PRINCIPLES OF CORPORATE FINANCE

13th Edition

ISBN: 9781264052059

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 2PS

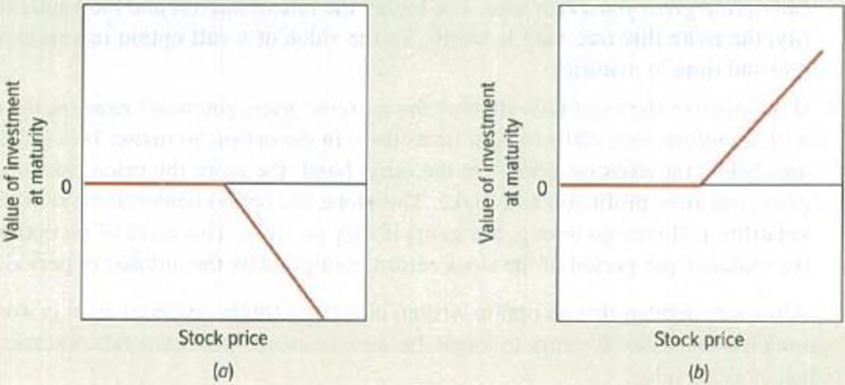

Option payoffs* Note Figure 20.12 below. Match each diagram, (a) and (b), with one of the following positions:

- Call buyer

- Call seller

- Put buyer

- Put seller

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A bond has a face value of $1,000 and a coupon rate of 6%. What is the annual interest payment?need help!!

7. If an investment grows from $2,000 to $2,500 in three years, what is the compound annual growth rate (CAGR)?

no gpt correct answer no ai ..,??!

A bond has a face value of $1,000 and a coupon rate of 6%. What is the annual interest payment?

Chapter 20 Solutions

PRINCIPLES OF CORPORATE FINANCE

Ch. 20 - Vocabulary Complete the following passage: A _____...Ch. 20 - Option payoffs Note Figure 20.12 below. Match each...Ch. 20 - Option payoffs Look again at Figure 20.12. It...Ch. 20 - Option payoffs What is a call option worth at...Ch. 20 - Option payoffs The buyer of the call and the...Ch. 20 - Option combinations Suppose that you hold a share...Ch. 20 - Option combinations Dr. Livingstone 1. Presume...Ch. 20 - Option combinations Suppose you buy a one-year...Ch. 20 - Option combinations Suppose that Mr. Colleoni...Ch. 20 - Option combinations Option traders often refer to...

Ch. 20 - Prob. 11PSCh. 20 - Option combinations Discuss briefly the risks and...Ch. 20 - Put-call parity A European call and put option...Ch. 20 - Putcall parity a. If you cant sell a share short,...Ch. 20 - Putcall parity The common stock of Triangular File...Ch. 20 - Put-call parity What is put-call parity and why...Ch. 20 - Putcall parity There is another strategy involving...Ch. 20 - Putcall parity It is possible to buy three-month...Ch. 20 - Putcall parity In April 2017, Facebooks stock...Ch. 20 - Option bounds Pintails stock price is currently...Ch. 20 - Option values How does the price of a call option...Ch. 20 - Option values Respond to the following statements....Ch. 20 - Option values FX Bank has succeeded in hiring ace...Ch. 20 - Option values Is it more valuable to own an option...Ch. 20 - Option values Youve just completed a month-long...Ch. 20 - Option values Table 20.4 lists some prices of...Ch. 20 - Option bounds Problem 21 considered an arbitrage...Ch. 20 - Prob. 30PSCh. 20 - Prob. 31PSCh. 20 - Prob. 32PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 8. A loan has an annual interest rate of 8% and a principal amount of $15,000. What is the interest payment for the first year? no ai correct answer...??arrow_forward1. If a stock's price increases from $50 to $60, what is the percentage change? no ai gpt..??arrow_forward10. A retirement account earns an annual interest rate of 6%. If you contribute $3,000 per year for 5 years, what will be the total value of the account after 5 years? Let me know..??arrow_forward

- 10. A retirement account earns an annual interest rate of 6%. If you contribute $3,000 per year for 5 years, what will be the total value of the account after 5 years? No directly answarrow_forward1. If a stock's price increases from $50 to $60, what is the percentage change?need help!!!arrow_forward2. A bond has a face value of $1,000 and a coupon rate of 6%. What is the annual interest payment? no ai gpt..??arrow_forward

- 4. A savings account earns an annual interest rate of 4%. If you deposit $2,000, how much interest will you earn in one year? no gpt ai ...???arrow_forward5. If a stock's dividend yield is 5% and the stock price is $80, what is the annual dividend payment per share? no ai ...???arrow_forward6. A company has a debt-to-equity ratio of 0.75. If its debt is $300,000, what is its equity? give me solution..???arrow_forward

- 5. If a stock's dividend yield is 5% and the stock price is $80, what is the annual dividend payment per share? write solution....???arrow_forward7. If an investment grows from $2,000 to $2,500 in three years, what is the compound annual growth rate (CAGR)? no ai and gpt..??arrow_forward9. If a company's current ratio is 1.5 and its current liabilities are $200,000, what are its current assets? give me correct solution..??arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Accounting for Derivatives Comprehensive Guide; Author: WallStreetMojo;https://www.youtube.com/watch?v=9D-0LoM4dy4;License: Standard YouTube License, CC-BY

Option Trading Basics-Simplest Explanation; Author: Sky View Trading;https://www.youtube.com/watch?v=joJ8mbwuYW8;License: Standard YouTube License, CC-BY