Concept explainers

The Main consideration while deciding on the method to be followed for assigning and recording the cost incurred in the products is based on the criterion of homogenous products and custom based products.

The Products which are homogenous in nature and is produced in large batches and passes through various processes before its completion to final products need to be recorded under Process costing system.

However, the products which are produced on a special request and is customized product as per customer request and is having unique feature and unique cost from the other product shall be recorded as per Job costing method.

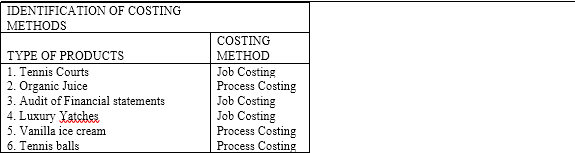

The determination of products to be recorded under Process costing or Job costing.

Answer to Problem 1QS

Solution:

TheProducts shall be recorded under costing methods as follows:

Explanation of Solution

The products which are produced in the batches of large quantities (as these are homogenous products) and passes through various processes before its completion to final product shall be treated under Process costing. Like, Organic Juice, vanilla ice cream and Tennis balls shall be recorded under Process costing.

The products which are customized products and has been made as per customer's specific request shall be recorded under Job costing. Like, Tennis court, Audit of financial statement, Luxury Yatches, etc are made on specific customer request and as per their specific requirement. These products shall be treated under Job costing.

To conclude, it must be said that the products are recorded in the different method of costing based on nature of product.

Want to see more full solutions like this?

Chapter 20 Solutions

FUND OF ACCOUNTING PRIN W/ACC <CUSTOM>

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardUnder the accrual basis of accounting, revenues are recognized when:A) Cash is receivedB) Services or goods have been deliveredC) Payment is madeD) Invoice is sent step by step !!arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- If there were 72,000 pounds of raw materials on hand on February 1, 195,000 pounds are desired for inventory at February 28, and 390,000 pounds are required for February production, how many pounds of raw materials should be purchased in February? a. 270,000 pounds. b. 479,000 pounds. c. 513,000 pounds d. 310,000 pounds.arrow_forwardJamison Corp. recently reported a net income of $6,850 and depreciation of $1,150. How much was its net cash flow, assuming it had no amortization expense and sold none of its fixed assets?arrow_forwardexplain properly all the answer for Financial accounting question Please given fastarrow_forward

- Which account type typically has a credit balance?A) AssetsB) ExpensesC) LiabilitiesD) Dividendsneed help!!arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardPlease explain the solution to this general accounting problem with accurate principlesarrow_forward

- Assets are typically reported on the balance sheet at:A) Current market valueB) CostC) Expected selling priceD) Replacement costarrow_forwardI need guidance in solving this financial accounting problem using standard procedures.arrow_forwardCan you help me with Financial accounting question?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education