a.

Determine the unit contribution margin and break-even point in units and break-even point in dollar sales.

a.

Explanation of Solution

Contribution Margin:

The process or theory which is used to judge the benefit given by each unit of the goods produced is called as contribution margin.

The contribution margin is the difference between the selling price and the cost of the product.

Formula to compute the unit contribution margin:

Calculate the contribution margin per unit:

Step 1: Calculate the variable cost per unit.

Step 2: Calculate the contribution margin per unit.

Calculate the break-even volume in units:

Step 1: Calculate the total monthly fixed costs.

Step 2: Calculate the break-even volume in units.

Working note:

Calculate the amount of

Calculate the break-even volume in dollars:

b.

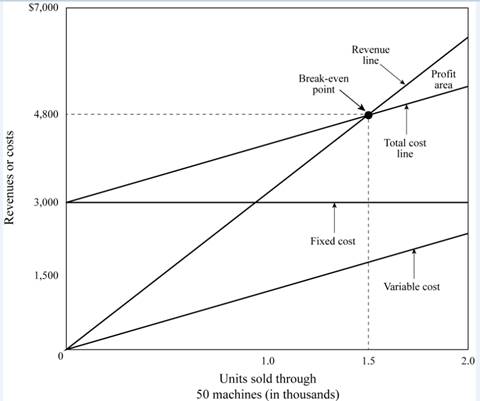

Draw a monthly cost-volume-profit graph for the sales volume up to 800 units per machine per month.

b.

Explanation of Solution

Cost-Volume- Profit Analysis (CVP Analysis): This analysis is helpful in determining that how any type of change in cost determines company’s income.

c.

Compute the sales volume in units and in dollars per month.

c.

Explanation of Solution

Compute the sales volume in units:

Step 1: Calculate the total desired contribution margin.

Step 2: Calculate the sales volume in units.

Working note:

Calculate the amount of desired operating income:

Compute the sales volume in dollars:

d.

Determine the changes in break-even volume in units.

d.

Explanation of Solution

Calculate the changes in break-even volume in units:

Working notes:

Calculate the amount of new monthly fixed costs:

Calculate the new contribution margin per unit:

Want to see more full solutions like this?

Chapter 20 Solutions

Financial & Managerial Accounting With Connect Plus Access Code: The Basis For Business Decisions

- Hii expert I need this general accounting question answer please solve and given step by step explanationarrow_forwardNeed help with this question solution general accountingarrow_forwardXYZ Industries' total quick assets were $4,500,000, its current assets were $9,800,000, and its current liabilities were $5,000,000. Its acid-test ratio equals: a. 0.46 b. 0.90 c. 1.96 d. 1.20 e. 2.18arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education