Break-even sales under present and proposed conditions

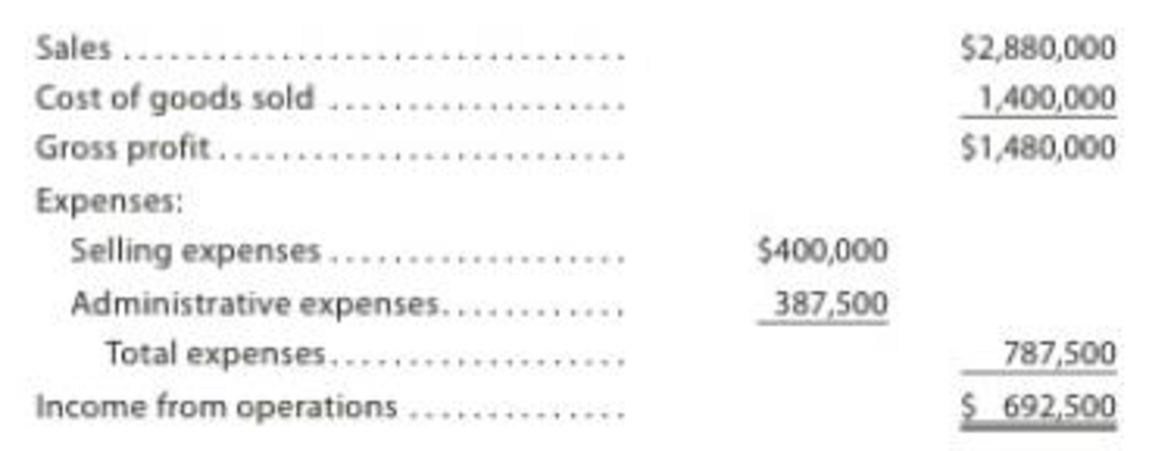

Howard Industries Inc., operating at full capacity, sold 64,000 units at a price of $45 per unit during the current year. Its income statement is as follows:

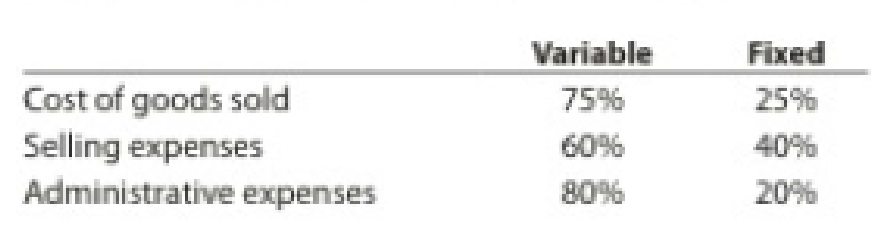

The division of costs between variable and fixed is as follows:

Management is considering a plant expansion program for the following year that will permit an increase of $900,000 in yearly sales. The expansion will increase fixed costs by $212,500 but will not affect the relationship between sales and variable costs.

Instructions

Determine the total fixed costs and the total variable costs for the current year.

Determine (A) the unit variable cost and (B) the unit contribution margin for the current year.

Compute the break-even sales (units) for the current year.

Compute the break-even sales (units) under the proposed program for the following year.

Determine the amount of sales (units) that would be necessary under the proposed program to realize the $692,500 of operating income that was earned in the current year.

Determine the maximum operating income possible with the expanded plant.

If the proposal is accepted and sales remain at the current level, what will the operating income or loss be for the following year?

Based on the data given, would you recommend accepting the proposal? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Financial and Managerial Accounting - Workingpapers

- Anti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000. Costs = $2, 173,000. Other expenses = $187,400. Depreciation expense = $79,000. Interest expense= $53,555. Taxes = $76,000. Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capitalarrow_forwardProvide Correct Answer of this Question General Accounting Solutionarrow_forwardDon't use ai solution please given true answer general accounting questionarrow_forward

- Please see an attachment for details general accounting questionarrow_forwardA retail company reports the following financial data: • Revenue: $1,200,000 • Expenses: $800,000 • Net income: $400,000 • Assets: $900,000 • Liabilities: $200,000 • Average equity: $700,000 What is the company's return on equity (ROE) in percentage terms, rounded to two decimal places?arrow_forwardEfford plc has the following equity capital at the year end. (Click here to view the financial data.) In addition, the company has 400,000 £1 8% preference shares in issue. The board of directors wishes to eliminate the company's reserves. It has decided to make an immediate 1-for-2 bonus issue of ordinary shares. Following the issue, an annual dividend will be paid to shareholders. What will be the required: 1. Transfer from revenue reserves to effect the bonus issue. £50,000 (Type an integer.) 2. Dividend per ordinary share. (Expressed as £ per share) £ 0.10 per share (Round to two decimal places as needed.) Data table £ Ordinary shares of £0.50 each 200,000 Share premium 50,000 General reserve 80,000 62,000 Retained profits 392.000arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT