Fundamentals of Corporate Finance

10th Edition

ISBN: 9781260703931

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Question

Chapter 20, Problem 1QP

a.

Summary Introduction

To calculate: The current assets of Company C.

a.

Expert Solution

Explanation of Solution

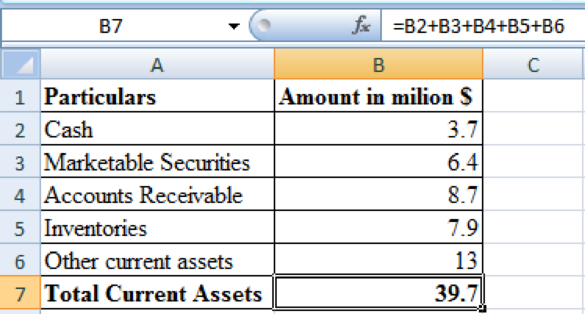

Determine the current assets of Company C:

Hence, the total current assets is $39.7 million.

b.

Summary Introduction

To calculate: The current liabilities of Company C.

b.

Expert Solution

Explanation of Solution

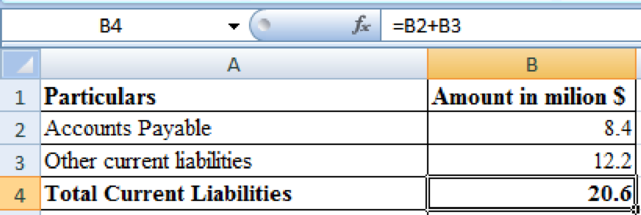

Determine the current liabilities of Company C:

Hence, the total current liabilities are $20.6 million.

c.

Summary Introduction

To calculate: The net working capital of Company C.

c.

Expert Solution

Explanation of Solution

Determine the net working capital of Company C:

Hence, the net working capital is $19.1 million.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Plz correct answer..

Plz correct sol

Give true answer. Pl

Chapter 20 Solutions

Fundamentals of Corporate Finance

Ch. 20 - Prob. 1QPCh. 20 - Prob. 3QPCh. 20 - Prob. 4QPCh. 20 - Prob. 5QPCh. 20 - Prob. 6QPCh. 20 - Prob. 7QPCh. 20 - Prob. 8QPCh. 20 - Prob. 9QPCh. 20 - Prob. 11QPCh. 20 - Prob. 13QP

Ch. 20 - Prob. 14QPCh. 20 - Prob. 15QPCh. 20 - Prob. 16QPCh. 20 - Prob. 17QPCh. 20 - Prob. 19QPCh. 20 - Prob. 20QPCh. 20 - Prob. 21QPCh. 20 - Prob. 22QPCh. 20 - Prob. 23QPCh. 20 - Prob. 27QPCh. 20 - Prob. 28QPCh. 20 - Prob. 29QPCh. 20 - Prob. 30QPCh. 20 - Prob. 31QPCh. 20 - Prob. 32QPCh. 20 - Prob. 33QPCh. 20 - Prob. 34QPCh. 20 - Prob. 35QPCh. 20 - Prob. 36QPCh. 20 - Prob. 37QPCh. 20 - Prob. 38QPCh. 20 - Prob. 39QPCh. 20 - Prob. 40QPCh. 20 - Prob. 41QPCh. 20 - Prob. 42QPCh. 20 - Prob. 43QPCh. 20 - Prob. 44QPCh. 20 - Prob. 45QP

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education