Concept explainers

1.

To prepare: Sale budget of Z manufacturing.

1.

Explanation of Solution

Statement that shows the sales budget of Z manufacturing

| Z Manufacturing | ||||

| Sales Budget | ||||

| Particulars | April ($) | May ($) | June ($) | Total ($) |

| Sales unit (A) | 20,500 | 19,500 | 20,000 | 60,000 |

| Selling price Per unit (B) | 23.85 | 23.85 | 23.85 | 23.85 |

| Total sales | 488,925 | 465,075 | 477,000 | 1,431,000 |

| Table (1) | ||||

2.

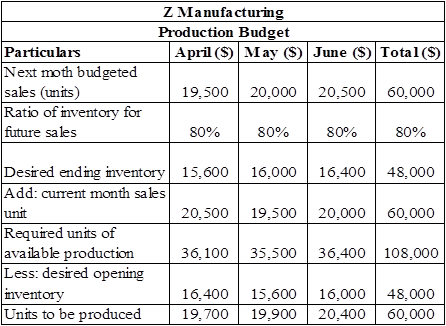

To prepare: Production budget of Z manufacturing.

2.

Explanation of Solution

Statement that shows the Production budget of Z manufacturing

Table (2)

3.

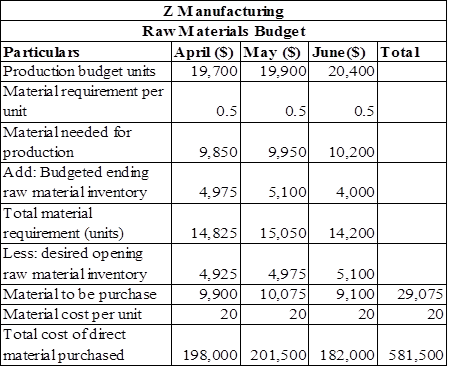

To prepare: Raw material budget of Z manufacturing.

3.

Explanation of Solution

Statement that shows the raw material budget of Z manufacturing

Table (3)

4.

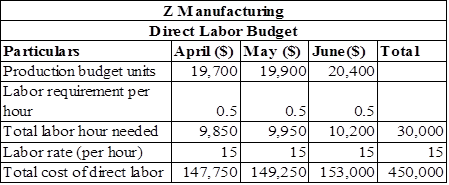

To prepare: Direct labor budget of Z manufacturing.

4.

Explanation of Solution

Statement that shows the direct labor budget of Z manufacturing

Table (4)

5.

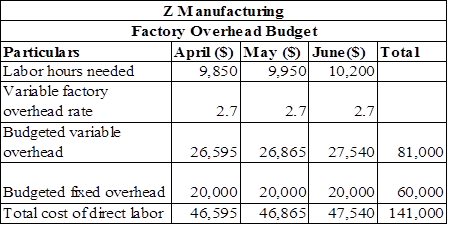

To prepare: Factory

5.

Explanation of Solution

Statement that shows the factory overhead budget of Z manufacturing

Table (5)

6.

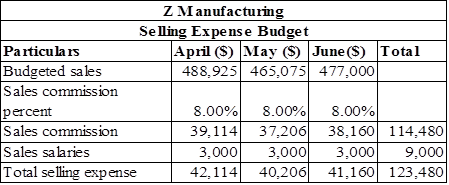

To prepare: Selling expense budget of Z manufacturing.

6.

Explanation of Solution

Statement that shows the selling expense budget of Z manufacturing

Table (6)

7.

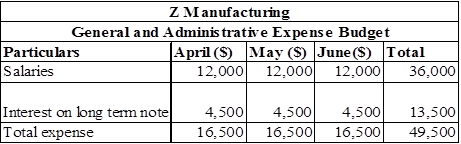

To prepare: General and administrative expense budget of Z manufacturing.

7.

Explanation of Solution

Statement that shows the General and administrative expense budget of Z manufacturing

Table (7)

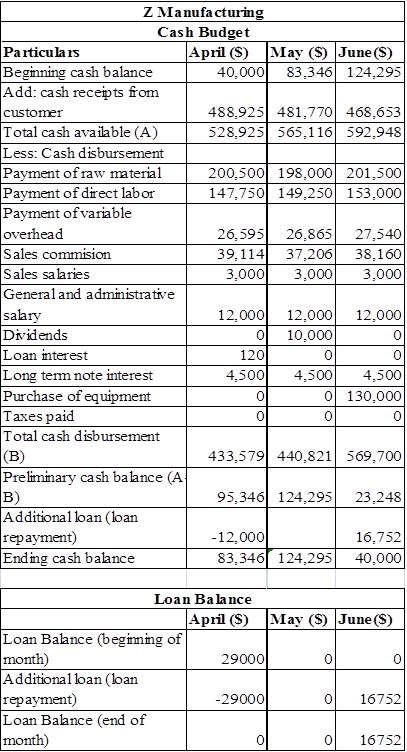

8.

To prepare:

8.

Explanation of Solution

Statement that shows the Cash budget of Z manufacturing

Table (8)

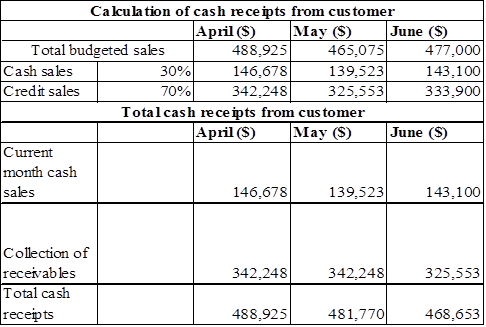

Working Notes:

Table (9)

9.

To prepare:

9.

Explanation of Solution

Prepare income statement.

| Z. Manufacturing | ||||

| Income Statement | ||||

| For three months ended June 30,2017 | ||||

| Particulars | Amount ($) | Amount ($) | ||

| Sales | 1,431,000 | |||

| Less: Cost of goods sold | 1,191,000 | |||

| Gross profit | 240,000 | |||

| Less: Operating expenses | ||||

| Sales commission | 114,480 | |||

| Sales salaries | 9000 | |||

| General administrative salary | 36000 | |||

| Total operating expense | 159,480 | |||

| Earnings before interest and taxes | 80,520 | |||

| Less: Interest on long term notes | 13,500 | |||

| Interest on short term note | 120 | |||

| Earnings before taxes (A) | 66,900 | |||

| Less: Income tax | 23,415 | |||

| Net income | 43,485 | |||

| Table (10) | ||||

Thus, budgeted net income of Z manufacturing is $43,485.

10.

To prepare: Budgeted

10.

Explanation of Solution

Prepare balance sheet

| Z. Manufacturing | ||||

| Balance sheet | ||||

| For three months ended June 30,2017 | ||||

| Particulars | Amount ($) | |||

| Assets | ||||

| Cash | 40,000 | |||

| Account Receivables | 333,900 | |||

| Raw material inventory | 80,000 | |||

| Finished goods inventory | 325,540 | |||

| Total current assets | 779,440 | |||

| Equipment | 730,000 | |||

| Less: Accumulated | 210,000 | |||

| Net equipment | 50,000 | |||

| Total Assets | 1,299,440 | |||

| Liabilities and | ||||

| Liabilities | ||||

| Accounts Payable | 182,000 | |||

| Bank loan payable | 16,752 | |||

| Income tax payable | 23,415 | |||

| Total current liability | 222,167 | |||

| Long term payables | 500,000 | |||

| Total liabilities | ||||

| Stockholder’s Equity | ||||

| Common Stock | 335,000 | |||

| 242,273 | ||||

| Total stockholders’ equity | 577,273 | |||

| Total Liabilities and Stockholder’s equity | 1,299,440 | |||

| Table (11) | ||||

Working Notes:

Calculation of retained earnings,

Hence, the total of the balance sheet of the Z Manufacturing as on June 30, 2017 is of $1,299,440.

Want to see more full solutions like this?

Chapter 20 Solutions

Loose-Leaf for Financial and Managerial Accounting

- Hello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardQuintana Corporation projected current year sales of 42,000 units at a unit sale price of $32.50. Actual current year sales were 39,500 units at $33.75 per unit. Actual variable costs, budgeted at $22.75 per unit, totaled $21.90 per unit. Budgeted fixed costs totaled $375,000, while actual fixed costs amounted to $392,000. What is the sales volume variance for total revenue? I want answerarrow_forwardWhat is hemingway corporation taxable income?arrow_forward

- Please given correct answer for General accounting question I need step by step explanationarrow_forwardArmour vacation cabin was destroyed by a wildfire. He had purchased the cabin 14 months ago for $625,000. He received $890,000 from his insurance company to replace the cabin. If he fails to rebuild the cabin or acquire a replacement property in the required time, how much gain must he recognize on this conversion? A. $375,000 B. $160,000 C. $265,000 D. $0 E. None of the above helparrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education