1.

Calculate the valuation of Company BPP using the market value method for the year 2019.

1.

Explanation of Solution

Valuation of Company BPP using the market value method for the year 2019.

2.

State the valuation of Company BPP using the book value method for the year 2019.

2.

Explanation of Solution

Valuation of Company BPP using the book value method for the year 2019 is $125,941,338 (amount of shareholder’s equity for the year 2019).

3.

Calculate the valuation of BPP using the multiple-based methods for sales, earnings, and

3.

Explanation of Solution

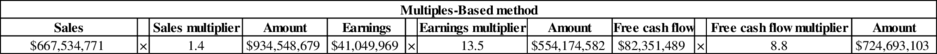

Calculate the valuation of BPP using the multiple-based methods for sales, earnings, and free

Figure (1)

4.

Calculate the estimated value for BPP using the discounted free cash flow method, by assuming that the 2019’s amount of free cash flow continues indefinitely.

4.

Explanation of Solution

Calculate the estimated value for BPP using the discounted free cash flow method:

5.

Recommend a method that could be used.

5.

Explanation of Solution

- For the discounted cash flow method, the six measures provide valuations in broad range, that is from a low of $125,941,338 for the equity at book value to a high of $1,551,685,117.

- The discounted cash flow method is comparatively greater due to the considerable increase in cash flow during 2019 as a result of increase in earnings and to the developed management of receivables and inventory, decreasing both of these account balances from 2018. Moreover, the discounted flow method is delicate to the selection of the discount rate, in this context a comparatively low 5.2%.

- The multiples-based measures range from $554,174,582 to $934,548,679 depending on current earnings, cash flows, and sales comparative to the industry average multiples. Placing the endpoints of the range away, a conservative evaluation of the company’s value must be nearer to $919,172,242, the market value of the firm deepening on the current market share price.

6.

State whether GSI offer is a good one.

6.

Explanation of Solution

- Approximately, If the valuation of company is $919,172,242, this reflects an expected share price nearer to its current market value of $35.78. Therefore, the $38 offer looks better.

- Conversely, if one plans a constant high level of free cash flow in the upcoming years, then as the discounted value of the firm is much greater, the selling price of the company must be slightly higher than $38 per share.

- For instance, the implied stock value is approximately $60 per share, at a discounted cash flow value of $1.6 billion. Now the $38 offer does not look good.

7.

Identify the effect of sustainability issues during the acquisition of BPP by GSI.

7.

Explanation of Solution

- There might be issues related to Sustainability rise in the acquisition as both GSI and BPP function in environmentally sensitive industries.

- GSI, a retailer of gardening supplies, should be attentive regarding both the manufacturing practices of its suppliers (to reduce harmful waste products dumping into the environment) and also about the management of the materials within GSI’s stores and in its transportation of these materials. Fertilizers, Insecticides, weed killers and other products could have poisonous and/or damaging chemicals.

- Moreover, the usage of BPP’s plumbing expertise and materials is having a sustainability dimension. The systems should be developed to use water as competently as possible, so that little quantity of water is wasted, if these products are used for the supply of home or commercial lawn and garden watering systems for the measure of sustainability.

- Additionally, if the BPP organization uses its knowledge and materials to develop drainage systems for commercial property and homes, then these drainage systems should be in such a manner that the harmful waste materials are not permitted to contaminate fields and streams that are nearby.

- Majority of the investors now consider sustainability as a significant part of a company’s strategic planning; valuation is also influenced by whether or not a company such as GSI or BPP have a sustainability plan.

- Sustainability efforts are also frequently tied to cost reduction, as the company’s efforts to develop sustainability decrease compliance costs and operating costs.

- Companies with an efficient plan for sustainability will probably attain greater valuations, as investors and analysts see the sustainability plan and effort as both a sign of an environmentally responsible company and also a company that uses sustainability to become more profitable.

Want to see more full solutions like this?

Chapter 20 Solutions

Loose Leaf for Cost Management: A Strategic Emphasis

- Please give me true answer this financial accounting questionarrow_forwardRaptors Inc. creates aluminum alloy parts for commercial aircraft. In a recent transaction Raptors leased a high precision lathe machine from Grizzlies Corp. on January 1, 2024. The following information pertains to the leased asset and the lease agreement: Cost of lathe to lessor $140,000 Grizzlies normal selling price for lathe 178,268 Useful life 7 years Estimated value at end of useful life 8,000 Lease provisions Lease term 5 years Payment frequency Annual Start date of lease January 1 Payment timing December 31 Estimated residual value at end of lease (unguaranteed) 20,000 Interest rate implicit in the lease (readily determinable by lessee) 7% Lessee's incremental borrowing rate 8% The lathe machine will revert back to the lessor at end of lease term, title does not transfer to lessee at any time, and there is not a bargain purchase option. Required…arrow_forwardFinancial Accountingarrow_forward

- Can you please solve this financial accounting problem without use Ai?arrow_forwardHobbiton Tours Ltd. has the following details related to its defined benefit pension plan as at December 31, 2024: Pension fund assets of $1,900,000 and actuarial obligation of $1,806,317. The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31, 2030, discounted at an interest rate of 10%; i.e. $3,200,000 / 1.106 = $1,806,317. Funding during 2025 was $55,000. The actual value of pension fund assets at the end of 2025 was $2,171,000. As a result of the current services received from employees, the single payment due on December 31, 2030, had increased from $3,200,000 to $3,380,000. Required Compute the current service cost for 2025 and the amount of the accrued benefit obligation at December 31, 2025. Perform this computation for an interest rate of 8%. Derive the pension expense for 2025 under various assumptions about the expected return and discount rate. Complete the following table: Case…arrow_forwardCalculate Debt Ratios and Debt to Equity Ratio for 2016arrow_forward

- Please explain the correct approach for solving this financial accounting question.arrow_forwardIn 2026, Maple Leafs Co. sells its single machine, which cost $100,000 and has an undepreciated capital cost (UCC) of $25,000 for tax purposes. For financial reporting, the machine has carrying amount of $40,000. The sale price of the machine is $30,000. Aside from the sale of the machine, the company has other income (before taxes) of $600,000, which includes non-taxable dividends of $120,000 dollars received during the year. There are no other permanent or temporary differences. The company faces an income tax rate of 35%. Required Provide the journal entries for the company for 2026.arrow_forwardBlue Jays Corporation started operations on March 1, 2025. It needs to acquire a special piece of equipment for its manufacturing operations. It is evaluating two options as follows. Option 1: Lease the equipment for 5 years. Lease payments would be $11,000 per year, due at the beginning of each fiscal year (March 1). Blue Jays incremental borrowing rate is 5%. There is not a bargain purchase or renewal option. Blue Jays is responsible for all non-lease costs of operating the equipment. Option 2: Purchase the equipment for $50,000 by borrowing the full purchase amount at 5% over 5 years. This price is considered the fair value of the equipment. Payments are due at the end of each fiscal year (February 28). The equipment has a useful life of 5 years and would be depreciated on a straight-line basis. No residual value is expected to exist at the end of 5 years. Required Calculate the present value of the lease payments (Option 1). Calculate the payment that would be…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education