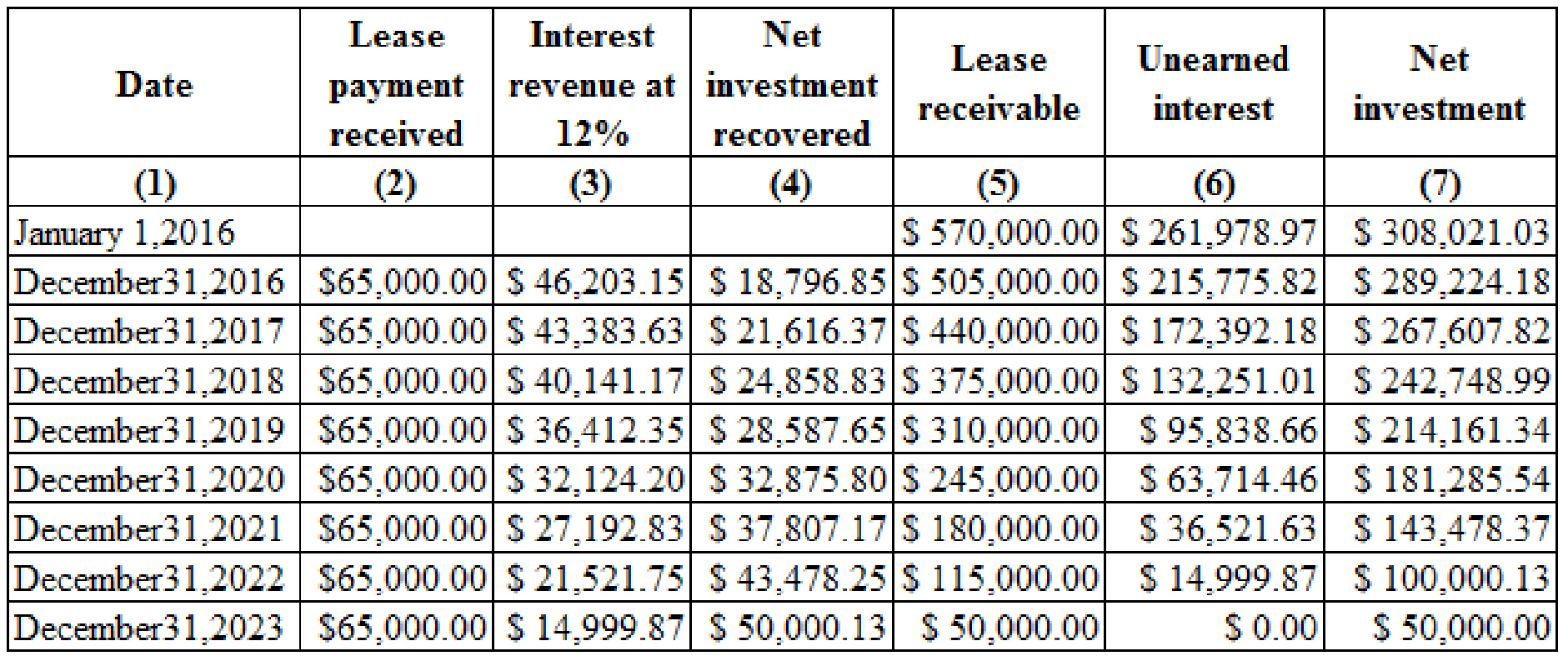

Prepare a table summarizing the lease receipts and interest revenue earned by the lessor for the direct financing lease.

1.

Explanation of Solution

Prepare a table summarizing the lease receipts and interest revenue earned by the lessor for the direct financing lease:

Table (1)

Notes to the above table:

2.

Explain the reasons for classifying the lease as a direct financing lease.

2.

Explanation of Solution

Direct Financing Lease: Under direct financing lease, the lessor considers the lease as a sale of the asset at fair value equal to the cost of the asset or its carrying value and records an accompanying receivable. Since there is no manufacture’s or dealer’s profit or loss, the lessor records the net amount at which the receivable must be equal to the cost of the asset or carrying value of the property.

The reasons for classifying the lease as direct financing lease from the criteria table as presented below:

| Capitalization Criteria | Met or not | Remarks |

| 1. Transfer of ownership at the end of lease | No | |

| 2. Bargain purchase option | No | |

| 3. Lease term is 75% or more | Yes | 89% |

| 4. Present value of lease payment is 90% or more of the fair value | Yes | PV is 94.7% of the fair value of the equipment |

| Recognition Criteria | ||

| 1. Collectivity assured | Yes | |

| 2. No Uncertainties | Yes |

Table (2)

From the above table, it is noted that the lease is a direct financing lease for Company C as more than one capitalization criteria is met and both of the recognition criteria also met according to the terms of the lease agreement. Moreover there is a dealer’s profit of $$350,090.68

Working Note 1: Compute the present value of minimum lease payment:

3.

Prepare the

3.

Explanation of Solution

Prepare the journal entries for Company C for the years 2016, 2017, and 2018:

| Date | Accounts title and explanation | Post Ref. | Debit($) | Credit($) |

| January 1,2016 | Equipment Leased to Others | 308,021.03 | ||

| Cash | 308,021.03 | |||

| (To record the payment of capital lease at inception) | ||||

| January 1,2016 | Lease Receivable | 570,000.00 | ||

| Equipment Leased to Others | 308,021.03 | |||

| Unearned Interest: Leases | 261,978.97 | |||

| (To record the lease receivable in a capital lease) | ||||

| December 31,2016 | Unearned Interest: Leases | 46,203.15 | ||

| Interest Revenue: Leases | 46,203.15 | |||

| (To recognize the interest revenue of the year) | ||||

| December 31,2016 | Cash | 65,000.00 | ||

| Lease Receivable | 65,000.00 | |||

| (To record the receipt of final lease payment ) | ||||

| December 31,2017 | Cash | 65,000.00 | ||

| Lease Receivable | 65,000.00 | |||

| (To record the receipt of final lease payment ) | ||||

| December 31,2017 | Unearned Interest: Leases | 43,383.63 | ||

| Interest Revenue: Leases | 43,383.63 | |||

| (To recognize the interest revenue of the year) | ||||

| December 31,2018 | Cash | 65,000.00 | ||

| Lease Receivable | 65,000.00 | |||

| (To record the receipt of final lease payment ) | ||||

| December 31,2018 | Unearned Interest: Leases | 40,141.17 | ||

| Interest Revenue: Leases | 40,141.17 | |||

| (To recognize the interest revenue of the year) |

Table (3)

4.

Prepare a partial

4.

Explanation of Solution

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare a partial balance sheet for December 31, 2016 and December 31, 2017 showing the reported accounts in it:

| Company C | ||

| Balance Sheet(Partial) | ||

| As on December 31 | ||

| Particulars | 2016 | 2017 |

| Assets | ||

| Current Assets: | ||

| Net Investment in Direct Financing Leases | $56,521.73 | $56,521.73 |

| Non-Current Assets: | ||

| Net Investment in Direct Financing Leases | $211,086.08 | $232,702.45 |

| Liabilities | ||

| Current liabilities: | ||

| Non-Current liabilities: | ||

Table (4)

Notes for the above table:

Want to see more full solutions like this?

Chapter 20 Solutions

Intermediate Accounting: Reporting and Analysis, 2017 Update

- Sea Harbor, Inc. has a marginal tax rate of 35 percent and an average tax rate of 22 percent. If the firm earns $79,500 in taxable income, how much will it owe in taxes? a. $10,335. b. $16,695. c. $17,490. d. $27,030. e. $27,825.arrow_forwardPlease give me true answer this financial accounting questionarrow_forwardNeed help with this financial accounting questionarrow_forward

- What is the net income percentage ?arrow_forwardCan you please answer the financial accounting question?arrow_forwardidentify the key factors that contributed to the collapse of Northern Rock bank. Compile documents and analysis of regulations (magazine articles, newspapers, online sources, working papers from different organizations, activity summaries, results reports, legal regulations, speeches, public statements, press conferences, etc.). Apply, in a practical and theoretical way, what has been learned in class about the financial world, regulation and risk management.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning