Concept explainers

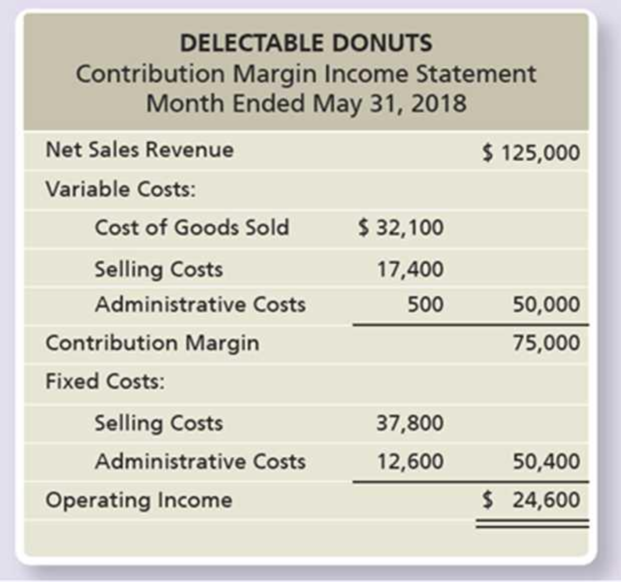

The contribution margin income statement of Delectable Donuts for May 2018 follows:

Delectable sells five dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $4.00, with a variable cost of $1.60 per dozen. A dozen custard-filled donuts sells for $8.00, with a variable cost of $3.20 per dozen.

Requirements

- 1. Calculate the weighted-average contribution margin.

- 2. Determine Delectable’s monthly breakeven point in dozens of plain donuts and custard-filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of costs: variable and fixed.

- 3. Compute Delectable’s margin of safety in dollars for May 2018.

- 4. Compute the degree of operating leverage for Delectable Donuts. Estimate the new operating income if total sales increase by 20%. (Round the degree of operating leverage to four decimal places and the final answer to the nearest dollar. Assume the sales mix remains unchanged.)

- 5. Prove your answer to Requirement 4 by preparing a contribution margin income statement with a 20% increase in total sales. (The sales mix remains unchanged.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- return on equity (ROE)?arrow_forwardWhat is the likely price of the stockarrow_forwardSummit Corporation is considering acquiring Everest Inc. The balance sheet of Everest Inc. as of December 31, 2022, is as follows: Cash: $50,000 Accounts receivable: $85,000 Inventory: $120,000 Property, plant, and equipment (net): $650,000 Current liabilities: $75,000 Bonds payable: $190,000 Common stock: $280,000 Retained earnings: $360,000 During due diligence, Summit Corporation finds: An allowance for doubtful accounts of $6,500 is necessary. Inventory should be adjusted to FIFO, increasing its value to $150,000. The fair value of property, plant, and equipment is $720,000. There is an unrecorded patent valued at $90,000. Current liabilities and bonds payable are at fair value. Summit pays $1,400,000 for Everest Inc. Calculate the goodwill.arrow_forward

- Active Gear Inc. reported earnings per share (EPS) of $10.00 last year when its stock price was $200.00. This year, its earnings increased by 15%. If the P/E ratio remains constant, what is the likely price of the stock?arrow_forwardExpert need your helparrow_forwardasset turnover ratio the profit margin ratioarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education