Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 3P

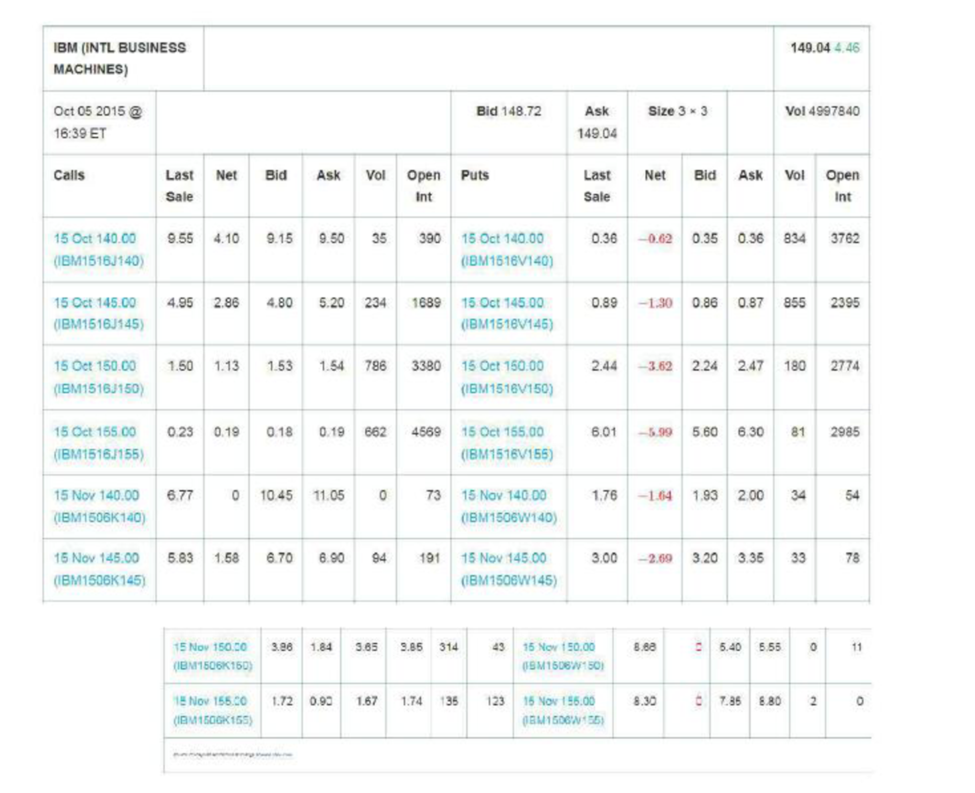

Below is an option quote on IBM from the CBOE Web site showing options expiring in October and November 2015.

- a. Which option contract had the most trades on that day?

- b. Which option contract is being held the most overall?

- c. Suppose you purchase one option with symbol IBM 1516J150. How much will you need to pay your broker for the option (ignoring commissions)?

- d. Explain why the last sale price is not always between the bid and ask prices.

- e. Suppose you sell one option with symbol IBM1516V 150. How much will you receive for the option (ignoring commissions)?

- f. The calls with which strike prices are currently in-the-money? Which puts are in-the money?

- g. What is the difference between the option with symboiiBM1 516J140 and the option with symbol IBM1506K140?

- h. On what date does the option with symbol IBM1516V140 expire? In what range must IBM’s stock price be at expiration for this option to be valuable?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Unless otherwise stated, clearly show any work used in calculations in order to receive full credit. If

you do not show your work, you will not receive credit.

Question #1: Option Basics and Option Strategies [28 Points]

Use the following Table to answer Parts (a) - (c)

Current Price of Twitter, Inc. (TWTR) Stock $60.50

Strike Price of a call option that will expire in

March 2022

$62.50

Premium of the call option ($ per share) that

will expire on March 2022

$8.06

(a) Suppose that Tristan purchases four (4) call option contracts on TWTR with an expiration date of

March 2022. Suppose that the stock price of TWTR increases to $73.49. What is the total profit (in

dollars) that Tristan will realize as a result of this option trade? [5 Points]

Here is some price information on FinCorp stock. Suppose that FinCorp trades in a dealer market.Bid =55.25

Ask= 55.50a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed?b. Suppose you have submitted an order to sell at market. At what price will your trade be executed?c. Suppose you have submitted a limit order to sell at $55.62. What will happen?d. Suppose you have submitted a limit order to buy at $55.37. What will happen?

Demonstrate how a margin account operates for both the long and the short futures position using the following information ( you do not need to adjust the values given for contract size or number of contracts)

The initial margin is R30

The initial future price is R100

On day 1 the price drops to R90

On day 2 the price rises to R95.

Fill in the correct monetary values for the margin account values (a) through to (f) in your answer booklet.Take care to show the signs (negative and positive) of your cash flows

Chapter 20 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 20.1 - What is the difference between an American option...Ch. 20.1 - Does the holder of an option have to exercise it?Ch. 20.1 - Prob. 3CCCh. 20.2 - What is a straddle?Ch. 20.2 - Explain how you can use put options to create...Ch. 20.3 - Explain put-call parity.Ch. 20.3 - If a put option trades at a higher price from the...Ch. 20.4 - What is the intrinsic value of an option?Ch. 20.4 - Can a European option with a later exercise date...Ch. 20.4 - How does the volatility of a stock affect the...

Ch. 20.5 - Is it ever optimal to exercise an American call on...Ch. 20.5 - When might it be optimal to exercise an American...Ch. 20.5 - Prob. 3CCCh. 20.6 - Explain how equity can be viewed as a call option...Ch. 20.6 - Explain how debt can be viewed as an option...Ch. 20 - Explain the meanings of the following financial...Ch. 20 - What is the difference between a European option...Ch. 20 - Below is an option quote on IBM from the CBOE Web...Ch. 20 - Prob. 4PCh. 20 - Prob. 5PCh. 20 - You own a call option on Intuit stock with a...Ch. 20 - Assume that you have shorted the call option in...Ch. 20 - You own a put option on Ford stock with a strike...Ch. 20 - Assume that you have shorted the put option in...Ch. 20 - What position has more downside exposure: a short...Ch. 20 - Consider the October 2015 IBM call and put options...Ch. 20 - You are long both a call and a put on the same...Ch. 20 - You are long two calls on the same share of stock...Ch. 20 - A forward contract is a contract to purchase an...Ch. 20 - You own a share of Costco stock. You are worried...Ch. 20 - Dynamic Energy Systems stock is currently trading...Ch. 20 - You happen to be checking the newspaper and notice...Ch. 20 - In mid-February 2016, European-style options on...Ch. 20 - Suppose Amazon stock is trading for 500 per share,...Ch. 20 - Consider the data for IBM options in Problem 3....Ch. 20 - You are watching the option quotes for your...Ch. 20 - Explain why an American call option on a...Ch. 20 - Consider an American put option on XAL stock with...Ch. 20 - The stock of Harford Inc. is about to pay a 0.30...Ch. 20 - Suppose the SP 500 is at 900, and a one-year...Ch. 20 - Suppose the SP 500 is at 900, and it will pay a...Ch. 20 - Prob. 29PCh. 20 - Suppose that in July 2009, Google were to issue 96...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The cost of capital. Introduction: The cost of capital is the opportunity cost involved in making a specific in...

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

(Future value) Giancarlo Stanton hit 59 home runs in 2017. If his home-run output grew at a rate of 12 percent ...

Foundations Of Finance

Define investors’ expected rate of return.

Foundations of Finance (9th Edition) (Pearson Series in Finance)

The risk-neutral probabilities and price of the option. Introduction: A binomial model portrays the development...

Corporate Finance

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

An annuity provides for 10 consecutive end-of-year payments of 72,000. The average general inflation rate is es...

Contemporary Engineering Economics (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Covered Calls Please help me.arrow_forwardA trader buys a six-month European call option and sells a six-month European put option. The options have the same underlying asset and the same strike price K. Can you identify a forward contract that has the same payoff as the trader’s combined options position? Under what circumstances does the price of the call equal the price of the put? (HINT: In answering these questions you may find it helpful to draw charts of the payoffs or profits of the two positions.)arrow_forwardYou have taken a long position in a call option on IBM common stock. The option has an exercise price of $176 and IBM’s stock currently trades at $180. The option premium is $5 per contract. How much of the option premium is due to intrinsic value versus time value?arrow_forward

- You buy a put option on IBM common stock. The option has an exercise price of $136 and IBM’s stock currently trades at $140. The option premium is $5 per contract.a. What is your net profit on the option if IBM’s stock price increases to $150 at expiration of the option and you exercise the option? b. How much of the option premium is due to intrinsic value versus time value?c. What is your net profit if IBM’s stock price decreases to $130?d. Draw the payout diagram at maturity on a short put option position, option premium = $2, and the same exercise price... (Please give the full solution I will upvote)arrow_forwardA speculator purchased a call option with an exercise price of $35 for a premium of $4. The option was exercised a few days later when the stock price was $34. What was the return to the speculator? wwwarrow_forwardwhich one is corect please confirm? Q8: An option that gives the owner the right to sell a financial instrument at the exercise price within a specified period of time is a put option call option swap premiumarrow_forward

- Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $80. Option Expiration Strike Price Calls Puts Volume Last Volume Last RWJ March 72 250 5.20 180 5.30 April 72 190 11.05 147 10.05 July 72 159 11.90 63 13.85 October 72 80 12.80 31 12.45 a-1. Are the call options in or out of the money? multiple choice 1 In the money Out of the money a-2. What is the intrinsic value of an RWJ Corporation call option? b-1. Are the put options in or out of the money? multiple choice 2 In the money Out of the money b-2. What is the intrinsic value of an RWJ Corporation put option? c-1. Two of the options are clearly mispriced. Which ones? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to…arrow_forward8. Buy one July 170 put contract. Hold it until the option expires. Determine the profits and display the results in a chart (include profits for the following underlying stock prices: 130,140,150,160,170,180,190). Identify the breakeven stock price at expiration. What is the maximum possible gain and loss on the transaction?arrow_forwardwhich one is correct please confirm? Q9: An option that gives the owner the right to buy a financial instrument at the exercise price within a specified period of time is a call option put option American option European optionarrow_forward

- Need help solving this, please explain kn detail if possible.arrow_forwardPlease explain step by steparrow_forwardSuppose that a June call option to buy a share for $65 costs $3.5 and is held until June. Under what circumstances will the holder of the option make profit Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a long position in the option depends on the stock price at the maturity of the option.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Accounting for Derivatives Comprehensive Guide; Author: WallStreetMojo;https://www.youtube.com/watch?v=9D-0LoM4dy4;License: Standard YouTube License, CC-BY

Option Trading Basics-Simplest Explanation; Author: Sky View Trading;https://www.youtube.com/watch?v=joJ8mbwuYW8;License: Standard YouTube License, CC-BY