a.

To discuss: The

Introduction:

Stock is a type of security in a company that denotes ownership. The company can raise the capital by issuing stocks.

a.

Explanation of Solution

The preferred stock differs from debt and common equity is as follows:

Preferred stock can be termed as hybrid stock because it is similar characteristically with common equity and debt. The preferred payments made to the investors remain contractually stable resembling debt whereas like common equity the non-payment of dividend does amount to default and bankruptcy.

Even most preferred stock prohibits paying common dividends when there are arrears in preferred. Moreover, their dividends are cumulative until a level. The dividend on common stock is not paid just in case of non-payment of dividend on preferred stock.

b.

To discuss: The meaning of adjustable-rate preferred.

b.

Explanation of Solution

The meaning of adjustable-rate preferred is as follows:

A particular form of preferred stock wherein the dividends issued varies with a benchmark such as Treasury-bill rate is termed as adjustable-rate preferred. This is the best short-term corporate investment since only 30 percent of the dividends are taxable to corporations and even the floating rate keeps the issue trading at the par value. Moreover, the adjustable-rate preferred stock will have price instability mostly for the liquid portfolios of numerous corporate investors.

c.

To discuss: The knowledge of call options helps people to understand convertibles and warrants.

Introduction:

Option is a contract to purchase a financial asset from one party and sell it to another party on an agreed price for a future date. There are two types of options, which are as follows:

- An option that buys an asset called call option

- An option that sells an asset called put option

c.

Explanation of Solution

The knowledge of call options helps people to understand convertibles and warrants is as follows:

Both the convertibles and warrants are two forms of call options. The understanding of options will help a company’s financial managers to make decision on convertible and warrant issues.

d.1.

To determine: The coupon rate that is set on the bond with warrants.

Introduction:

A warrant is securities that give the bondholder the right, yet not the obligation, to purchase a specific number of securities at a specific cost before a particular period.

d.1.

Explanation of Solution

Given information:

Person M (

The formula to compute the value of package is as follows:

Compute the value of warrant:

Note: Assume the entire package is to sell for the price of $1,000.

Hence, the value of warrant is $75.

Compute the

Hence, the value of bond is $925.

Compute the PTM

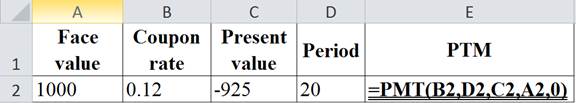

The table below shows the Excel formula to compute the PTM:

The table below shows the calculated value of PTM:

Hence, the PTM is $109.96. The bonds will have a value of $925 and the package of one bond plus 50 warrants will cost $1,000 at 12 percent coupon rate.

d.2.

To discuss: The implication of terms of issues and whether the company loses or wins.

d.2.

Explanation of Solution

The implication of terms of issues and determine whether the company loses or wins are as follows:

The company issues bonds and warrants directly trade for $2.50 each for 50 warrants. The total worth of 50 warrants will be $125

d.3.

To discuss: The expected period when the warrants to be exercised.

d.3.

Explanation of Solution

The expected time when the warrant to be exercised is discussed below:

A warrant is sold for premium beyond exercise value in an open market. Every investor will sell warrants in specific place than exercising it; on stock selling at price more than exercise price. However, few warrants comprise of step-up provisions of exercise price in which exercise price raises than warrant’s life period. It is because the warrant value drops when the exercise price increases.

As a result, the step-up provision will support holders for exercising their warrants. Therefore, the warrants holder would voluntarily exercise when there is higher dividend. Moreover, the higher dividends will raise the attraction of stock from warrants.

d.4.

To discuss: Whether the warrants will bring in additional capital when exercised and determine the type of capital.

d.4.

Explanation of Solution

Determine whether the warrants will bring in additional capital when exercised and determine the types of capital are as follows:

At the time when a warrant is exercised, it will bring in exercise price or additional capital of $12.50 (equity capital). As a result, the holder will receive a share of common stock per warrant. Here, let assume that the exercise price is set at 10 percent to 30 percent above the current price of stock. In this case, a higher-growth company will set the exercise price to a higher-end range and vice-versa.

d.5.

To discuss: Whether all the debt been issued with warrants when the warrants lower the cost of debt and determine the expected cost of the bond with warrants.

d.5.

Explanation of Solution

Determine whether all the debt been issued with warrants when the warrants lower the cost of debt and determine the expected cost of the bond with warrants are as follows:

The overall cost of the issue will be higher than straight debt even though the coupon rate on the debt is lower. Few returns are contractual in nature for the investors while the remaining return is related to price of stock movements. As a result, the cost will be much higher as compared to the debt. Therefore, the overall cost and risk is greater as compared to the cost of debt.

At the time when the warrants are exercised in 5-years, then the price of stock will be $17.50. Then the F Company will exchange stock worth $17.50 for one warrant plus $12.50. Therefore, the company will realize an

To discuss: The comparison on the cost of bond with warrants by the cost of straight debt and cost of common stock.

Explanation of Solution

Given information:

Person M (financial manager) of the F Company decided to issue a bond with warrants. The current stock price of the company is $10 and cost of 20-years annual coupon debt is 12 percent without warrants. Later, the banker has recommends to assign 50 warrants for every bond of the company. The exercise price of the warrant is $12.50 and the value of every warrant when detached and trade separately is $1.50.

Note: The F Company will make interest payments over the 20-year life of bonds and repay the principal after 20-years.

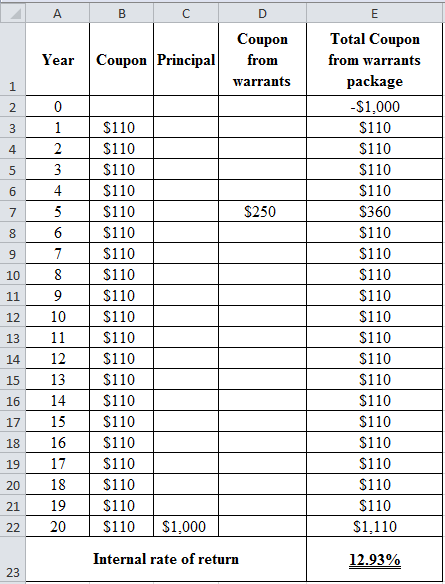

Compute the

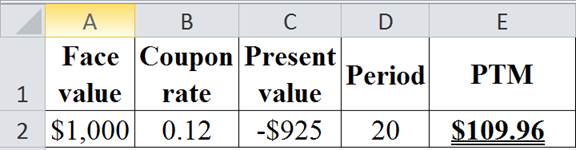

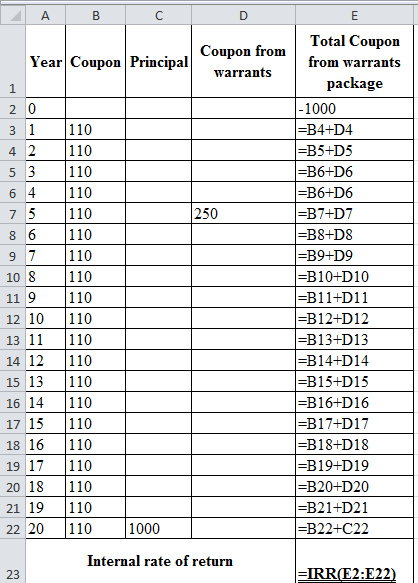

The table below shows the Excel formula to compute the IRR:

The table below shows the calculated value of IRR:

Hence, the IRR is 12.93%. The IRR from this cash flows stream is higher than the 12 percent cost of straight debt. It is because the issue is riskier as compared to the straight debt as per the investor point of view. However, the bonds with warrants will be less risky as compared to the common stock. Therefore, the bonds with warrants will have a lower cost than common stock.

e.1.

To determine: The conversion price and whether ot is implied in the convertible’s terms.

e.1.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula to compute the conversion price is as follows:

Compute the conversion price:

Hence, the conversion price is $12.50. Here, the conversion price can be assumed as the convertible’s exercise price, even though it has already paid out. Therefore, the conversion price is set at 20 percent to 30 percent above the prevailing stock price as with the warrants.

e.2.

To determine: The straight-debt value of the convertible and implied value of the convertibility.

e.2.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula to compute the value of convertibility is as follows:

The formula to compute per share value of convertibility is as follows:

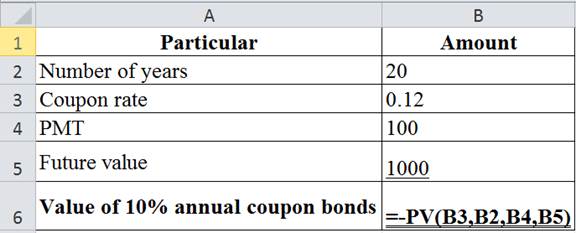

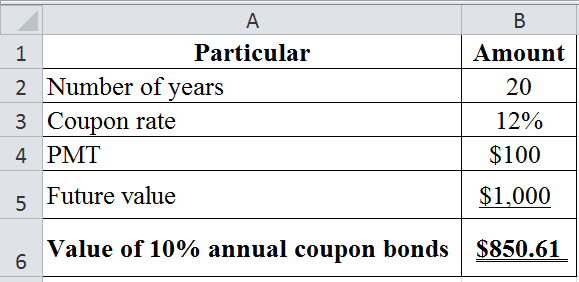

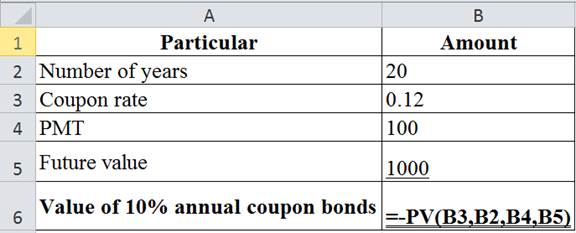

Compute the value of 10% annual coupon bonds (straight bond):

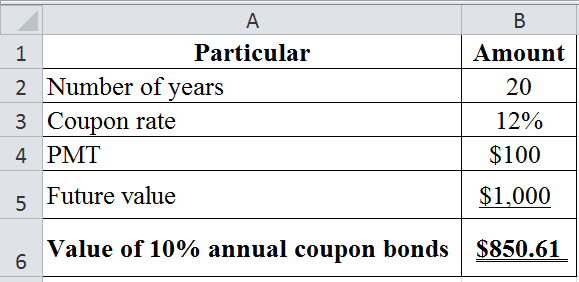

The table below shows the Excel formula to compute the value of 10% annual coupon bonds:

The table below shows the calculated value of 10% annual coupon bonds:

Hence, the value of 10% annual coupon bonds is $850.61.

Compute the value of convertibility:

Note: The convertible will sell at $1,000 (face value).

Hence, the value of convertibility is $149.39.

Compute the per share value of convertibility:

Hence, per share value of convertibility is $1.87.

e.3.

To determine: The formula for the conversion value of bond in any year and even compute the value of conversion at Year 0 and Year 10.

e.3.

Explanation of Solution

The formula for the conversion value of bond in any year is as follows:

The value of the stock which is obtained by converting is termed as conversion value in any year. In the case of F Company, the stock price is expected to increase by “g” every year since it has a constant growth stock. Therefore, the formula for the conversion value of bond in any year is given below:

Where,

Pt refers to the price at conversion of bonds

Po refers to the current stock price

g refers to the constant growth rate of stock

t refers to the number of years

Note: The value of converting at any year is denoted as CR(Pt). Here, CR refers to the number of share received.

Compute the value of conversion at Year 0:

Hence, the value of conversion at Year 0 is $800.

Compute the value of conversion at Year 10:

Hence, the value of conversion at Year 10 is $1,727.12.

e.4.

To discuss: The meaning of the term floor value of a convertible and compute the convertible’s expected floor value in the Year 0 and Year 10.

e.4.

Explanation of Solution

The meaning of term floor value of a convertible and even compute the convertible’s expected floor value in the Year 0 and Year 10 are as follows:

The higher of straight-debt value and higher value of conversion is termed as floor value of a convertible.

Compute the expected floor value of convertible in the Year 0:

The table below shows the Excel formula to compute the value of 10% annual coupon bonds:

The table below shows the calculated value of 10% annual coupon bonds:

Hence, the value of 10% annual coupon bonds is $850.61. The straight-debt value in Year 0 is $850.61 when the conversion value is $800. Therefore, the floor value is $850.61.

The conversion value of $1,727.12 is higher than the straight-debt value at the Year 10. Therefore, the conversion value sets at the floor price. The convertible would sell above its floor value in any period before the date of maturity. It is because the convertibility option carries extra values.

e.5.

To determine: The number of year or period when the issue is expected to callable.

e.5.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner.

The formula for the conversion value of bond in any year is given below:

Where,

Pt refers to the price at conversion of bonds

Po refers to the current stock price

g refers to the constant growth rate of stock

t refers to the number of years

Compute the number of years or period when the issue is expected to callable:

Hence, the number of year is 5.2678 years that is considered as 5-years.

e.6.

To determine: The expected cost of the convertible and whether the cost appears consistent with the risk of the issue.

e.6.

Explanation of Solution

Given information:

Person M is considering convertible bonds. As per the investment banker estimates, the F Company will sell a 20-years bond for 10 percent coupon rate. The callable convertible bond’s face value is $1,000 and straight-debt issue will need a 12% coupon rate. The F Company’s current price of stock is $10 and its last year’s dividends are $0.74. The constant growth rate of dividend is 8 percent and it’s converted in 80 shares of F Company’s stock at the position of owner. The conversion value in Year 5 is $1,200.

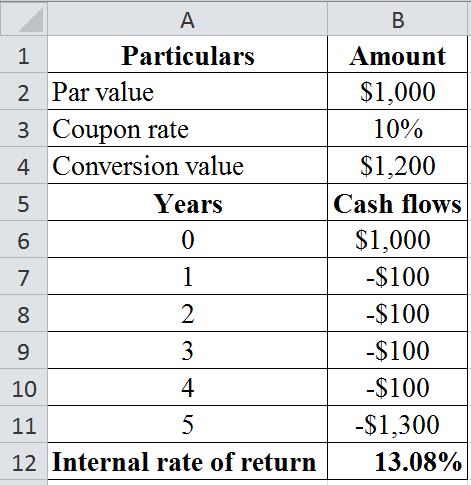

Compute the IRR:

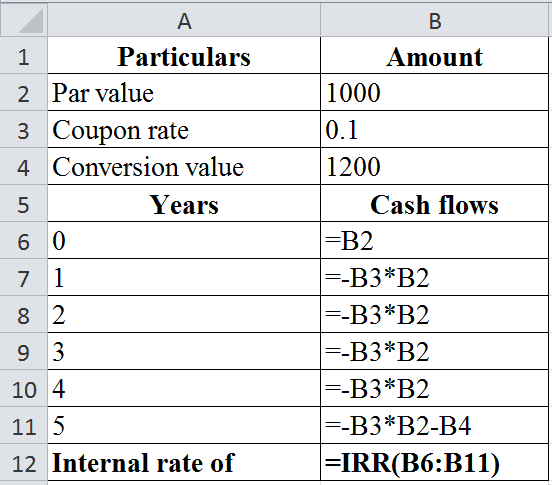

The table below shows the Excel formula to compute the IRR:

The table below shows the calculated value of IRR:

Hence, the IRR is 13.08% that is the cost of the convertible issue.

Compute the

Hence, the cost of equity is 0.15992 that is approximately is 16%. The convertible bond of firm has risk, which falls between the risk of its equity and debt. Therefore, the cost that appears consistent with the risk of the issue is 13.08 percent.

f.

To discuss: The factors that Person M as to consider on making decision between to securities.

f.

Explanation of Solution

The factors that Person M as to consider on making decision between to securities are as follows:

- The Person M has to consider the future need for capital of the company. The warrants must be favorable because their exercise can bring in extra equity capital without retirement of the low-cost debt when the company anticipates continues need for capital. On the contrary, the convertible issue cannot bring in new funds at conversion.

- The second factor that Person M must consider is whether the Company wants to commit towards 20-year of debt at this period. Here, the conversion can remove off the debt issue but it does not occur on the exercise of warrants. In case, the F Company cannot increase over the period, then neither the warrants nor the convertibles will be exercised and debt will remain outstanding in the both case.

Want to see more full solutions like this?

Chapter 20 Solutions

Bundle: Fundamentals of Financial Management, 14th + MindTap Finance, 1 term (6 months) Printed Access Card

- no ai Image is blurr do not answer this question if data is not clear or image is blurr. please comment i will write values but do not amswer with unclear values. i will give unhelpful sure.arrow_forwardDon't solve this question with unclear data. i will give unhelpful rating . please skip this qnarrow_forwardThe prodave paint company earned a net profit margin of 20% on revenues of $20m this year. Fixed Capital Investment was $2 m and depreciation was $3 m. Working capital Investment equals 7.5% of the Sales level in that year. Net income, fixed Capital Investment, depreciation, interest expenses and sales are expected to grow at 10% per year for the next 5 years. After 5 years, the growth in sales , net income, depreciation and interest expenses will decline to a stable 5% per year and fixed Capital Investment and depreciation will offset each other. The tax rate is 40% and the prodave has 1 m shares of common stock outstanding and long term debt paying 12.5% interest trading at it's par value of $32 m. The WACC is 17% during the high growth stage and 15% during the stable growth stage. Required: a) Calculate FCFE b) Determine FCFF c) Estimate the value of Equity d) Calculate the value of the Firmarrow_forward

- A key dynamic within any Multi-National Corporation (MNC) is cash and foreign exchange risk exposure. Cash management is critical and also heavily influenced by global dynamics, especially since COVID-19. Within the Caribbean and North American jurisdiction, the economic framework is tightly connected with the major Asian economies of China, the United Kingdom and Japan. The Caribbean and the North American economy have been a barometer of the global economic cycle.) For both Caribbean and North American economies, many Multi-National Corporations have made significant investments to reduce the production cost of goods and diversification benefits. Despite the benefits that could materialize, some North American countries have not been resilient through Global market shocks. Given this context, the following questions require research within the Caribbean context and current market dynamics since COVID-19. Your Manager has asked you to address the following concerns in the report 1)…arrow_forwardA key dynamic within any Multi-National Corporation (MNC) is cash and foreign exchange risk exposure. Cash management is critical and also heavily influenced by global dynamics, especially since COVID-19. Within the Caribbean and North American jurisdiction, the economic framework is tightly connected with the major Asian economies of China, the United Kingdom and Japan. The Caribbean and the North American economy have been a barometer of the global economic cycle.) For both Caribbean and North American economies, many Multi-National Corporations have made significant investments to reduce the production cost of goods and diversification benefits. Despite the benefits that could materialize, some North American countries have not been resilient through Global market shocks. Given this context, the following questions require research within the Caribbean context and current market dynamics since COVID-19. Your Manager has asked you to address the following concerns in the report 1)…arrow_forwardA key dynamic within any Multi-National Corporation (MNC) is cash and foreign exchange risk exposure. Cash management is critical and also heavily influenced by global dynamics, especially since COVID-19. Within the Caribbean and North American jurisdiction, the economic framework is tightly connected with the major Asian economies of China, the United Kingdom and Japan. The Caribbean and the North American economy have been a barometer of the global economic cycle.) For both Caribbean and North American economies, many Multi-National Corporations have made significant investments to reduce the production cost of goods and diversification benefits. Despite the benefits that could materialize, some North American countries have not been resilient through Global market shocks. Given this context, the following questions require research within the Caribbean context and current market dynamics since COVID-19. Your Manager has asked you to address the following concerns in the report 1)…arrow_forward

- Jeff Krause purchased 1,000 shares of a speculative stock in January for $1.89 per share. Six months later, he sold them for $9.95 per share. He uses an online broker that charges him $10.00 per trade. What was Jeff's annualized HPR on this investment? Jeff's annualized HPR on this investment is %. (Round to the nearest whole percent.)arrow_forwardCongratulations! Your portfolio returned 16.7% last year, 2.5% better than the market return of 14.2%. Your portfolio had a standard deviation of earnings equal to 18%, and the risk-free rate is equal to 4.4%. Calculate Sharpe's measure for your portfolio. If the market's Sharpe's measure is 0.29, did you do better or worse than the market from a risk/return perspective? The Sharpe's measure of your portfolio is (Round to two decimal places.)arrow_forwardOn January 1, 2020, Simon Love's portfolio of 15 common stocks had a market value of $258,000. At the end of May 2020, Simon sold one of the stocks, which had a beginning-of-year value of $26,900, for $31,400. He did not reinvest those or any other funds in the portfolio during the year. He received total dividends from stocks in his portfolio of $11,900 during the year. On December 31, 2020, Simon's portfolio had a market value of $246,000. Find the HPR on Simon's portfolio during the year ended December 31, 2020. (Measure the amount of withdrawn funds at their beginning-of-year value.) Simon's portfolio HPR during the year ended December 31, 2020, is %. (Round to two decimal places.)arrow_forward

- Chee Chew's portfolio has a beta of 1.27 and earned a return of 13.6% during the year just ended. The risk-free rate is currently 4.6%. The return on the market portfolio during the year just ended was 10.5%. a. Calculate Jensen's measure (Jensen's alpha) for Chee's portfolio for the year just ended. b. Compare the performance of Chee's portfolio found in part a to that of Carri Uhl's portfolio, which has a Jensen's measure of -0.25. Which portfolio performed better? Explain. c. Use your findings in part a to discuss the performance of Chee's portfolio during the period just ended.arrow_forwardDuring the year just ended, Anna Schultz's portfolio, which has a beta of 0.91, earned a return of 8.1%. The risk-free rate is currently 4.1%, and the return on the market portfolio during the year just ended was 9.4%. a. Calculate Treynor's measure for Anna's portfolio for the year just ended. b. Compare the performance of Anna's portfolio found in part a to that of Stacey Quant's portfolio, which has a Treynor's measure of 1.39%. Which portfolio performed better? Explain. c. Calculate Treynor's measure for the market portfolio for the year just ended. d. Use your findings in parts a and c to discuss the performance of Anna's portfolio relative to the market during the year just ended.arrow_forwardNeed answer.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning