a.

Determine the unit contribution margin and break-even point in units and break-even point in dollar sales.

a.

Explanation of Solution

Contribution Margin:

The process or theory which is used to judge the benefit given by each unit of the goods produced is called as contribution margin.

The contribution margin is the difference between the selling price and the cost of the product.

Formula to compute the unit contribution margin:

Calculate the contribution margin per unit:

Step 1: Calculate the variable cost per unit.

Step 2: Calculate the contribution margin per unit.

Calculate the break-even volume in units:

Step 1: Calculate the total monthly fixed costs.

Step 2: Calculate the break-even volume in units.

Working note:

Calculate the amount of

Calculate the break-even volume in dollars:

b.

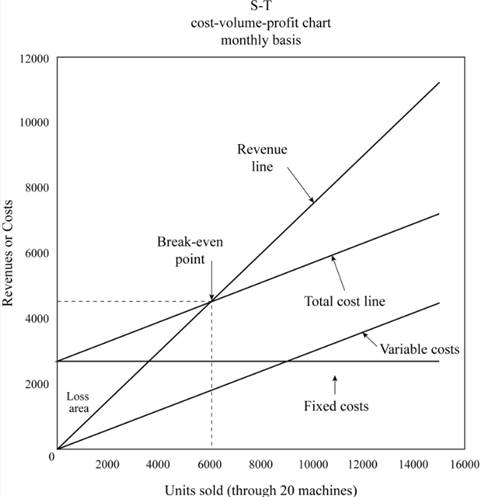

Draw a monthly cost-volume-profit graph for the sales volume up to 800 units per machine per month.

b.

Explanation of Solution

Cost-Volume- Profit Analysis (CVP Analysis): This analysis is helpful in determining that how any type of change in cost determines company’s income.

c.

Compute the sales volume in units and in dollars per month.

c.

Explanation of Solution

Compute the sales volume in units:

Step 1: Calculate the total desired contribution margin.

Step 2: Calculate the sales volume in units.

Working note:

Calculate the amount of desired operating income:

Compute the sales volume in dollars:

d.

Determine the changes in break-even volume in units.

d.

Explanation of Solution

Calculate the changes in break-even volume in units:

Working notes:

Calculate the amount of new monthly fixed costs:

Calculate the new contribution margin per unit:

Want to see more full solutions like this?

Chapter 20 Solutions

Financial & Managerial Accounting

- What does the "matching principle" in accounting state? A. Revenues should be matched with expenses incurred to generate those revenuesB. Assets should equal liabilitiesC. All accounts must be balanced at year-endD. Revenue is recognized only when cash is receivedarrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forwardPlease explain the solution to this financial accounting problem using the correct financial principles.arrow_forward

- Which method of inventory valuation results in the highest cost of goods sold in a period of rising prices? A. FIFO (First-In, First-Out)B. LIFO (Last-In, First-Out)C. Weighted AverageD. Specific Identificationarrow_forwardKindly help general accounting questionarrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forward

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this financial accounting problem using accurate calculation methods?arrow_forwardWhich method of inventory valuation results in the highest cost of goods sold in a period of rising prices? A. FIFO (First-In, First-Out)B. LIFO (Last-In, First-Out)C. Weighted AverageD. Specific Identificationneed help!arrow_forward

- General accounting questionarrow_forwardHarlow Corporation is the sole owner and operator of Harlow's Retail. As of the end of its accounting period, December 31, 2022, Harlow's Retail has assets of $2,400,000 and liabilities of $920,000. During 2023, Harlow invested an additional $150,000 and withdrew $80,000 from the business. What is the amount of net income during 2023, assuming that as of December 31, 2023, assets were $2,750,000 and liabilities were $880,000? accurate answerarrow_forwardAccurate Answerarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education