a.

To discuss: The

Introduction:

Stock is a type of security in a company that denotes ownership. The company can raise the capital by issuing stocks.

a.

Explanation of Solution

The preferred stock differs from debt and common equity is as follows:

Preferred stock can be termed as hybrid stock because it is similar characteristically with common equity and debt. The preferred payments made to the investors remain contractually stable resembling debt whereas like common equity the non-payment of dividend does amount to default and bankruptcy.

Even most preferred stock prohibits paying common dividends when there are arrears in preferred. Moreover, their dividends are cumulative until a level. The dividend on common stock is not paid just in case of non-payment of dividend on preferred stock.

b.

To discuss: The meaning of adjustable-rate preferred.

b.

Explanation of Solution

The meaning of adjustable-rate preferred is as follows:

A particular form of preferred stock wherein the dividends issued varies with a benchmark such as Treasury-bill rate is termed as adjustable-rate preferred. This is the best short-term corporate investment since only 30 percent of the dividends are taxable to corporations and even the floating rate keeps the issue trading at the par value. Moreover, the adjustable-rate preferred stock will have price instability mostly for the liquid portfolios of numerous corporate investors.

c.

To discuss: The knowledge of call options helps people to understand convertibles and warrants.

Introduction:

Option is a contract to purchase a financial asset from one party and sell it to another party on an agreed price for a future date. There are two types of options, which are as follows:

- An option that buys an asset called call option

- An option that sells an asset called put option

c.

Explanation of Solution

The knowledge of call options helps people to understand convertibles and warrants is as follows:

Both the convertibles and warrants are two forms of call options. The understanding of options will help a company’s financial managers to make decision on convertible and warrant issues.

d.1.

To determine: The coupon rate that is set on the bond with warrants.

Introduction:

A warrant is securities that give the bondholder the right, yet not the obligation, to purchase a specific number of securities at a specific cost before a particular period.

d.1.

Explanation of Solution

Given information:

Person M (

The formula to compute the value of package is as follows:

Compute the value of warrant:

Note: Assume the entire package is to sell for the price of $1,000.

Hence, the value of warrant is $75.

Compute the

Hence, the value of bond is $925.

Compute the PTM

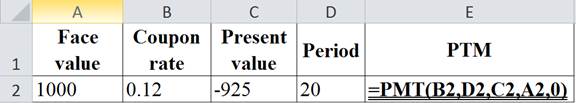

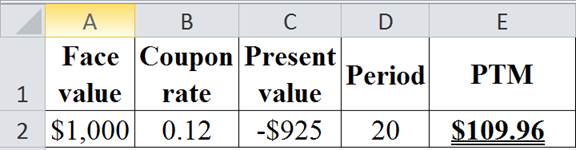

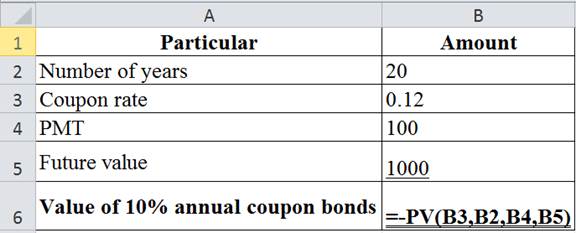

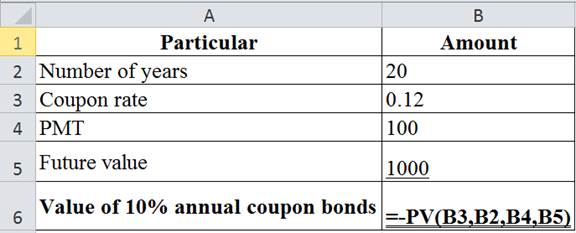

The table below shows the Excel formula to compute the PTM:

The table below shows the calculated value of PTM:

Hence, the PTM is $109.96. The bonds will have a value of $925 and the package of one bond plus 50 warrants will cost $1,000 at 12 percent coupon rate.

d.2.

To discuss: The implication of terms of issues and whether the company loses or wins.

d.2.

Explanation of Solution

The implication of terms of issues and determine whether the company loses or wins are as follows:

The company issues bonds and warrants directly trade for $2.50 each for 50 warrants. The total worth of 50 warrants will be $125

d.3.

To discuss: The expected period when the warrants to be exercised.

d.3.

Explanation of Solution

The expected time when the warrant to be exercised is discussed below:

A warrant is sold for premium beyond exercise value in an open market. Every investor will sell warrants in specific place than exercising it; on stock selling at price more than exercise price. However, few warrants comprise of step-up provisions of exercise price in which exercise price raises than warrant’s life period. It is because the warrant value drops when the exercise price increases.

As a result, the step-up provision will support holders for exercising their warrants. Therefore, the warrants holder would voluntarily exercise when there is higher dividend. Moreover, the higher dividends will raise the attraction of stock from warrants.

d.4.

To discuss: Whether the warrants will bring in additional capital when exercised and determine the type of capital.

d.4.

Explanation of Solution

Determine whether the warrants will bring in additional capital when exercised and determine the types of capital are as follows:

At the time when a warrant is exercised, it will bring in exercise price or additional capital of $12.50 (equity capital). As a result, the holder will receive a share of common stock per warrant. Here, let assume that the exercise price is set at 10 percent to 30 percent above the current price of stock. In this case, a higher-growth company will set the exercise price to a higher-end range and vice-versa.

d.5.

To discuss: Whether all the debt been issued with warrants when the warrants lower the cost of debt and determine the expected cost of the bond with warrants.

d.5.

Explanation of Solution

Determine whether all the debt been issued with warrants when the warrants lower the cost of debt and determine the expected cost of the bond with warrants are as follows:

The overall cost of the issue will be higher than straight debt even though the coupon rate on the debt is lower. Few returns are contractual in nature for the investors while the remaining return is related to price of stock movements. As a result, the cost will be much higher as compared to the debt. Therefore, the overall cost and risk is greater as compared to the cost of debt.

At the time when the warrants are exercised in 5-years, then the price of stock will be $17.50. Then the F Company will exchange stock worth $17.50 for one warrant plus $12.50. Therefore, the company will realize an

To discuss: The comparison on the cost of bond with warrants by the cost of straight debt and cost of common stock.

Explanation of Solution

Given information:

Person M (financial manager) of the F Company decided to issue a bond with warrants. The current stock price of the company is $10 and cost of 20-years annual coupon debt is 12 percent without warrants. Later, the banker has recommends to assign 50 warrants for every bond of the company. The exercise price of the warrant is $12.50 and the value of every warrant when detached and trade separately is $1.50.

Note: The F Company will make interest payments over the 20-year life of bonds and repay the principal after 20-years.

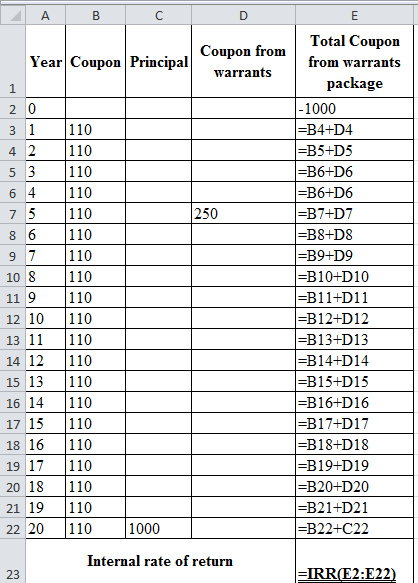

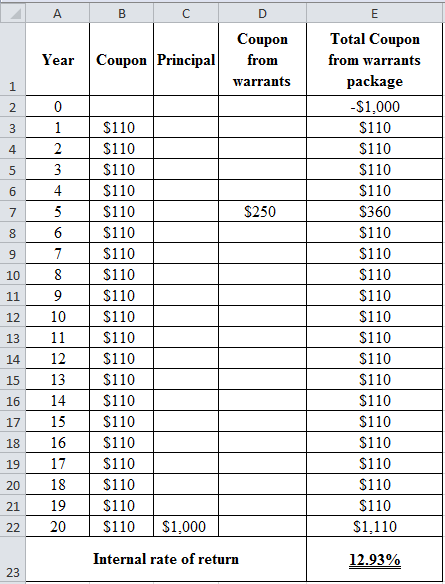

Compute the

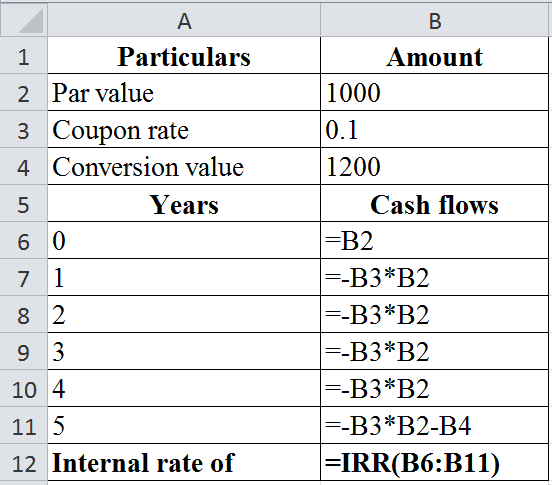

The table below shows the Excel formula to compute the IRR:

The table below shows the calculated value of IRR:

Hence, the IRR is 12.93%. The IRR from this cash flows stream is higher than the 12 percent cost of straight debt. It is because the issue is riskier as compared to the straight debt as per the investor point of view. However, the bonds with warrants will be less risky as compared to the common stock. Therefore, the bonds with warrants will have a lower cost than common stock.

e.1.

To determine: The conversion price and whether ot is implied in the convertible’s terms.

e.1.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula to compute the conversion price is as follows:

Compute the conversion price:

Hence, the conversion price is $12.50. Here, the conversion price can be assumed as the convertible’s exercise price, even though it has already paid out. Therefore, the conversion price is set at 20 percent to 30 percent above the prevailing stock price as with the warrants.

e.2.

To determine: The straight-debt value of the convertible and implied value of the convertibility.

e.2.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula to compute the value of convertibility is as follows:

The formula to compute per share value of convertibility is as follows:

Compute the value of 10% annual coupon bonds (straight bond):

The table below shows the Excel formula to compute the value of 10% annual coupon bonds:

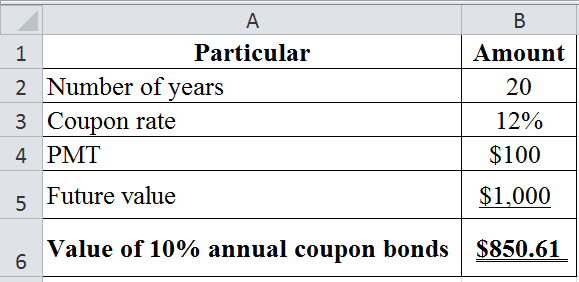

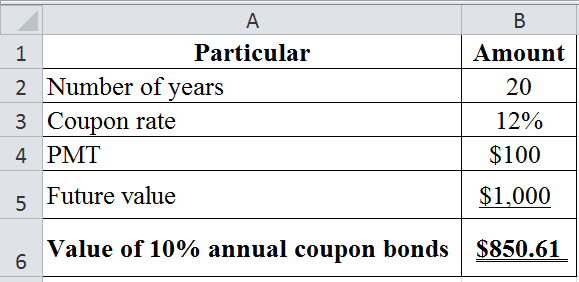

The table below shows the calculated value of 10% annual coupon bonds:

Hence, the value of 10% annual coupon bonds is $850.61.

Compute the value of convertibility:

Note: The convertible will sell at $1,000 (face value).

Hence, the value of convertibility is $149.39.

Compute the per share value of convertibility:

Hence, per share value of convertibility is $1.87.

e.3.

To determine: The formula for the conversion value of bond in any year and even compute the value of conversion at Year 0 and Year 10.

e.3.

Explanation of Solution

The formula for the conversion value of bond in any year is as follows:

The value of the stock which is obtained by converting is termed as conversion value in any year. In the case of F Company, the stock price is expected to increase by “g” every year since it has a constant growth stock. Therefore, the formula for the conversion value of bond in any year is given below:

Where,

Pt refers to the price at conversion of bonds

Po refers to the current stock price

g refers to the constant growth rate of stock

t refers to the number of years

Note: The value of converting at any year is denoted as CR(Pt). Here, CR refers to the number of share received.

Compute the value of conversion at Year 0:

Hence, the value of conversion at Year 0 is $800.

Compute the value of conversion at Year 10:

Hence, the value of conversion at Year 10 is $1,727.12.

e.4.

To discuss: The meaning of the term floor value of a convertible and compute the convertible’s expected floor value in the Year 0 and Year 10.

e.4.

Explanation of Solution

The meaning of term floor value of a convertible and even compute the convertible’s expected floor value in the Year 0 and Year 10 are as follows:

The higher of straight-debt value and higher value of conversion is termed as floor value of a convertible.

Compute the expected floor value of convertible in the Year 0:

The table below shows the Excel formula to compute the value of 10% annual coupon bonds:

The table below shows the calculated value of 10% annual coupon bonds:

Hence, the value of 10% annual coupon bonds is $850.61. The straight-debt value in Year 0 is $850.61 when the conversion value is $800. Therefore, the floor value is $850.61.

The conversion value of $1,727.12 is higher than the straight-debt value at the Year 10. Therefore, the conversion value sets at the floor price. The convertible would sell above its floor value in any period before the date of maturity. It is because the convertibility option carries extra values.

e.5.

To determine: The number of year or period when the issue is expected to callable.

e.5.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula for the conversion value of bond in any year is given below:

Where,

Pt refers to the price at conversion of bonds

Po refers to the current stock price

g refers to the constant growth rate of stock

t refers to the number of years

Compute the number of years or period when the issue is expected to callable:

Hence, the number of year is 5.2678 years that is considered as 5-years.

e.6.

To determine: The expected cost of the convertible and whether the cost appears consistent with the risk of the issue.

e.6.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner. The conversion value in Year 5 is $1,200.

Compute the IRR:

The table below shows the Excel formula to compute the IRR:

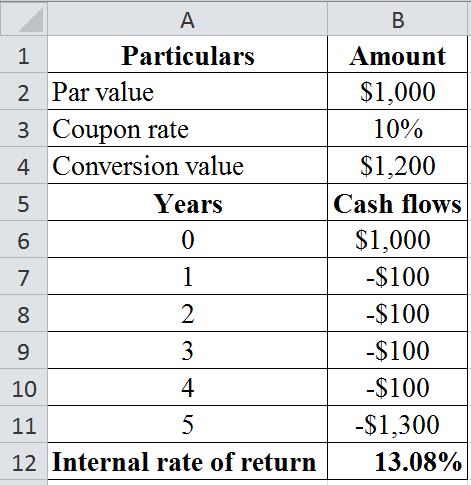

The table below shows the calculated value of IRR:

Hence, the IRR is 13.08% that is the cost of the convertible issue.

Compute the

Hence, the cost of equity is 0.15992 that is approximately is 16%. The convertible bond of firm has risk, which falls between the risk of its equity and debt. Therefore, the cost that appears consistent with the risk of the issue is 13.08 percent.

f.

To discuss: The factors that Person M as to consider on making decision between to securities.

f.

Explanation of Solution

The factors that Person M as to consider on making decision between to securities are as follows:

- The Person M has to consider the future need for capital of the company. The warrants must be favorable because their exercise can bring in extra equity capital without retirement of the low-cost debt when the company anticipates continues need for capital. On the contrary, the convertible issue cannot bring in new funds at conversion.

- The second factor that Person M must consider is whether the Company wants to commit towards 20-year of debt at this period. Here, the conversion can remove off the debt issue but it does not occur on the exercise of warrants. In case, the F Company cannot increase over the period, then neither the warrants nor the convertibles will be exercised and debt will remain outstanding in the both case.

Want to see more full solutions like this?

Chapter 20 Solutions

Fundamentals of Financial Management (MindTap Course List)

- What is ethical dilemma?arrow_forward$1.35 Million for the below question is incorrect, Machine A is $1.81 and Machine B is $0.46 Million. The Perez Company has the opportunity to invest in one of two mutually exclusive machines that will produce a product it will need for the foreseeable future. Machine A costs $8 million but realizes after-tax inflows of $4.5 million per year for 4 years. After 4 years, the machine must be replaced. Machine B costs $17 million and realizes after-tax inflows of $4 million per year for 8 years, after which it must be replaced. Assume that machine prices are not expected to rise because inflation will be offset by cheaper components used in the machines. The cost of capital is 13%. Using the replacement chain approach to project analysis, by how much would the value of the company increase if it accepted the better machine? Round your answer to two decimal places. 1.) $1.35 millionarrow_forwardBuggies-Are-Us Steady Freddie, Inc Gang Buster Group g = 0 g = 55% Year 1 $3.51 (i.e., dividends are expected to remain at $3.053.05/share) (for the foreseeable future) Year 2 $4.04 Year 3 $4.63 Year 4 $5.36 Year 5 $6.15 Year 6 and beyond: g = 55%arrow_forward

- Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects' NPVs, assuming a cost of capital of 12%. Do not round intermediate calculations. Round your answers to the nearest cent. Calculate the two projects' PIs, assuming a cost of capital of 12%. Do not round intermediate calculations. Round your answers to three decimal places. Project L is not 1.07arrow_forwardWilbur and Orville are brothers. They're both serious investors, but they have different approaches to valuing stocks. Wilbur, the older brother, likes to use the dividend valuation model. Orville prefers the free cash flow to equity valuation model. As it turns out, right now, both of them are looking at the same stock-Wright First Aerodynmaics, Inc. (WFA). The company has been listed on the NYSE for over 50 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about WFA's stock: Current dividend (D) = $2.30/share Current free cash flow (FCF) = $1.5 million Expected growth rate of dividends and cash flows (g) = 5% Required rate of return (r) = 14% Shares outstanding 500,000 shares How would Wilbur and Orville each value this stock?arrow_forwardCompany P/S Multiples Facebook 13.33 Snap 18.22 Twitter 13.27arrow_forward

- The Perez Company has the opportunity to invest in one of two mutually exclusive machines that will produce a product it will need for the foreseeable future. Machine A costs $8 million but realizes after-tax inflows of $4.5 million per year for 4 years. After 4 years, the machine must be replaced. Machine B costs $17 million and realizes after-tax inflows of $4 million per year for 8 years, after which it must be replaced. Assume that machine prices are not expected to rise because inflation will be offset by cheaper components used in the machines. The cost of capital is 13%. Using the replacement chain approach to project analysis, by how much would the value of the company increase if it accepted the better machine? Round your answer to two decimal places. 1.) $ millionarrow_forwardWilbur and Orville are brothers. They're both serious investors, but they have different approaches to valuing stocks. Wilbur, the older brother, likes to use the dividend valuation model. Orville prefers the free cash flow to equity valuation model. As it turns out, right now, both of them are looking at the same stock-Wright First Aerodynmaics, Inc. (WFA). The company has been listed on the NYSE for over 50 years and is widely regarded as a mature, rock-solid, dividend-paying stock. The brothers have gathered the following information about WFA's stock: Current dividend (D) = $3.30/share Current free cash flow (FCF) = $1.5 million Expected growth rate of dividends and cash flows (g)=8% Required rate of return (r) = 13% Shares outstanding 500,000 shares How would Wilbur and Orville each value this stock? The stock price from Wilbur's valuation is $ (Round to the nearest cent.)arrow_forwardThe Perez Company has the opportunity to invest in one of two mutually exclusive machines that will produce a product it will need for the foreseeable future. Machine A costs $8 million but realizes after-tax inflows of $4.5 million per year for 4 years. After 4 years, the machine must be replaced. Machine B costs $17 million and realizes after-tax inflows of $4 million per year for 8 years, after which it must be replaced. Assume that machine prices are not expected to rise because inflation will be offset by cheaper components used in the machines. The cost of capital is 13%. Using the replacement chain approach to project analysis, by how much would the value of the company increase if it accepted the better machine? Round your answer to two decimal places. 1.) $ million What is the equivalent annual annuity for each machine? Do not round intermediate calculations. Round your answers to two decimal places. 2.) Machine A: $ million 3.) Machine B: $ millionarrow_forward

- You expect to have $29,865. You plan to make X savings contribution of $1,690 per month. The expected return is 0.92 percent per month and the first regular savings contribution will be made later today. What is X? Round to 2 decimal places.arrow_forwardCompany P/S Multiples Facebook 13.67 Snap 18.76 Twitter 13.55arrow_forwardEnergy Resources generated an EPS of $4.38 over the last 12 months. The company's earnings are expected to grow by 30.7% next year, and because there will be no significant change in the number of shares outstanding, EPS should grow at about the same rate. You feel the stock should trade at a P/E of around 30 times earnings. Use the P/E approach to set a value on this stock. Using the P/E approach, the value on this stock is $ (Round to the nearest cent.)arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning