a.

Determine the unit contribution margin and break-even point in units and break-even point in dollar sales.

a.

Explanation of Solution

Contribution Margin:

The process or theory which is used to judge the benefit given by each unit of the goods produced is called as contribution margin.

The contribution margin is the difference between the selling price and the cost of the product.

Formula to compute the unit contribution margin:

Calculate the contribution margin per unit:

Step 1: Calculate the variable cost per unit.

Step 2: Calculate the contribution margin per unit.

Calculate the break-even volume in units:

Step 1: Calculate the total monthly fixed costs.

Step 2: Calculate the break-even volume in units.

Working note:

Calculate the amount of

Calculate the break-even volume in dollars:

b.

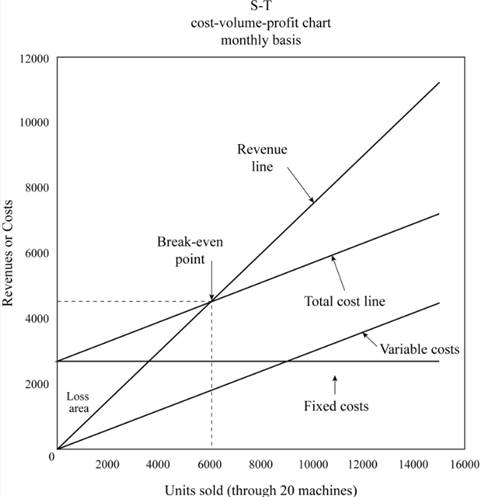

Draw a monthly cost-volume-profit graph for the sales volume up to 800 units per machine per month.

b.

Explanation of Solution

Cost-Volume- Profit Analysis (CVP Analysis): This analysis is helpful in determining that how any type of change in cost determines company’s income.

c.

Compute the sales volume in units and in dollars per month.

c.

Explanation of Solution

Compute the sales volume in units:

Step 1: Calculate the total desired contribution margin.

Step 2: Calculate the sales volume in units.

Working note:

Calculate the amount of desired operating income:

Compute the sales volume in dollars:

d.

Determine the changes in break-even volume in units.

d.

Explanation of Solution

Calculate the changes in break-even volume in units:

Working notes:

Calculate the amount of new monthly fixed costs:

Calculate the new contribution margin per unit:

Want to see more full solutions like this?

Chapter 20 Solutions

Financial Accounting

- Please give me true answerarrow_forwardYou've been asked to evaluate a new 25-year callable, convertible bond issued by Nova Energy Inc.. The bond has a 6.5% annual coupon, a face value of $1,000, and a conversion price of $45. The company's stock currently trades at $38 per share. What is the conversion premium for this bond? a) $5 b) $6 c) $7 d) $8 e) $10arrow_forwardsubject general accountingarrow_forward

- Correct answer please this questionarrow_forwardNeed help this questionarrow_forwardBeta Ltd. manufactures a product and has provided the following contribution format income statement: • Sales (6,200 units) = $186,000 • Variable expenses = $99,200 • Contribution margin = $86,800 • Fixed expenses = $67,000 ⚫ Net operating income = $19,800 If Beta Ltd. sells 6,800 units, what is the total contribution margin?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education