Concept explainers

2.

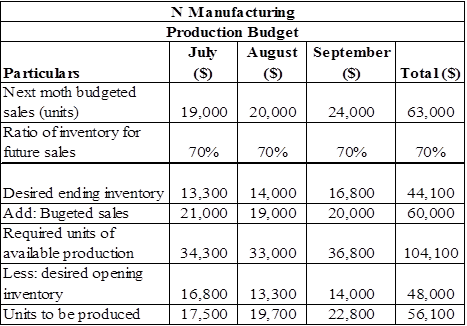

To prepare: Production budget of N manufacturing.

2.

Explanation of Solution

Statement that shows the Production budget of N manufacturing

Table (2)

3.

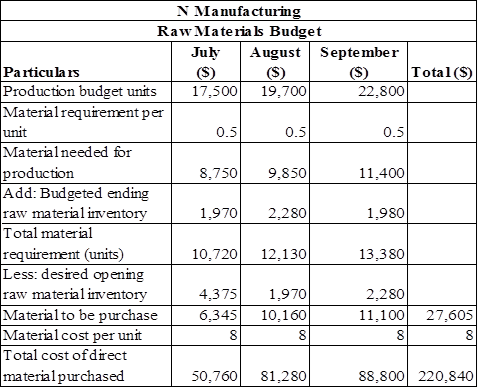

To prepare: Raw material budget of N manufacturing.

3.

Explanation of Solution

Statement that shows the raw material budget of N manufacturing

Table (3)

4.

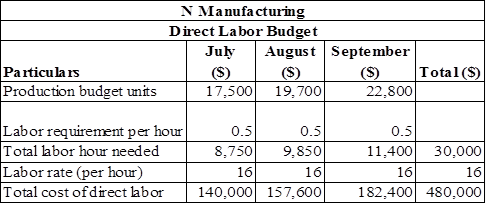

To prepare: Direct labor budget of N manufacturing.

4.

Explanation of Solution

Statement that shows the direct labor budget of N manufacturing

Table (4)

5.

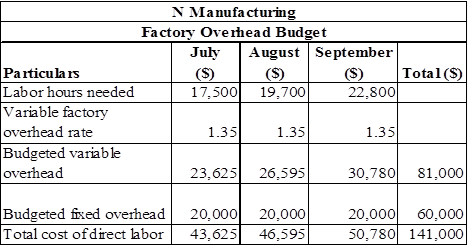

To prepare: Factory overhead budget of N manufacturing.

5.

Explanation of Solution

Statement that shows the factory overhead budget of N manufacturing

Table (5)

6.

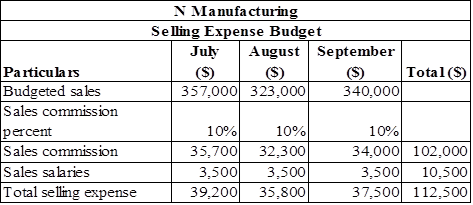

To prepare: Selling expense budget of N manufacturing.

6.

Explanation of Solution

Statement that shows the selling expense budget of N manufacturing

Table (6)

7.

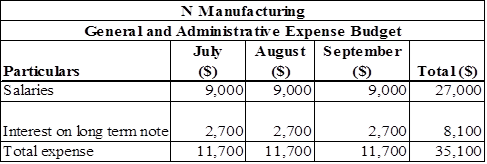

To prepare: General and administrative expense budget of N manufacturing.

7.

Explanation of Solution

Statement that shows the General and administrative expense budget of N manufacturing

Table (7)

8.

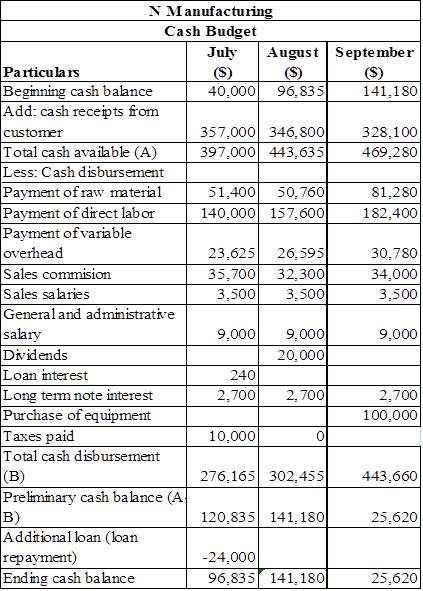

To prepare:

8.

Explanation of Solution

Statement that shows the Cash budget of N manufacturing

Table (8)

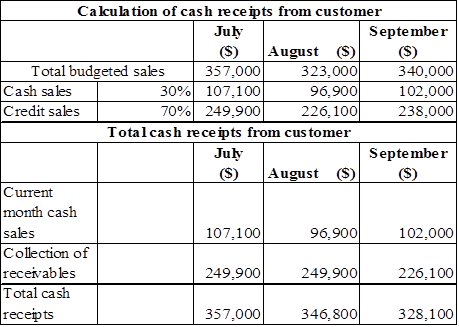

Working note:

Table (9)

9.

To prepare:

9.

Explanation of Solution

Prepare income statement.

| N. Manufacturing | ||||

| Income Statement | ||||

| For three months ended September 30,2017 | ||||

| Particulars | Amount ($) | Amount ($) | ||

| Sales | 1,020,000 | |||

| Less: Cost of goods sold | 861,000 | |||

| Gross profit | 159,000 | |||

| Less: Operating expenses | ||||

| Sales commission | 102,000 | |||

| Sales salaries | 10,500 | |||

| General administrative salary | 27,000 | |||

| Total operating expense | 139,500 | |||

| Earnings before interest and taxes | 19500 | |||

| Less: Interest on long term notes | 8100 | |||

| Interest on short term note | 240 | |||

| Earnings before taxes (A) | 11,160 | |||

| Less: Income tax | 3,906 | |||

| Net income | 7,254 | |||

| Table (10) | ||||

Thus, budgeted net income of N manufacturing is $7,254.

10.

To prepare: Budgeted

10.

Explanation of Solution

Prepare balance sheet

| N. Manufacturing | ||||

| Balance sheet | ||||

| For three months ended September 30,2017 | ||||

| Particulars | Amount ($) | |||

| Assets | ||||

| Cash | 40,000 | |||

| Account Receivables | 238,000 | |||

| Raw material inventory | 15,840 | |||

| Finished goods inventory | 241,080 | |||

| Total current assets | 534,920 | |||

| Equipment | 820,000 | |||

| Less: | 300,000 | |||

| Net equipment | 520,000 | |||

| Total Assets | 1,054,920 | |||

| Liabilities and | ||||

| Liabilities | ||||

| Accounts Payable | 88,800 | |||

| Bank loan payable | 14,380 | |||

| Income tax payable | 3,906 | |||

| Total current liability | 107,086 | |||

| Long term note payables | 300,000 | |||

| Total liabilities | 407,086 | |||

| Stockholder’s Equity | ||||

| Common Stock | 600,000 | |||

| 47,834 | ||||

| Total stockholders’ equity | 647,834 | |||

| Total Liabilities and Stockholder’s equity | 1,054,920 | |||

| Table (11) | ||||

Working note:

Calculation of retained earnings,

Hence, the total of the balance sheet of the N Manufacturing as on September 30, 2017 is of $1,054,920.

Want to see more full solutions like this?

Chapter 20 Solutions

GEN COMBO FINANCIAL AND MANAGERIAL ACCOUNTING; CONNECT ACCESS CARD

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease provide the solution to this general accounting question with accurate accounting calculations.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- You are employed by an external audit firm that is hired by JBltd, a privately owned incorporated business. Accounting records are maintained on a computer using proprietary software. You have worked on the audit for three years and this year you are in charge of the audit. Your assistant is a newly recruited business graduate who has done an accounting course but has no practical experience. Because of the small size of the company there is limited opportunity for segregation of duties. You decide, as in previous years, that the appropriate audit strategy is to obtain evidence primarily through the performance of substantive procedures. You also plan to perform the audit around the computer as the proprietary software is known to be reliable and details of all transactions and balances can be readily printed out. On arriving at the company's premises in December 2019 to perform the final audit on the 31 October 2019 financial statements, you obtain a copy of the year end bank…arrow_forwardGeneral accountingarrow_forwardI needarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education