EBK ADVANCED FINANCIAL ACCOUNTING

11th Edition

ISBN: 8220102796096

Author: Christensen

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.4E

Chapter 7 Liquidation

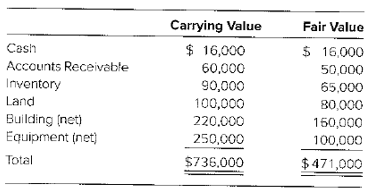

Penn Inc.'s assets have the carrying values and estimated fair values as follows:

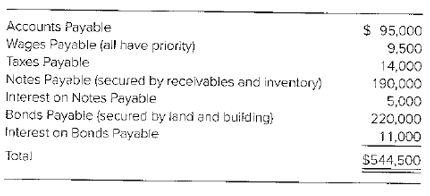

Penn's debts follow:

Required

a. Prepare a schedule to calculate the net estimated amount available for general unsecured creditors.

b. Compute the percentage dividend to general unsecured creditors.

c. Prepare a schedule showing the amount to be paid each of the creditors groups upon distribution of the $471,000 estimated to be realizable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am looking for the correct answer to this financial accounting problem using valid accounting standards.

I need help solving this financial accounting question with the proper methodology.

I am looking for help with this general accounting question using proper accounting standards.

Chapter 20 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

Ch. 20 - What are the nonjudicial actions available to a...Ch. 20 - What is the difference between a Chapter 7 action...Ch. 20 - Prob. 20.3QCh. 20 - What is usually included in the plan of...Ch. 20 - Prob. 20.5QCh. 20 - Prob. 20.6QCh. 20 - Prob. 20.7QCh. 20 - Prob. 20.8QCh. 20 - How is the statement of affairs used in planning...Ch. 20 - What are the financial reporting responsibilities...

Ch. 20 - Prob. 20.11QCh. 20 - Creditors' Alternatives The creditors of Lost Hope...Ch. 20 - Prob. 20.3CCh. 20 - Prob. 20.1.1ECh. 20 - Prob. 20.1.2ECh. 20 - Prob. 20.1.3ECh. 20 - Prob. 20.1.4ECh. 20 - Prob. 20.1.5ECh. 20 - Prob. 20.2ECh. 20 - Prob. 20.3.1ECh. 20 - Prob. 20.3.2ECh. 20 - Prob. 20.3.3ECh. 20 - Prob. 20.3.4ECh. 20 - Prob. 20.3.5ECh. 20 - Chapter 7 Liquidation Penn Inc.'s assets have the...Ch. 20 - Prob. 20.5ECh. 20 - Chapter 11 Reorganization During the recent...Ch. 20 - Prob. 20.7PCh. 20 - Chapter 7 Liquidation, Statements of Affairs...Ch. 20 - Prob. 20.9P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose Webster Resort has annual fixed costs applicable to its rooms of $3.2 million for its 400-room resort. Average daily room rents are $85 per room, and average variable costs are $22 for each room rented. It operates 365 days per year. If the resort is completely full throughout the year, what is the net income for one year?arrow_forwardNonearrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

- Based on this information the cost that would be collected to the land isarrow_forwardEddie Woodworks manufactures custom shelving. During the most productive month of the year, 4,200 units were manufactured at a total cost of $73,500. In the month of lowest production, the company made 1,600units at a cost of $49,800. Using the high-low method of cost estimation, total fixed costs are__.arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License