ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

12th Edition

ISBN: 9781265074623

Author: Christensen

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.4E

Chapter 7 Liquidation

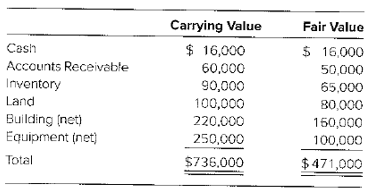

Penn Inc.'s assets have the carrying values and estimated fair values as follows:

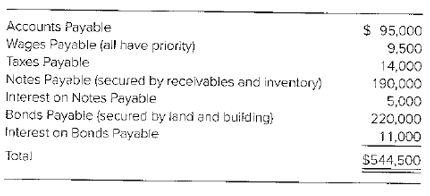

Penn's debts follow:

Required

a. Prepare a schedule to calculate the net estimated amount available for general unsecured creditors.

b. Compute the percentage dividend to general unsecured creditors.

c. Prepare a schedule showing the amount to be paid each of the creditors groups upon distribution of the $471,000 estimated to be realizable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The comparative balance sheets and an income statement for Raceway Corporation follow.

Balance Sheets

As of December 31

Year 2

Year 1

Assets

Cash

$ 6,300

$ 48,400

Accounts receivable

10,200

7,260

Inventory

45,200

56,000

Prepaid rent

700

2,140

Equipment

140,000

144,000

Accumulated depreciation

(73,400)

(118,000)

Land

116,000

50,000

Total assets

$ 245,000

$ 189,800

Liabilities

Accounts payable (inventory)

$ 37,200

$ 40,000

Salaries payable

12,200

10,600

Stockholders’ equity

Common stock, $50 par value

150,000

120,000

Retained earnings

45,600

19,200

Total liabilities and stockholders’ equity

$ 245,000

$ 189,800

Income Statement

For the Year Ended December 31, Year 2

Sales

$ 480,000

Cost of goods sold

(264,000)

Gross profit

216,000

Operating expenses

Depreciation expense

(11,400)

Rent expense

(7,000)

Salaries expense

(95,200)

Other operating expenses

(76,000)

Net income

$ 26,400

Other Information

Purchased…

Please help holy tamale I have been staring at this for hours.

Could you explain the steps for solving this financial accounting question accurately?

Chapter 20 Solutions

ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

Ch. 20 - What are the nonjudicial actions available to a...Ch. 20 - What is the difference between a Chapter 7 action...Ch. 20 - Prob. 20.3QCh. 20 - What is usually included in the plan of...Ch. 20 - Prob. 20.5QCh. 20 - Prob. 20.6QCh. 20 - Prob. 20.7QCh. 20 - Prob. 20.8QCh. 20 - How is the statement of affairs used in planning...Ch. 20 - What are the financial reporting responsibilities...

Ch. 20 - Prob. 20.11QCh. 20 - Creditors' Alternatives The creditors of Lost Hope...Ch. 20 - Prob. 20.3CCh. 20 - Prob. 20.1.1ECh. 20 - Prob. 20.1.2ECh. 20 - Prob. 20.1.3ECh. 20 - Prob. 20.1.4ECh. 20 - Prob. 20.1.5ECh. 20 - Prob. 20.2ECh. 20 - Prob. 20.3.1ECh. 20 - Prob. 20.3.2ECh. 20 - Prob. 20.3.3ECh. 20 - Prob. 20.3.4ECh. 20 - Prob. 20.3.5ECh. 20 - Chapter 7 Liquidation Penn Inc.'s assets have the...Ch. 20 - Prob. 20.5ECh. 20 - Chapter 11 Reorganization During the recent...Ch. 20 - Prob. 20.7PCh. 20 - Chapter 7 Liquidation, Statements of Affairs...Ch. 20 - Prob. 20.9P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License