Bundle: Financial & Managerial Accounting, Loose-Leaf Version, 14th + CengageNOWv2, 2 terms Printed Access Card

14th Edition

ISBN: 9781337591010

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 20.17EX

Contribution margin analysis — sales

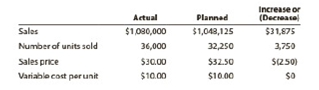

Select Audio Inc. sells electronic equipment. Management decided curly in the year to reduce the price of the speakers in order to increase sales volume. As a result, for the year ended December 31, the .sales increased by $31,875 from the planned level of $1,048,125. The following information is available from the accounting records for the year ended December 31.

- A. Prepare an analysis of the sales quantity and unit price factors.

- B. Did the price decrease generate sufficient volume to result in a net increase in contribution margin if the actual variable cost per unit was $10, as planned?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What does GAAP stand for?

A) General Accounting Analysis PrinciplesB) Government and Accounting ProceduresC) Generally Accepted Accounting PrinciplesD) Global Accounting Assurance Practices

Solve this explanation and accounting question

If a business pays rent in advance, what is the correct entry?

A) Debit Rent Expense, Credit CashB) Debit Prepaid Rent, Credit CashC) Debit Cash, Credit Prepaid RentD) Debit Rent Payable, Credit Cashdont use ai

Chapter 20 Solutions

Bundle: Financial & Managerial Accounting, Loose-Leaf Version, 14th + CengageNOWv2, 2 terms Printed Access Card

Ch. 20 - What types of costs are customarily included in...Ch. 20 - Which type of manufacturing cost (direct...Ch. 20 - Which of the following costs would be included in...Ch. 20 - In the variable costing income statement, how are...Ch. 20 - Since all costs of operating a business are...Ch. 20 - Discuss how financial data prepared on the basis...Ch. 20 - Why might management analyze product...Ch. 20 - Explain why rewarding sales personnel on the basis...Ch. 20 - Discuss the two factors affecting both sales and...Ch. 20 - How is the quantity factor for an increase or a...

Ch. 20 - Explain why service companies use different...Ch. 20 - Variable costing Marley Company has the following...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costing sales exceed production The...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin analysis The actual variable...Ch. 20 - Inventory valuation under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Cost of goods manufactured, using variable costing...Ch. 20 - Variable costing income statement On November 30,...Ch. 20 - Absorption costing income statement On March 31....Ch. 20 - Variable costing income statement The following...Ch. 20 - Estimated income statements, using absorption and...Ch. 20 - Variable and absorption costing Ansara Company had...Ch. 20 - Prob. 20.10EXCh. 20 - Prob. 20.11EXCh. 20 - Product profitability analysis Power Train Sports...Ch. 20 - Territory and product profitability analysis Coast...Ch. 20 - Sales territory and salesperson profitability...Ch. 20 - Segment profitability analysis The marketing...Ch. 20 - Prob. 20.16EXCh. 20 - Contribution margin analysis sales Select Audio...Ch. 20 - Prob. 20.18EXCh. 20 - Contribution margin analysis variable costs Based...Ch. 20 - Variable costing income statement for a service...Ch. 20 - Contribution margin reporting and analysis for a...Ch. 20 - Variable costing income statement and contribution...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Walthman...Ch. 20 - Segment variable costing income statement and...Ch. 20 - Contribution margin analysis Farr Industries Inc....Ch. 20 - Prob. 20.1BPRCh. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Pachec Inc....Ch. 20 - Variable costing income statement and effect on...Ch. 20 - Contribution margin analysis Mathews Company...Ch. 20 - Prob. 1ADMCh. 20 - Prob. 2ADMCh. 20 - Apple Inc.: Segment revenue analysis Segment...Ch. 20 - LVMH: Group segment sales and EBITDA analysis LVMH...Ch. 20 - Prob. 20.1TIFCh. 20 - Communication Bon Jager Inc. manufactures and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Unearned revenue is considered a: A) RevenueB) LiabilityC) ExpenseD) Assetdont use aiarrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardUnearned revenue is considered a: A) RevenueB) LiabilityC) ExpenseD) Assetarrow_forward

- No chatgpt!! What type of account is “Accumulated Depreciation”? A) Contra-assetB) AssetC) ExpenseD) Revenuearrow_forwardWhat type of account is “Accumulated Depreciation”? A) Contra-assetB) AssetC) ExpenseD) Revenuehelparrow_forwardWhat type of account is “Accumulated Depreciation”? A) Contra-assetB) AssetC) ExpenseD) Revenuearrow_forward

- I need correct solution with explanation A trial balance is used to: A) Prepare journal entriesB) Record cash transactionsC) Ensure debits equal creditsD) Close temporary accountsarrow_forwardA trial balance is used to: A) Prepare journal entriesB) Record cash transactionsC) Ensure debits equal creditsD) Close temporary accountsarrow_forwardGet correct answer with accounting questionarrow_forward

- If a business pays rent in advance, what is the correct entry? A) Debit Rent Expense, Credit CashB) Debit Prepaid Rent, Credit CashC) Debit Cash, Credit Prepaid RentD) Debit Rent Payable, Credit Cashneed helparrow_forwardIf a business pays rent in advance, what is the correct entry? A) Debit Rent Expense, Credit CashB) Debit Prepaid Rent, Credit CashC) Debit Cash, Credit Prepaid RentD) Debit Rent Payable, Credit Casharrow_forwardInformation: A detailed market study revealed expected annual revenues of $300,000 for new earphones. Equipment to produce the earphones will cost $320,000. After 5 years, the equipment can be sold for $40,000. In addition to equipment, working capital is expected to increase by $40,000 because of increases in inventories and receivables. The firm expects to recover the investment in working capital at the end of the project's life. Annual cash operating expenses are estimated at $180,000. The required rate of return is 12%. Required: Estimate the annual cash flows, and calculate the NPV.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY